1040ez Form Example

What is the 1040ez Form Example

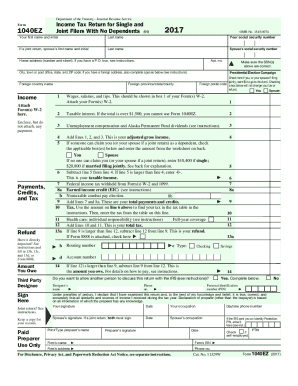

The 1040ez form is a simplified version of the standard IRS Form 1040, designed for taxpayers with straightforward tax situations. It is primarily used by individuals who have a taxable income below a certain threshold, do not claim any dependents, and do not itemize deductions. This form streamlines the filing process, making it easier for eligible taxpayers to report their income and calculate their tax liability. The 1040ez form example illustrates how to accurately fill out this form, ensuring compliance with IRS regulations while maximizing potential refunds.

Steps to Complete the 1040ez Form Example

Completing the 1040ez form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms and any other income statements. Next, follow these steps:

- Enter your personal information, including name, address, and Social Security number.

- Report your total income, including wages and interest.

- Calculate your adjusted gross income (AGI) if applicable.

- Determine your tax liability using the IRS tax tables.

- Claim any eligible credits or payments.

- Sign and date the form before submission.

Each section of the form must be filled out accurately to avoid delays or penalties.

Legal Use of the 1040ez Form Example

The 1040ez form is legally recognized by the IRS as a valid method for reporting income and calculating tax obligations. To ensure the form is legally binding, it must be completed correctly and submitted by the appropriate deadline. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Using a reliable eSignature solution can enhance the legal standing of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the 1040ez form typically align with the annual tax season. For most taxpayers, the deadline to submit the form is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to be aware of these dates to avoid late filing penalties. Additionally, taxpayers may request an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the 1040ez form. The most common methods include:

- Online Filing: Many taxpayers choose to file electronically using tax software, which often provides step-by-step guidance.

- Mail: Paper forms can be mailed to the appropriate IRS address, ensuring that all required documents are included.

- In-Person: Some individuals may prefer to file in person at designated IRS offices or authorized tax preparation services.

Each submission method has its advantages, and selecting the right one can depend on personal preference and the complexity of the tax situation.

Eligibility Criteria

To qualify for using the 1040ez form, taxpayers must meet specific eligibility criteria. Generally, these include:

- Filing as single or married filing jointly.

- Having a taxable income below a set threshold, which varies by tax year.

- Not claiming any dependents.

- Not itemizing deductions.

- Reporting income solely from wages, salaries, tips, taxable interest, and unemployment compensation.

Understanding these criteria is crucial for ensuring that taxpayers select the appropriate form for their filing needs.

Quick guide on how to complete 1040ez form example

Complete 1040ez Form Example effortlessly on any device

Digital document management has gained popularity among companies and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage 1040ez Form Example on any platform using airSlate SignNow Android or iOS applications and simplify any document-based task today.

The easiest way to edit and eSign 1040ez Form Example with ease

- Find 1040ez Form Example and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for such purposes.

- Generate your signature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced files, cumbersome form searches, or errors that require new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Edit and eSign 1040ez Form Example and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040ez form example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040ez form?

The 1040ez form is a simplified tax return form designed for individuals with straightforward tax situations. This form allows taxpayers to report their income and claim credits efficiently, making it an ideal choice for those who meet specific eligibility criteria, such as having no dependents and taking the standard deduction.

-

How can airSlate SignNow assist with the 1040ez form?

airSlate SignNow provides a seamless platform for eSigning and managing your 1040ez form. Users can easily fill out, sign, and send the form securely, ensuring that all necessary signatures are collected without the hassle of printing and mailing.

-

Is there a fee associated with using airSlate SignNow for the 1040ez form?

airSlate SignNow offers a cost-effective solution with various pricing plans to fit different budgets. Users can take advantage of a free trial to explore features before committing, making it budget-friendly for those needing to manage the 1040ez form.

-

Can I integrate airSlate SignNow with other applications for my 1040ez form?

Yes, airSlate SignNow integrates seamlessly with various applications, including cloud storage solutions and accounting software. This integration capability enhances the workflow for users preparing and submitting their 1040ez form, streamlining the entire process.

-

What features does airSlate SignNow offer for the 1040ez form?

AirSlate SignNow provides a range of features for managing your 1040ez form, including customizable templates, electronic signatures, and secure cloud storage. These features help ensure that your document processes are efficient and compliant with tax filing requirements.

-

Is my data secure when using airSlate SignNow for the 1040ez form?

Absolutely! airSlate SignNow prioritizes data security, employing advanced encryption methods to protect your information while working on your 1040ez form. The platform complies with industry standards, ensuring that your sensitive tax documents remain secure.

-

How does airSlate SignNow enhance the experience of filing the 1040ez form?

AirSlate SignNow enhances your experience by making the filing of the 1040ez form more convenient and user-friendly. With features like user-friendly templates and easy sharing options, users can complete and file their forms faster and with less stress.

Get more for 1040ez Form Example

- Resume cover letter for paralegal form

- Resume cover letter for animator form

- Cover personal trainer form

- Resume cover letter for funeral director form

- Resume cover letter for anchor reporter form

- Cover interior designer form

- Resume cover letter for master cosmetologist form

- Resume cover letter for associate auctioneer form

Find out other 1040ez Form Example

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure