St 11a Form

What is the St 11a

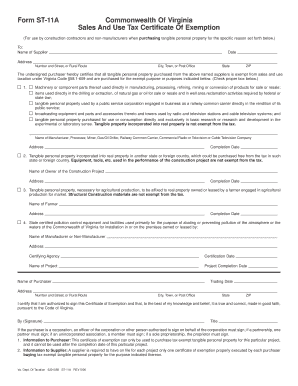

The St 11a form, also known as the Virginia Sales Tax Exemption Form, is a crucial document for businesses and individuals seeking to claim sales tax exemptions in the state of Virginia. This form is primarily used by organizations that qualify for sales tax exemptions, such as non-profits, government entities, and certain educational institutions. By submitting the St 11a, eligible parties can avoid paying sales tax on qualifying purchases, which can lead to significant savings over time.

How to use the St 11a

To effectively use the St 11a form, individuals or organizations must first ensure they meet the eligibility criteria for sales tax exemption. Once eligibility is confirmed, they can fill out the form with accurate information, including details about the purchaser and the nature of the purchases. It is important to provide clear and precise information to avoid any delays or issues during processing. After completing the form, it should be presented to the seller at the time of purchase to validate the exemption claim.

Steps to complete the St 11a

Completing the St 11a form involves several important steps:

- Gather necessary information: Collect details such as the name and address of the purchaser, the type of exemption being claimed, and the nature of the items being purchased.

- Fill out the form: Accurately complete all required fields on the St 11a form, ensuring that all information is correct and up to date.

- Review the form: Double-check for any errors or omissions that could lead to complications.

- Submit the form: Present the completed St 11a form to the seller at the time of purchase to validate the sales tax exemption.

Legal use of the St 11a

The St 11a form is legally recognized in Virginia as a valid means for claiming sales tax exemptions. To ensure compliance with state regulations, it is essential that the form is filled out accurately and submitted appropriately. Misuse or fraudulent claims can result in penalties, including fines or legal repercussions. Therefore, understanding the legal framework surrounding the use of the St 11a is vital for any entity looking to utilize this exemption.

Key elements of the St 11a

Several key elements are essential to the St 11a form:

- Purchaser Information: The name and address of the individual or organization claiming the exemption.

- Type of Exemption: A clear indication of the basis for the exemption, such as non-profit status or governmental purpose.

- Description of Goods or Services: A detailed account of what items or services the exemption applies to.

- Signature: The form must be signed by an authorized representative of the purchaser to validate the claim.

Form Submission Methods

The St 11a form can be submitted in several ways, depending on the seller's policies. Typically, the form is presented in person at the time of purchase. Some sellers may also accept the form via email or fax, allowing for more flexibility in transactions. It is advisable to confirm with the seller regarding their preferred submission method to ensure the exemption is honored.

Quick guide on how to complete st 11a

Complete St 11a seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle St 11a on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign St 11a effortlessly

- Obtain St 11a and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign St 11a and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 11a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ST 11A Virginia?

Form ST 11A Virginia is a sales and use tax exemption certificate used by eligible purchasers to claim an exemption from sales tax on qualifying purchases. This form is crucial for businesses in Virginia looking to minimize their tax liabilities. Using airSlate SignNow, you can easily eSign and manage your Form ST 11A Virginia efficiently.

-

How can I use airSlate SignNow to fill out Form ST 11A Virginia?

With airSlate SignNow, you can effortlessly fill out Form ST 11A Virginia online. Our platform provides an intuitive interface that guides you through the necessary fields and ensures all required information is included. You can also save and edit the form as needed, making it a streamlined process for your business.

-

Is there a cost associated with using airSlate SignNow for Form ST 11A Virginia?

Yes, airSlate SignNow offers various pricing plans to accommodate your business needs when managing documents like Form ST 11A Virginia. The plans are designed to be cost-effective and provide value through features like eSigning, multiple user access, and secure document storage. You can choose a plan that fits your budget and document needs.

-

What features does airSlate SignNow offer for handling Form ST 11A Virginia?

airSlate SignNow offers a range of features to streamline the handling of Form ST 11A Virginia, including easy eSigning, templates for repetitive use, and secure document storage. You can also track the status of your form and receive notifications when it is signed. These features enhance efficiency and ensure compliance with Virginia's tax regulations.

-

Can I integrate airSlate SignNow with other tools for managing Form ST 11A Virginia?

Absolutely! airSlate SignNow offers integrations with various business tools, such as CRM systems and accounting software. This capability allows you to seamlessly manage Form ST 11A Virginia within your existing workflows, making it easier to track sales tax exemptions and related documentation without switching platforms.

-

What are the benefits of using airSlate SignNow for Form ST 11A Virginia?

Using airSlate SignNow for Form ST 11A Virginia offers numerous benefits, including enhanced efficiency, reduced processing time, and improved accuracy. The platform's user-friendly interface and eSigning capabilities allow you to complete your form quickly and securely. Additionally, it helps ensure compliance with Virginia's specific tax regulations.

-

How can I ensure the security of my Form ST 11A Virginia on airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including Form ST 11A Virginia, with advanced encryption protocols and compliance with industry standards. All your data is securely stored and transmitted, ensuring that sensitive information remains protected. You can trust that your documents will be handled safely throughout the signing process.

Get more for St 11a

Find out other St 11a

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer