Nj 1040 Es V Payment Voucher Form

What is the NJ 1040 ES V Payment Voucher

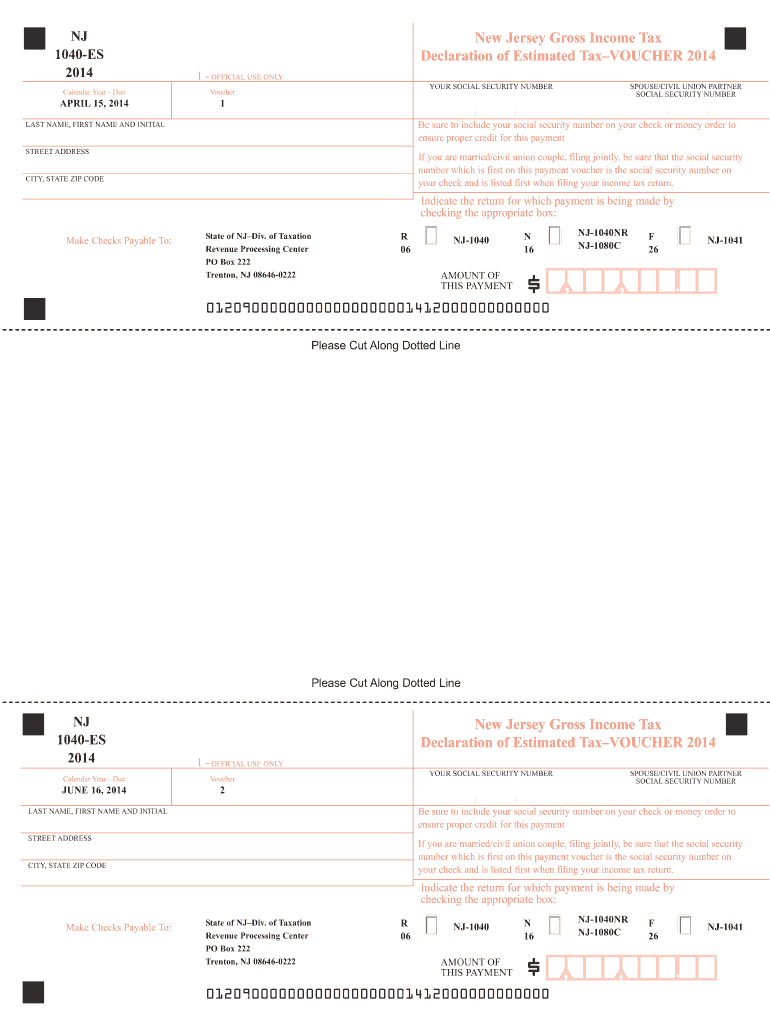

The NJ 1040 ES V Payment Voucher is a document used by New Jersey taxpayers to make estimated tax payments for the current tax year. This voucher is specifically designed for individuals who expect to owe tax and wish to pay it in advance to avoid penalties. The form is part of the state’s tax system, allowing taxpayers to report and remit their estimated tax liabilities efficiently.

How to use the NJ 1040 ES V Payment Voucher

To use the NJ 1040 ES V Payment Voucher, taxpayers must first calculate their estimated tax liability for the year. This involves determining expected income, deductions, and credits. Once the estimated amount is calculated, the voucher must be filled out with personal information, including name, address, and Social Security number. After completing the voucher, taxpayers can submit it along with their payment to the New Jersey Division of Taxation.

Steps to complete the NJ 1040 ES V Payment Voucher

Completing the NJ 1040 ES V Payment Voucher involves several key steps:

- Obtain the NJ 1040 ES V form from the New Jersey Division of Taxation website or other official sources.

- Fill in your personal details, including your name, address, and Social Security number.

- Calculate your estimated tax payment based on your expected income for the year.

- Indicate the payment amount on the voucher.

- Sign and date the voucher to certify the information provided is accurate.

Legal use of the NJ 1040 ES V Payment Voucher

The NJ 1040 ES V Payment Voucher is legally recognized as a valid method for making estimated tax payments in New Jersey. To ensure compliance with state tax laws, taxpayers must accurately complete and submit this form by the specified deadlines. Failure to do so may result in penalties or interest on unpaid taxes.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the NJ 1040 ES V Payment Voucher. Estimated tax payments are typically due quarterly, with specific dates set by the New Jersey Division of Taxation. It is crucial to adhere to these deadlines to avoid penalties and ensure timely processing of payments.

Form Submission Methods (Online / Mail / In-Person)

The NJ 1040 ES V Payment Voucher can be submitted through various methods. Taxpayers may choose to mail the completed voucher along with their payment to the appropriate address provided by the New Jersey Division of Taxation. Additionally, some taxpayers may have the option to submit payments electronically through the state’s online tax portal, which offers a convenient and secure way to make payments.

Quick guide on how to complete nj 1040 es form

Prepare Nj 1040 Es V Payment Voucher effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and safely save it online. airSlate SignNow provides all the features you require to create, modify, and eSign your documents quickly without any hold-ups. Manage Nj 1040 Es V Payment Voucher on any device through airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to update and eSign Nj 1040 Es V Payment Voucher with ease

- Obtain Nj 1040 Es V Payment Voucher and click Get Form to initiate.

- Employ the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive details using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and press the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Nj 1040 Es V Payment Voucher to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

How do I file form 1040-ES and how does it work?

File Form 1040 - ES only if you are making a payment of estimated tax by check or money order. Mail this voucher with your check or money order payable to “United States Treasury.” Write your social security number and “2017 Form 1040-ES” on your check or money order.If you have your own business, you need to make estimated tax payments to the IRS throughout the year in order to avoid paying interest and penalties on top of your taxes.Follow the below example for filing and Paying of the Estimated TaxesExample:For Tax Year 2017 you can pay all of your estimated tax by April 18, 2017, or in four equal amounts by the dates shown below.1st payment April 18, 20172nd payment June 15, 20173rd payment Sept. 15, 20174th payment Jan. 16, 2018

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

Which NJ STATE Tax form do I file if I’m a student on OPT? I moved to NJ in April 2017 and worked from April to December 2017 for that tax year.should it be NJ 1040 or NJ 1040NR?

If you had taxable earned wages then you would file NJ-1040. The below website will give you all the info you needhttp://www.state.nj.us/treasury/...

Create this form in 5 minutes!

How to create an eSignature for the nj 1040 es form

How to create an electronic signature for your Nj 1040 Es Form in the online mode

How to generate an eSignature for your Nj 1040 Es Form in Google Chrome

How to create an eSignature for putting it on the Nj 1040 Es Form in Gmail

How to create an electronic signature for the Nj 1040 Es Form right from your smart phone

How to create an eSignature for the Nj 1040 Es Form on iOS

How to create an eSignature for the Nj 1040 Es Form on Android OS

People also ask

-

What is the nj 1040 es 2023 form?

The nj 1040 es 2023 form is a payment voucher used by New Jersey taxpayers to make estimated income tax payments. This form is critical for individuals who expect to owe more than $400 in state tax. Proper completion and timely submission ensure compliance with New Jersey tax regulations.

-

How can airSlate SignNow help with nj 1040 es 2023 submissions?

airSlate SignNow streamlines the process of signing and sending your nj 1040 es 2023 form digitally. Our platform allows you to easily eSign documents and share them securely, ensuring that your tax payments are made on time without the hassle of paper processing.

-

Is airSlate SignNow cost-effective for managing nj 1040 es 2023 forms?

Absolutely! airSlate SignNow offers competitive pricing that allows you to manage your nj 1040 es 2023 submissions without breaking the bank. Our users benefit from a cost-effective solution that combines efficiency with affordability, making tax season stress-free.

-

What features does airSlate SignNow offer for nj 1040 es 2023 management?

airSlate SignNow includes essential features like customizable templates, secure eSignatures, and automatic reminders, all beneficial for handling your nj 1040 es 2023 forms. These features enhance user experience, reduce errors, and ensure that your documents are processed quickly and securely.

-

Can airSlate SignNow integrate with other software for nj 1040 es 2023?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software. This means you can manage your nj 1040 es 2023 forms alongside your financial documents, making your workflow more efficient and reducing the likelihood of document mishaps.

-

What are the benefits of using airSlate SignNow for nj 1040 es 2023?

Using airSlate SignNow for nj 1040 es 2023 offers signNow time savings, enhanced security through encrypted transactions, and increased convenience with mobile access. By digitizing the process, you can manage your taxes from anywhere, simplifying your tax preparation and submission.

-

Is it safe to eSign my nj 1040 es 2023 documents using airSlate SignNow?

Yes, it is safe to eSign your nj 1040 es 2023 documents using airSlate SignNow. We employ industry-standard security measures, including data encryption and secure cloud storage, ensuring that your sensitive information is protected at all times.

Get more for Nj 1040 Es V Payment Voucher

- Concert reflection worksheet form

- Subp 002 instructions form

- Bio data fill up example form

- Form 19 388

- Illinois form 45 printable

- Form mv 1 title tag application

- Construction means amp method plan form city of beverly hills beverlyhills

- Ww combined contingency addendum to purchase and sales agreement doc form

Find out other Nj 1040 Es V Payment Voucher

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple