Form 8919

What is the Form 8919

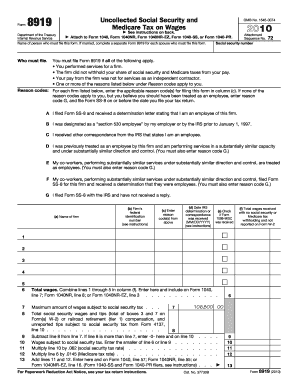

The Form 8919 is a tax form used by employees to report uncollected Social Security and Medicare taxes on wages paid to them by an employer who did not withhold these taxes. This form is particularly relevant for individuals who believe they should have been classified as employees rather than independent contractors. The form allows taxpayers to calculate and report the amount of these taxes that should have been withheld, ensuring compliance with federal tax regulations.

How to use the Form 8919

Using the Form 8919 involves several steps. First, individuals must determine if they are eligible to file the form based on their employment classification. If eligible, they will need to gather necessary information, such as the total wages received and the employer's identification number. After filling out the form, it should be submitted along with the individual's tax return to the IRS. It is essential to ensure accuracy in reporting to avoid potential penalties.

Steps to complete the Form 8919

Completing the Form 8919 involves a systematic approach:

- Gather your income information, including total wages and any relevant employer details.

- Indicate the total amount of uncollected Social Security and Medicare taxes on the form.

- Provide your personal information, including your name, address, and Social Security number.

- Review the form for accuracy before submission.

- File the completed form with your federal tax return.

Legal use of the Form 8919

The Form 8919 is legally binding when completed correctly and submitted to the IRS. It is crucial to adhere to IRS guidelines and ensure that all reported information is accurate. Failure to comply with tax regulations can result in penalties or additional taxes owed. Utilizing a reliable electronic signature solution can provide an added layer of security and legitimacy to the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8919 align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to file the form on time to avoid penalties and ensure compliance with tax obligations.

Required Documents

To complete the Form 8919, individuals must gather specific documents, including:

- W-2 forms from employers.

- Any 1099 forms received if applicable.

- Documentation supporting the claim of employee status, if necessary.

Having these documents ready will streamline the process of filling out the form and ensure accurate reporting.

Quick guide on how to complete form 8919

Complete Form 8919 effortlessly on any device

Online document management has become favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents rapidly without delays. Handle Form 8919 on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest method to edit and eSign Form 8919 without hassle

- Find Form 8919 and then click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 8919 and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8919

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8919 and why do I need it?

Form 8919 is used to determine your share of employment taxes if you haven't paid them for certain types of wages. It's essential for individuals who need to report their wages under self-employment tax guidelines. Using airSlate SignNow, you can easily prepare and eSign Form 8919, ensuring compliance and accurate tax filings.

-

How does airSlate SignNow help with completing Form 8919?

airSlate SignNow streamlines the process of completing Form 8919 by providing user-friendly templates and an intuitive dashboard. This way, you can fill out the required information seamlessly and electronically sign the form, making the submission process faster and more efficient. The platform also ensures that all necessary fields are completed correctly, reducing errors.

-

Is airSlate SignNow cost-effective for managing Form 8919?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 8919 and other documents. With various pricing plans available, businesses of all sizes can find an option that fits their budget while enjoying the features they need. The simplicity and efficiency of the platform can potentially save you money on administrative costs.

-

What features of airSlate SignNow make it ideal for handling Form 8919?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage that are perfect for handling Form 8919. The platform allows you to track the document's status and receive real-time notifications upon completion. Additionally, its mobile compatibility lets you manage your forms on the go.

-

Can I integrate airSlate SignNow with my accounting software for Form 8919?

Absolutely! airSlate SignNow offers integrations with various accounting software, making it easier to manage Form 8919 alongside your financial data. This gives you a comprehensive solution for handling tax documents while ensuring that all relevant information is updated and synchronized in real-time.

-

What security measures does airSlate SignNow have for handling Form 8919?

Security is a top priority for airSlate SignNow when it comes to handling Form 8919. The platform employs industry-standard encryption and secure access protocols to protect your sensitive financial data. Additionally, all signed documents are stored securely in the cloud, ensuring that your information remains safe and accessible.

-

How can I track the status of my Form 8919 using airSlate SignNow?

You can easily track the status of your Form 8919 using the airSlate SignNow dashboard. The platform provides real-time updates on whether your document is pending, signed, or completed. This level of transparency helps you stay organized and ensures that you know exactly what stage your form is in at all times.

Get more for Form 8919

- Revocation of power of attorney for care of child or children texas form

- Newly divorced individuals package texas form

- Tx durable form

- Contractors forms package texas

- Power of attorney for sale of motor vehicle texas form

- Declaration mental treatment form

- Revocation power attorney 497327839 form

- Wedding planning or consultant package texas form

Find out other Form 8919

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile