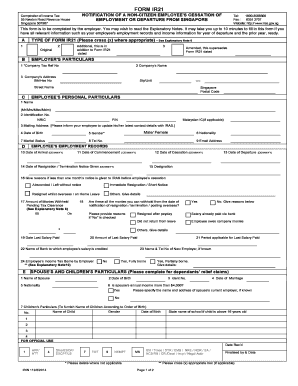

Ir 21 Tax Form

What is the IR-21 Tax Form

The IR-21 tax form is a crucial document used for reporting income and tax obligations for specific categories of taxpayers in the United States. This form is primarily designed for individuals and businesses that need to declare certain types of income to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the IR-21 form is essential for ensuring compliance with federal tax regulations.

How to Use the IR-21 Tax Form

Using the IR-21 tax form involves several steps to ensure accurate reporting of income. Taxpayers must first gather all necessary financial information, including income statements and relevant deductions. After completing the form, it is vital to review the entries for accuracy before submission. This form can be filed electronically or via traditional mail, depending on the taxpayer's preference and the specific requirements set by the IRS.

Steps to Complete the IR-21 Tax Form

Completing the IR-21 tax form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out the personal information section accurately, including your name, address, and Social Security number.

- Report your income in the designated sections, ensuring that all amounts are correctly entered.

- Calculate any deductions or credits you may be eligible for, and apply them to your total income.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline to avoid penalties.

Legal Use of the IR-21 Tax Form

The legal use of the IR-21 tax form is governed by IRS regulations. This form must be completed accurately and submitted on time to avoid potential legal issues, including fines or audits. Compliance with tax laws is essential, and using a reliable platform for electronic submission can help ensure that the form meets all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the IR-21 tax form are critical for compliance. Typically, the form must be submitted by April 15 of each year, but this date may vary depending on weekends or holidays. Taxpayers should be aware of any extensions that may apply and keep track of important dates to ensure timely filing.

Required Documents

To complete the IR-21 tax form accurately, taxpayers must gather several key documents, including:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any additional income sources, such as interest or dividends.

- Documentation for deductions, including receipts and statements.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the IR-21 tax form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for taxpayers to understand these risks and ensure that they file their forms accurately and on time to avoid any negative consequences.

Quick guide on how to complete ir 21 tax form

Effortlessly Prepare Ir 21 Tax Form on Any Device

Managing documents online has gained traction among both companies and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Handle Ir 21 Tax Form on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

The Easiest Way to Modify and Electronically Sign Ir 21 Tax Form

- Locate Ir 21 Tax Form and then click Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to share your form, whether via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Ir 21 Tax Form while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir 21 tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ir21 document?

An ir21 document is a specific tax declaration form used in Singapore for employees who are leaving the country permanently or holding non-resident status. This document ensures that the tax obligations of the individual are settled before they depart. Understanding how to properly complete an ir21 document is crucial for compliance with tax regulations.

-

How can airSlate SignNow help with the ir21 document?

airSlate SignNow provides a seamless solution for managing and eSigning the ir21 document. You can easily upload the document, gather signatures, and send it securely to relevant parties. This streamlines the process, ensuring that your ir21 document is completed quickly and efficiently.

-

What are the costs associated with using airSlate SignNow for the ir21 document?

airSlate SignNow offers competitive pricing plans tailored to different business needs, making it an affordable choice for managing the ir21 document. You can choose from various subscription options, allowing you to select the plan that best fits your budget and usage. Additionally, the cost savings from efficient document management can outweigh the subscription fees.

-

Is it easy to use airSlate SignNow for the ir21 document?

Yes, airSlate SignNow is designed to be user-friendly, making the process of preparing and signing the ir21 document straightforward. Even those who aren't tech-savvy can navigate the platform with ease. The platform also offers tutorials and support to assist users in completing their documents.

-

Can I integrate airSlate SignNow with other tools for managing the ir21 document?

Absolutely! airSlate SignNow provides integrations with various platforms, including CRM systems and cloud storage solutions. This allows you to streamline your workflow when managing the ir21 document, ensuring that everything is connected and accessible from one place.

-

What security measures does airSlate SignNow have for the ir21 document?

airSlate SignNow takes document security seriously, employing industry-standard encryption and compliance measures to protect your ir21 document. Access controls and audit trails ensure that your data remains safe and that you can track who has viewed and signed your documents. You can trust that your sensitive documents are handled with the utmost care.

-

How long does it take to eSign the ir21 document with airSlate SignNow?

The eSigning process for the ir21 document on airSlate SignNow is typically quick, often taking just a few minutes. Once the document is uploaded, it can be sent out for signatures instantly. Most signers can complete their part in under ten minutes, making the overall package extremely efficient.

Get more for Ir 21 Tax Form

Find out other Ir 21 Tax Form

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free