Kansas K 41 Form

What is the Kansas K-41 Form

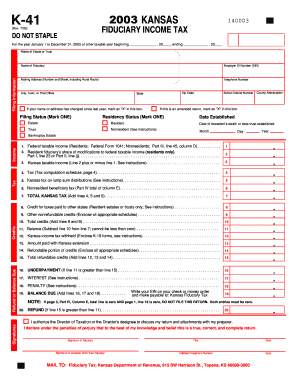

The Kansas K-41 Form is a state-specific document used primarily for reporting income tax information in Kansas. This form is essential for individuals and businesses to accurately declare their income and calculate their tax obligations. It serves as a means for the Kansas Department of Revenue to assess tax liabilities and ensure compliance with state tax laws.

How to Use the Kansas K-41 Form

Using the Kansas K-41 Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with the relevant information, ensuring all entries are correct and complete. After completing the form, review it for accuracy before submitting it to the Kansas Department of Revenue. Utilizing digital tools can simplify this process, allowing for easy editing and secure submission.

Steps to Complete the Kansas K-41 Form

Completing the Kansas K-41 Form requires careful attention to detail. Follow these steps:

- Gather all relevant income documentation, such as W-2 forms and 1099s.

- Enter personal information, including your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections.

- Calculate your total income and any deductions you may qualify for.

- Review the form for any errors or omissions.

- Sign and date the form before submission.

Legal Use of the Kansas K-41 Form

The Kansas K-41 Form is legally binding when completed accurately and submitted in accordance with state regulations. It is crucial to ensure that all information provided is truthful and complete to avoid potential legal issues. The form must be filed by the designated deadline to remain compliant with Kansas tax laws. Failure to submit the form or inaccuracies can lead to penalties or legal repercussions.

Key Elements of the Kansas K-41 Form

Understanding the key elements of the Kansas K-41 Form is vital for accurate completion. Essential components include:

- Personal identification information, such as name and Social Security number.

- Income sources, including wages, self-employment income, and investment earnings.

- Deductions and credits that may apply to reduce overall tax liability.

- Signature and date fields to validate the submission.

Form Submission Methods

The Kansas K-41 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Kansas Department of Revenue's website, which often allows for quicker processing.

- Mailing a paper copy of the form to the appropriate state office.

- In-person submission at designated state revenue offices, offering assistance if needed.

Quick guide on how to complete kansas k 41 form

Effortlessly Prepare Kansas K 41 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Kansas K 41 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to edit and electronically sign Kansas K 41 Form effortlessly

- Find Kansas K 41 Form and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Kansas K 41 Form and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kansas k 41 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kansas K 41 Form used for?

The Kansas K 41 Form is primarily used for reporting certain types of income and calculating tax obligations in the state of Kansas. This form is essential for businesses and individuals who need to ensure compliance with state tax regulations. By accurately completing the Kansas K 41 Form, you can avoid penalties and streamline your tax reporting process.

-

How can airSlate SignNow help with the Kansas K 41 Form?

airSlate SignNow provides a user-friendly platform for electronically signing and sending documents, making it easier to manage your Kansas K 41 Form. With our service, you can easily upload, fill, and eSign your forms, ensuring a quick and secure submission to the relevant authorities. This eliminates the need for paper documents and simplifies the filing process.

-

What is the cost of using airSlate SignNow for the Kansas K 41 Form?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Our subscription model allows you to choose the plan that fits your needs, enabling unlimited access to eSigning features for documents like the Kansas K 41 Form. You can also take advantage of our free trial to test the service before committing.

-

Are there any specific features for handling the Kansas K 41 Form?

Yes, airSlate SignNow includes specific features that enhance the handling of the Kansas K 41 Form. These features include customizable templates, real-time collaboration, and secure storage, which help ensure your forms are completed accurately and efficiently. Additionally, automated reminders can help you stay on track with important filing deadlines.

-

Can I integrate airSlate SignNow with other software for the Kansas K 41 Form?

Absolutely! airSlate SignNow seamlessly integrates with popular productivity tools and business applications, allowing you to streamline the process of managing the Kansas K 41 Form. Whether you use CRM systems, accounting software, or project management tools, our integrations help you centralize your document workflows and enhance efficiency.

-

Is airSlate SignNow compliant with Kansas laws regarding the Kansas K 41 Form?

Yes, airSlate SignNow is fully compliant with Kansas laws and regulations concerning electronic signatures and document management. Our platform adheres to industry standards, ensuring that your Kansas K 41 Form and other documents are handled securely and legally. You can trust our service to maintain the integrity of your important tax documentation.

-

What are the benefits of using airSlate SignNow for the Kansas K 41 Form?

Using airSlate SignNow for the Kansas K 41 Form offers multiple benefits, including time savings, enhanced security, and reduced costs associated with traditional printing and mailing. Our platform allows for instant signing and immediate submission, signNowly speeding up your tax filing process. Plus, you will have peace of mind knowing your documents are stored safely in the cloud.

Get more for Kansas K 41 Form

- Quitclaim deed from corporation to corporation michigan form

- Warranty deed from corporation to corporation michigan form

- Quitclaim deed from corporation to two individuals michigan form

- Warranty deed from corporation to two individuals michigan form

- Warranty deed from individual to a trust michigan form

- Warranty deed from husband and wife to a trust michigan form

- Mi laws form

- Affidavit abandoned form

Find out other Kansas K 41 Form

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer