Pa 1000 Instructions Form

What is the PA 1000 Instructions

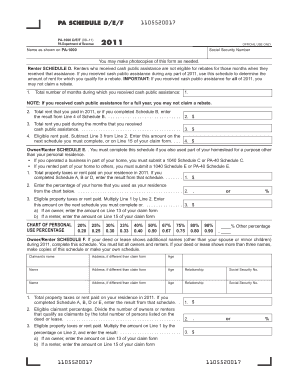

The PA 1000 Instructions provide detailed guidance for completing the Pennsylvania Property Tax Rent Rebate program application. This form is designed for eligible residents who wish to claim a rebate on property taxes or rent paid during the previous year. It is essential for individuals to understand the specific requirements and processes outlined in the instructions to ensure accurate completion and submission.

Steps to Complete the PA 1000 Instructions

Completing the PA 1000 form involves several key steps:

- Gather necessary documentation, including proof of income and residency.

- Carefully read the PA 1000 Instructions to understand eligibility and required information.

- Fill out the form accurately, ensuring all sections are completed as per the guidelines.

- Double-check the entries for accuracy before submission.

- Submit the form through the preferred method: online, by mail, or in person.

Required Documents

To successfully complete the PA 1000 form, applicants must provide specific documentation, including:

- Proof of income, such as W-2 forms or tax returns.

- Documentation of rent paid or property tax statements.

- Identification verification, which may include a driver's license or state ID.

Having these documents ready will streamline the application process and help avoid delays.

Eligibility Criteria

Eligibility for the PA 1000 rebate is based on several factors:

- Age: Applicants must be sixty-five years or older, or be a widow/widower aged fifty-one or older, or be permanently disabled.

- Income limits: There are specific income thresholds that applicants must meet to qualify for the rebate.

- Residency: Applicants must be residents of Pennsylvania for the entire year they are claiming the rebate.

Understanding these criteria is crucial for determining whether you can apply for a rebate.

Form Submission Methods

The PA 1000 form can be submitted through various methods, providing flexibility for applicants:

- Online: Submit the completed form through the Pennsylvania Department of Revenue's website.

- By Mail: Send the completed form to the appropriate address listed in the instructions.

- In-Person: Deliver the form directly to a local Department of Revenue office.

Choosing the right submission method can help ensure timely processing of your application.

Legal Use of the PA 1000 Instructions

The PA 1000 Instructions serve as an official guideline for applicants, ensuring compliance with state laws regarding property tax rebates. Adhering to these instructions is vital for the legal acceptance of the application by the Pennsylvania Department of Revenue. Misinterpretation or failure to follow the instructions may result in delays or rejection of the rebate claim.

Quick guide on how to complete pa 1000 instructions

Complete Pa 1000 Instructions effortlessly on any device

Managing documents online has become popular among organizations and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Pa 1000 Instructions on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Pa 1000 Instructions seamlessly

- Obtain Pa 1000 Instructions and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Modify and eSign Pa 1000 Instructions to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 1000 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the airSlate SignNow platform related to PA 1000 instructions 2020?

The airSlate SignNow platform offers robust features such as customizable templates, real-time collaboration, and secure eSigning, all tailored to enhance the PA 1000 instructions 2020 workflow. Users can easily manage document signing processes, ensuring compliance with legal standards associated with the PA 1000 instructions 2020. Additionally, the platform integrates seamlessly with other business applications, making it a comprehensive solution.

-

How much does airSlate SignNow cost for users looking to implement PA 1000 instructions 2020?

Pricing for airSlate SignNow is competitive and varies based on the plan selected. For those focusing on PA 1000 instructions 2020, users can choose from several subscription options, ensuring they find a cost-effective solution that meets their document management needs while staying compliant with the PA 1000 instructions 2020. Discounts may be available for annual subscriptions.

-

Can airSlate SignNow integrate with other software for PA 1000 instructions 2020?

Yes, airSlate SignNow is designed to integrate seamlessly with a variety of software applications, which is particularly beneficial for managing PA 1000 instructions 2020. This includes popular tools such as CRM systems, cloud storage solutions, and productivity applications, allowing for a streamlined workflow. Users can connect their favorite apps to enhance efficiency in handling PA 1000 instructions 2020.

-

What benefits does airSlate SignNow offer for handling PA 1000 instructions 2020?

Utilizing airSlate SignNow for PA 1000 instructions 2020 offers numerous benefits, including reduced turnaround times and improved document security. The platform enables users to send, receive, and eSign documents quickly and securely, ensuring that PA 1000 instructions 2020 are processed efficiently. This not only enhances productivity but also helps in maintaining compliance with regulatory requirements.

-

Is training provided for using airSlate SignNow with PA 1000 instructions 2020?

Absolutely! airSlate SignNow offers comprehensive training resources and customer support to help users become proficient with the platform, particularly for PA 1000 instructions 2020. These resources include video tutorials, live webinars, and a dedicated help center to address all your queries. This support ensures that users can fully leverage the features of airSlate SignNow when working with PA 1000 instructions 2020.

-

How secure is airSlate SignNow for managing PA 1000 instructions 2020?

Security is a top priority for airSlate SignNow, especially when it comes to handling sensitive information related to PA 1000 instructions 2020. The platform uses advanced encryption methods to protect documents and user data at all stages of the signing process. This commitment to security ensures compliance with legal standards governing document handling, including those relevant to PA 1000 instructions 2020.

-

Can I access airSlate SignNow on mobile devices for PA 1000 instructions 2020?

Yes, airSlate SignNow is fully accessible through mobile devices, enabling users to manage their PA 1000 instructions 2020 on the go. The mobile app provides all the essential features needed to send and sign documents, ensuring that users can stay productive wherever they are. This flexibility is particularly beneficial for businesses that require mobility in processing PA 1000 instructions 2020.

Get more for Pa 1000 Instructions

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential vermont form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property vermont form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property vermont form

- Adoption petition vermont form

- Adult adoption petition form

- Notice to interested persons of commencement of adoption proceeding vermont form

- Vt father form

- Vt appearance form

Find out other Pa 1000 Instructions

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document