How to File Form 10ccb Online

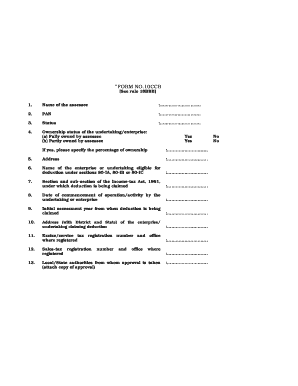

What is the form 10CCB?

The form 10CCB is a crucial document under the Income Tax Act that enables taxpayers to claim deductions for investments made in specified assets. This form is primarily used by individuals and businesses that have invested in eligible projects, such as infrastructure or renewable energy initiatives, and wish to avail themselves of tax benefits. Understanding the 10CCB meaning is essential for ensuring compliance with tax regulations and maximizing potential deductions.

Steps to complete the form 10CCB online

Filing form 10CCB online involves several straightforward steps. Begin by gathering all necessary information related to your investment, including project details and financial records. Next, access the online portal designated for tax filing. Follow these steps:

- Log in to your account or create a new account if you are a first-time user.

- Navigate to the section for filing form 10CCB.

- Fill in the required fields with accurate information about your investments.

- Review the details carefully to ensure accuracy.

- Submit the form electronically and save a copy for your records.

Required documents for filing form 10CCB

To successfully file form 10CCB, you need to prepare several documents that support your claims. These may include:

- Proof of investment in eligible projects, such as receipts or contracts.

- Financial statements that detail the income generated from these investments.

- Any relevant correspondence with tax authorities regarding your investments.

Having these documents ready will facilitate a smoother filing process and help in case of any audits or inquiries.

Filing deadlines for form 10CCB

Being aware of the filing deadlines for form 10CCB is vital to avoid penalties. Generally, the form must be filed along with your annual income tax return. The due date typically aligns with the tax return deadlines, which are:

- April 15 for individual taxpayers.

- March 15 for partnerships and corporations.

It is essential to check for any updates or changes to these dates each tax year to ensure timely submission.

Legal use of form 10CCB

The legal use of form 10CCB is governed by the provisions of the Income Tax Act. To ensure that your filing is compliant, it is important to:

- Understand the eligibility criteria for claiming deductions.

- Maintain accurate records of all investments and related expenses.

- File the form within the stipulated deadlines to avoid penalties.

Compliance with these regulations not only protects you from legal issues but also maximizes the benefits you can receive from your investments.

Who issues the form 10CCB?

The form 10CCB is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. Understanding the role of the IRS in the issuance and regulation of this form is important for taxpayers to ensure they are following the correct procedures and guidelines when filing.

Quick guide on how to complete how to file form 10ccb online

Complete How To File Form 10ccb Online effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage How To File Form 10ccb Online on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign How To File Form 10ccb Online without hassle

- Locate How To File Form 10ccb Online and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you want to send your form, by email, SMS, or invite link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign How To File Form 10ccb Online and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to file form 10ccb online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 10CCB and why should I file it online?

Form 10CCB is a declaration essential for businesses claiming deductions under Section 80-IB of the Income Tax Act. Learning how to file Form 10CCB online ensures a smoother, quicker submission process, reduces paperwork, and minimizes errors. Utilizing digital solutions like airSlate SignNow makes it easier to manage your documents electronically.

-

How does airSlate SignNow help in filing Form 10CCB online?

airSlate SignNow streamlines the process of filing Form 10CCB online by providing an intuitive interface for eSigning and submitting documents. With features like real-time tracking and cloud storage, you can ensure your documents are securely stored and accessible anytime. This signNowly reduces the hassle of traditional methods.

-

Is there a cost involved with using airSlate SignNow for filing Form 10CCB?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. However, the cost is generally justified by the time and resources saved by enabling efficient filing processes. For more detailed pricing, visit our website or contact our sales team.

-

What features does airSlate SignNow offer for electronic document signing?

airSlate SignNow provides a variety of features including customizable templates, multiple signing options, and automated workflows. These features are designed to enhance your experience while learning how to file Form 10CCB online, ensuring that your documents are executed quickly and securely.

-

Can I integrate airSlate SignNow with other software for filing Form 10CCB?

Absolutely! airSlate SignNow seamlessly integrates with a range of popular business applications, including CRM and project management tools. This feature helps you gather and manage your data more effectively while you navigate how to file Form 10CCB online.

-

What are the benefits of filing Form 10CCB online with airSlate SignNow?

Filing Form 10CCB online with airSlate SignNow offers convenience, security, and efficiency. It allows for quick access to your documents, eliminates the need for print-outs, and provides immediate confirmation upon submission. This electronic method ensures compliance with regulations while saving your business time.

-

Is airSlate SignNow compliant with legal regulations for signing Form 10CCB?

Yes, airSlate SignNow complies with all legal requirements for electronic signatures as outlined in legislation. This means you can confidently file Form 10CCB online, knowing that your submissions are legally binding. Our platform is designed to meet the highest security and compliance standards.

Get more for How To File Form 10ccb Online

- Warranty deed from husband and wife to an individual michigan form

- Warranty deed trust to individual michigan form

- Michigan affidavit 497311284 form

- Notice commencement 497311285 form

- Notice commencement form 497311287

- Quitclaim deed from individual to individual michigan form

- Warranty deed form michigan

- Enhanced life estate or lady bird deed individual to two individuals husband and wife michigan form

Find out other How To File Form 10ccb Online

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract