Tn Fae 173 Form

What is the Tennessee Form FAE 173?

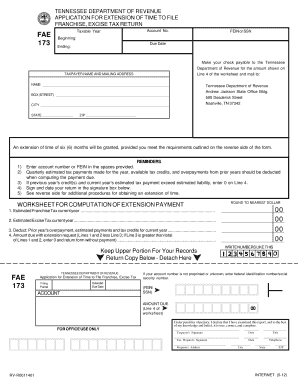

The Tennessee Form FAE 173 is a crucial document used by businesses and individuals for tax purposes within the state of Tennessee. This form is specifically designed to report franchise and excise taxes, which are levied on the net earnings and the net worth of businesses operating in the state. Understanding the purpose and requirements of the form is essential for compliance with Tennessee tax regulations.

How to Use the Tennessee Form FAE 173

Utilizing the Tennessee Form FAE 173 involves several steps to ensure accurate completion and submission. First, gather all necessary financial information, including income statements and balance sheets, as these documents will provide the data needed to fill out the form. Next, carefully follow the instructions provided for each section of the form, ensuring that all calculations are accurate. Finally, submit the completed form to the appropriate state department, either electronically or via mail, depending on your preference and the guidelines set forth by the state.

Steps to Complete the Tennessee Form FAE 173

Completing the Tennessee Form FAE 173 requires a systematic approach:

- Gather Financial Records: Collect all relevant financial documents, including profit and loss statements and balance sheets.

- Fill Out the Form: Enter the required information in the designated fields, ensuring accuracy in all calculations.

- Review for Errors: Double-check all entries for mistakes or omissions to avoid delays in processing.

- Submit the Form: Choose your submission method—either electronically through the state’s online portal or by mailing a physical copy to the designated address.

Legal Use of the Tennessee Form FAE 173

The Tennessee Form FAE 173 is legally binding when completed and submitted according to state regulations. It is essential for businesses to understand that failure to file this form accurately and on time can result in penalties and interest charges. Compliance with the state’s tax laws not only avoids legal repercussions but also ensures that businesses maintain good standing with state authorities.

Key Elements of the Tennessee Form FAE 173

Several key elements must be included when completing the Tennessee Form FAE 173:

- Business Information: Include the legal name, address, and federal employer identification number (FEIN) of the business.

- Income and Deductions: Report total income and any applicable deductions to determine taxable income.

- Franchise and Excise Tax Calculations: Accurately calculate the taxes owed based on the reported income and net worth.

- Signature: Ensure that the form is signed by an authorized representative of the business to validate the submission.

Filing Deadlines for the Tennessee Form FAE 173

Filing deadlines for the Tennessee Form FAE 173 are critical to avoid penalties. Typically, the form is due on the 15th day of the fourth month following the end of the business's fiscal year. For businesses operating on a calendar year, this means the form is due by April 15. It is advisable to mark these dates on your calendar and prepare the necessary documentation in advance to ensure timely submission.

Quick guide on how to complete tn fae 173

Prepare Tn Fae 173 seamlessly on any device

Digital document management has gained signNow traction with businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your files quickly and efficiently. Manage Tn Fae 173 across any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and eSign Tn Fae 173 effortlessly

- Locate Tn Fae 173 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Tn Fae 173 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tn fae 173

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tennessee form FAE 173?

The Tennessee form FAE 173 is a state-specific form used to report Franchise and Excise tax for businesses in Tennessee. Understanding how to accurately complete this form is essential for compliance and to avoid penalties. With airSlate SignNow, you can easily eSign and manage your documents, including the Tennessee form FAE 173.

-

How can airSlate SignNow help with filing the Tennessee form FAE 173?

airSlate SignNow simplifies the process of preparing and filing the Tennessee form FAE 173 by enabling easy document management and eSigning capabilities. You can collaborate with team members in real time and ensure that your submissions are accurate and timely. Our solution makes it easier to stay organized and compliant with state requirements.

-

Is there a cost associated with using airSlate SignNow for Tennessee form FAE 173?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The robust features included can streamline the eSigning process for the Tennessee form FAE 173 and more, providing excellent value for your investment. By choosing the right plan, you can enhance productivity without breaking the bank.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a range of features including customizable templates, real-time collaboration, and secure cloud storage for documents like the Tennessee form FAE 173. You can also track document status and receive notifications when signatures are completed. These features make managing documents efficient and effective for any business.

-

Can airSlate SignNow integrate with other software for filing the Tennessee form FAE 173?

Yes, airSlate SignNow can seamlessly integrate with various software solutions to facilitate the filing of documents, including the Tennessee form FAE 173. This allows you to connect your existing systems and streamline workflows further. Integration capabilities enhance your efficiency by bringing all tools together in one easy-to-use platform.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides many benefits including faster document turnaround, improved compliance with the Tennessee form FAE 173, and reduced operational costs. Businesses can save time and minimize errors associated with manual document handling. Additionally, the ability to eSign documents securely empowers your team to work more efficiently.

-

How secure is airSlate SignNow when handling sensitive documents like the Tennessee form FAE 173?

airSlate SignNow prioritizes security and utilizes industry-standard encryption to protect sensitive documents, including the Tennessee form FAE 173. We adhere to strict compliance measures to ensure that your data remains secure throughout the signing process. You can have peace of mind knowing your documents are handled with the utmost care.

Get more for Tn Fae 173

- Document locator and personal information package including burial information form michigan

- Demand to produce copy of will from heir to executor or person in possession of will michigan form

- Minnesota affidavit form

- Affidavit service mail form

- Affidavit of personal service minnesota form

- Mn service mail form

- Affidavit of personal service minnesota 497311813 form

- Affidavits of service minnesota form

Find out other Tn Fae 173

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple