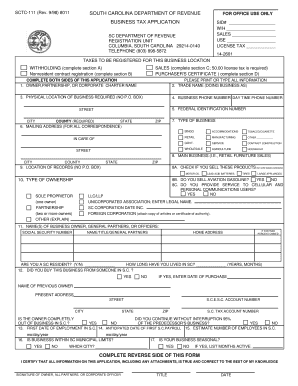

Sctc 111 Form

What is the Sctc 111

The Sctc 111 is a specific form used primarily in the context of tax and compliance within the United States. It serves as a formal document that individuals or businesses may need to complete for various regulatory purposes. Understanding the Sctc 111 is essential for ensuring compliance with applicable laws and regulations, particularly in relation to tax reporting and other legal obligations.

How to use the Sctc 111

Using the Sctc 111 involves several steps to ensure accurate completion and submission. First, gather all necessary information and documents related to the form. This may include personal identification details, financial records, or other relevant data. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once the form is filled out, it may be submitted electronically or by mail, depending on the specific requirements associated with the Sctc 111.

Steps to complete the Sctc 111

Completing the Sctc 111 requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Review the instructions provided with the form to understand the requirements.

- Gather all necessary documentation and information needed for the form.

- Fill out each section of the form accurately, ensuring that all information is correct.

- Double-check the completed form for any errors or omissions.

- Submit the form according to the specified submission methods, whether online, by mail, or in person.

Legal use of the Sctc 111

The Sctc 111 must be used in compliance with relevant laws and regulations to ensure its legal validity. This includes adherence to federal and state guidelines regarding the information provided on the form. Proper use of the Sctc 111 can help avoid potential legal issues, including penalties for non-compliance.

Key elements of the Sctc 111

Several key elements are essential to the Sctc 111. These include:

- Accurate identification of the individual or business completing the form.

- Detailed financial information as required by the form.

- Signature and date to validate the submission.

Ensuring that these elements are correctly addressed is crucial for the form's acceptance by regulatory bodies.

Filing Deadlines / Important Dates

Filing deadlines for the Sctc 111 can vary based on the specific context in which the form is used. It is important to be aware of any important dates associated with the form to ensure timely submission. Late submissions may result in penalties or complications with compliance.

Who Issues the Form

The Sctc 111 is typically issued by a relevant government agency or regulatory body. Understanding the issuing authority is important for ensuring that the form is completed correctly and submitted to the appropriate office. This can vary based on the specific use case of the Sctc 111.

Quick guide on how to complete sctc 111

Complete Sctc 111 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Sctc 111 on any device using airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to amend and eSign Sctc 111 with ease

- Obtain Sctc 111 and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Develop your eSignature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to store your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Sctc 111 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sctc 111

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sctc 111 feature in airSlate SignNow?

The sctc 111 feature in airSlate SignNow allows users to streamline their document signing process. It provides a user-friendly interface for sending, eSigning, and managing documents efficiently. This feature is particularly beneficial for businesses aiming to enhance workflow automation and improve turnaround times.

-

How much does airSlate SignNow with sctc 111 cost?

Pricing for airSlate SignNow with sctc 111 varies based on the plan you choose. We offer different tiers to accommodate businesses of all sizes, keeping it cost-effective. You can find detailed pricing information on our website, which aligns with the capabilities provided by the sctc 111 feature.

-

What are the main benefits of using sctc 111 in airSlate SignNow?

Using sctc 111 in airSlate SignNow offers signNow benefits, including faster document processing and improved security. It enables users to manage multiple documents seamlessly and ensures that all signed documents are securely stored. This advancement helps businesses maintain compliance and improve customer satisfaction.

-

Can I integrate sctc 111 with other applications?

Yes, airSlate SignNow with sctc 111 can be easily integrated with popular applications like Google Drive, Salesforce, and Microsoft Office. These integrations enhance the functionality of your document management system. This allows for a more seamless workflow and better data management across your business processes.

-

Is there a free trial available for sctc 111?

Absolutely! airSlate SignNow offers a free trial that includes access to the sctc 111 features. This trial allows prospective customers to explore the functionalities and see how it can benefit their document management needs. Sign up today to experience it firsthand without any commitment.

-

How secure is the sctc 111 feature in airSlate SignNow?

The sctc 111 feature in airSlate SignNow is built with robust security measures to protect your documents. We utilize encryption protocols and secure data storage to ensure that your information is safe. Compliance with industry standards also guarantees that your sensitive signed documents are handled with the utmost care.

-

What types of documents can I manage with sctc 111?

With sctc 111 in airSlate SignNow, you can manage a wide variety of documents, including contracts, agreements, and forms. The platform supports various file formats, enabling businesses to create, send, and sign any document type necessary for their operations. This versatility makes it suitable for any industry looking to streamline their paperwork.

Get more for Sctc 111

- Affidavit residency form

- Residency lawful 497331119 form

- Answer complaint 497331120 form

- Amendment partnership form

- Sample letter for welcome discount for new enterprise form

- Sample letter legal representation form

- Postnuptial property form

- Employment of president of logistics and freight forwarding company form

Find out other Sctc 111

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter