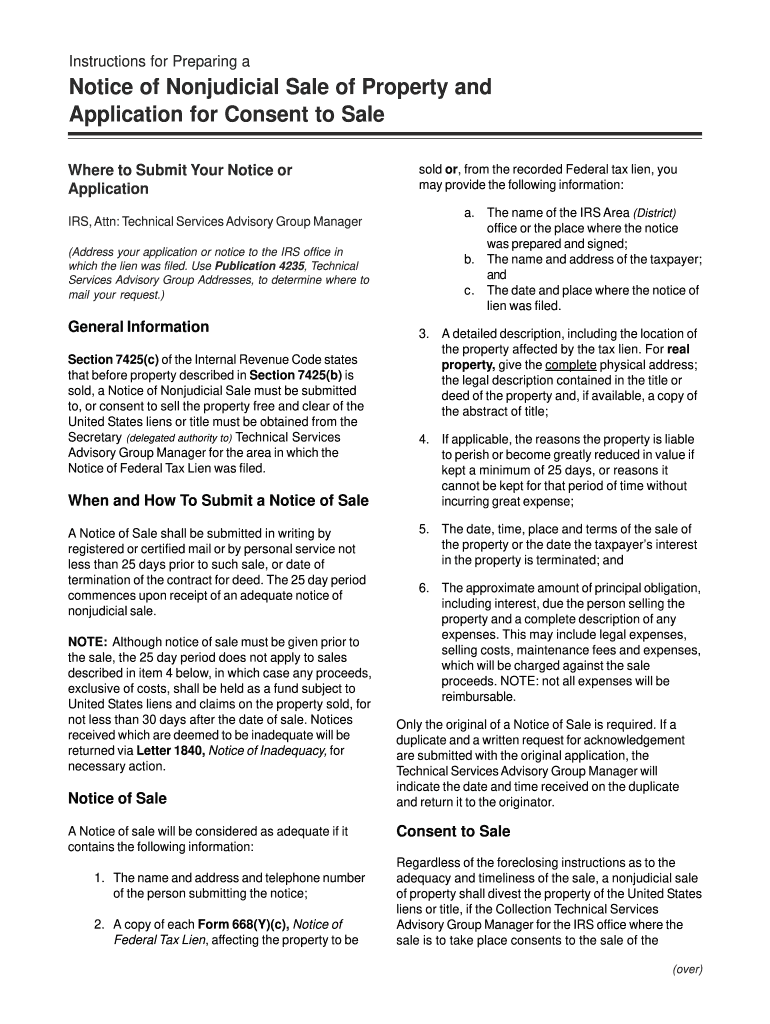

Irs Publication 786 2006

What is the IRS Publication 786

The IRS Publication 786 is a comprehensive resource that provides guidance on the tax implications of certain transactions involving foreign entities. This publication is particularly relevant for U.S. taxpayers who engage in international business or have investments in foreign assets. It outlines the necessary reporting requirements and offers detailed explanations of the tax treatment of various types of income derived from foreign sources.

How to Use the IRS Publication 786

To effectively use the IRS Publication 786, taxpayers should first familiarize themselves with the specific sections that pertain to their situation. The publication includes examples and scenarios that illustrate how to apply the rules in real-life contexts. Taxpayers should pay close attention to the definitions and guidelines provided to ensure compliance with IRS regulations. Utilizing this publication can help taxpayers accurately report income and avoid potential penalties.

Steps to Complete the IRS Publication 786

Completing the IRS Publication 786 involves several key steps:

- Review the publication to understand the relevant tax rules and requirements.

- Gather necessary documentation related to foreign income and transactions.

- Fill out the relevant sections of the publication, ensuring all information is accurate.

- Consult with a tax professional if needed, especially for complex situations.

- Submit the completed publication along with any required tax forms to the IRS.

Legal Use of the IRS Publication 786

The legal use of the IRS Publication 786 is essential for ensuring compliance with U.S. tax laws. This publication serves as an authoritative source for understanding the obligations of U.S. taxpayers regarding foreign income and transactions. By adhering to the guidelines outlined in the publication, taxpayers can mitigate risks associated with non-compliance, such as penalties or audits.

Key Elements of the IRS Publication 786

Key elements of the IRS Publication 786 include:

- Definitions of terms related to foreign income and transactions.

- Detailed explanations of tax treatment for various types of foreign income.

- Reporting requirements for foreign assets and income.

- Examples that illustrate how to apply the rules in practice.

- Guidance on potential penalties for non-compliance.

Examples of Using the IRS Publication 786

Examples of using the IRS Publication 786 can provide clarity on how to navigate complex tax situations. For instance, a U.S. taxpayer receiving dividends from a foreign corporation would refer to the publication to understand how to report that income. Similarly, an individual with a foreign bank account would find guidance on the necessary disclosures and reporting requirements. These examples serve as practical applications of the rules, helping taxpayers make informed decisions.

Quick guide on how to complete irs publication 786

Prepare Irs Publication 786 effortlessly on any device

Online document administration has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed forms, as you can access the required document and securely keep it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and electronically sign your documents quickly without delays. Manage Irs Publication 786 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Irs Publication 786 with ease

- Locate Irs Publication 786 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the information and click on the Done button to save your alterations.

- Choose how you wish to submit your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors requiring new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and electronically sign Irs Publication 786 and ensure excellent communication at any point in the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs publication 786

Create this form in 5 minutes!

How to create an eSignature for the irs publication 786

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Publication 786 and how does it relate to airSlate SignNow?

IRS Publication 786 provides guidance on tax-related documents, which can include those signed electronically. With airSlate SignNow, you can easily eSign necessary tax forms, ensuring compliance with IRS regulations while streamlining your document management process.

-

How can airSlate SignNow help me with IRS Publication 786 compliance?

Using airSlate SignNow ensures that your electronically signed documents adhere to the IRS guidelines outlined in Publication 786. Our platform provides a secure and legally compliant way to manage and sign tax-related forms, simplifying compliance for your business.

-

What are the pricing options for airSlate SignNow when focusing on IRS Publication 786-related documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those focusing on IRS Publication 786 requirements. With our cost-effective solutions, you can choose a plan that best fits your budget while ensuring you meet compliance standards.

-

Can airSlate SignNow integrate with other tools for IRS Publication 786 documentation?

Yes, airSlate SignNow seamlessly integrates with various tools and platforms to facilitate the signing and management of IRS Publication 786 documents. This integration enhances your workflow, allowing you to easily handle tax forms alongside other essential business applications.

-

What features does airSlate SignNow offer to simplify the signing of IRS Publication 786 documents?

airSlate SignNow provides features like templates, bulk sending, and custom branding to simplify the eSigning process for IRS Publication 786 documents. These tools streamline your document workflows and help ensure that necessary forms are signed efficiently and professionally.

-

How does airSlate SignNow ensure the security of my IRS Publication 786 documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods and compliance measures to protect your IRS Publication 786 documents, ensuring that all electronic signatures and personal information remain secure throughout the signing process.

-

Is airSlate SignNow user-friendly for non-technical users dealing with IRS Publication 786 forms?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for everyone, even those who are not tech-savvy. Our intuitive interface ensures that anyone can easily navigate and manage IRS Publication 786 forms without hassle.

Get more for Irs Publication 786

- Warning notice due to complaint from neighbors north dakota form

- Lease subordination agreement north dakota form

- Apartment rules and regulations north dakota form

- Agreed cancellation of lease north dakota form

- Amendment of residential lease north dakota form

- Agreement for payment of unpaid rent north dakota form

- Commercial lease assignment from tenant to new tenant north dakota form

- Tenant consent to background and reference check north dakota form

Find out other Irs Publication 786

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document