1080 Form

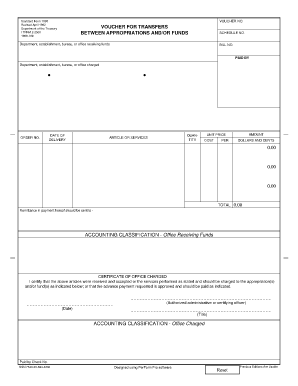

What is the 1080 Form

The 1080 form, commonly referred to as the IRS Form 1080, is a tax document used primarily for reporting specific financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses who need to disclose income, deductions, and credits accurately. Understanding the purpose and requirements of the 1080 tax form is crucial for ensuring compliance with federal tax regulations.

How to use the 1080 Form

Using the 1080 form involves several steps that require careful attention to detail. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, accurately fill out the form by entering your financial information in the designated sections. It is vital to double-check all entries for accuracy to avoid potential issues with the IRS. Once completed, the form can be submitted electronically or by mail, depending on your preference and the specific requirements for your situation.

Steps to complete the 1080 Form

Completing the 1080 form involves a systematic approach to ensure all information is accurate and complete. Follow these steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Download the latest version of the 1080 form from the IRS website or obtain a physical copy.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form electronically or by mail, adhering to the IRS guidelines.

Legal use of the 1080 Form

The legal use of the 1080 form is governed by IRS regulations, which stipulate how and when the form should be completed and submitted. To ensure the form is legally binding, it must be filled out truthfully and submitted by the appropriate deadlines. Additionally, utilizing a secure platform for electronic submission can help maintain compliance with eSignature laws and protect sensitive information.

Filing Deadlines / Important Dates

Filing deadlines for the 1080 form vary depending on the type of taxpayer and the specific circumstances. Generally, individual taxpayers must file their forms by April fifteenth of each year, while businesses may have different deadlines based on their fiscal year. It is essential to stay informed about these dates to avoid penalties and ensure timely compliance with IRS requirements.

Form Submission Methods

The 1080 form can be submitted through various methods, including:

- Online submission through the IRS e-file system.

- Mailing a physical copy to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Choosing the appropriate submission method depends on personal preference and specific circumstances surrounding the tax filing.

Quick guide on how to complete 1080 form

Effortlessly Prepare 1080 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage 1080 Form across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Simplest Way to Modify and eSign 1080 Form with Ease

- Find 1080 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select how you wish to share your form, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign 1080 Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1080 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1080 form and how is it used?

The 1080 form is a document often required for various administrative and tax purposes. It helps businesses streamline their workflows by providing a structured way to collect signatures and necessary information. Using airSlate SignNow can simplify the process of filling out and eSigning the 1080 form.

-

How much does it cost to use airSlate SignNow for the 1080 form?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. The cost-effectiveness of our platform allows you to manage the 1080 form efficiently without breaking the bank. You can explore our plans to find the right fit for your needs.

-

What features does airSlate SignNow provide for the 1080 form?

airSlate SignNow offers a variety of features for the 1080 form, including customizable templates, secure eSigning, and real-time status tracking. These features empower businesses to automate and streamline their document workflows, minimizing errors and saving time.

-

Can I integrate airSlate SignNow with other software for processing the 1080 form?

Yes, airSlate SignNow integrates seamlessly with a wide array of applications, allowing you to manage the 1080 form efficiently. Whether you need to connect with CRM systems, cloud storage, or other business tools, our integrations enhance your workflow and productivity.

-

How does airSlate SignNow ensure the security of my 1080 form?

Security is a top priority for airSlate SignNow. We use industry-standard encryption and secure servers to protect your documents, including the 1080 form. This ensures that your sensitive information remains confidential and safeguarded throughout the signing process.

-

What are the benefits of using airSlate SignNow for the 1080 form?

Using airSlate SignNow for the 1080 form streamlines the document signing process, increases team productivity, and reduces turnaround time. The platform's user-friendly interface makes it easy for anyone to eSign documents, ultimately enhancing your business efficiency.

-

Is there a trial available for airSlate SignNow to test the 1080 form features?

Yes, airSlate SignNow provides a trial period that allows you to explore all its features, including those specific to the 1080 form. This gives you a chance to evaluate how our platform can meet your needs before committing to a subscription.

Get more for 1080 Form

- Ok discovery form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant oklahoma form

- Quitclaim deed limited liability company to limited liability company oklahoma form

- Oklahoma mineral deed form

- Quitclaim deed one individual to four individuals oklahoma form

- Oklahoma warranty deed 497322820 form

- Oklahoma life estate form

- Special warranty deed limited liability company to limited liability company oklahoma form

Find out other 1080 Form

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT