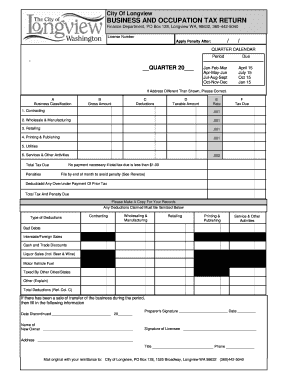

Business and Occupation Tax Return City of Longview, WA Form

What is the Business and Occupation Tax Return City of Longview, WA

The Business and Occupation Tax Return for the City of Longview, Washington, is a tax form that businesses must complete to report their gross receipts and pay the corresponding taxes. This tax is imposed on the gross income of businesses operating within the city limits, regardless of their legal structure. The tax rate may vary based on the type of business activity conducted, and it is essential for businesses to understand their obligations to ensure compliance with local regulations.

Steps to Complete the Business and Occupation Tax Return City of Longview, WA

Completing the Business and Occupation Tax Return involves several key steps:

- Gather necessary financial records, including gross receipts and any relevant deductions.

- Obtain the correct tax form from the City of Longview's official website or local government office.

- Fill out the form by accurately reporting your gross income and calculating the tax owed based on the applicable rate.

- Review the completed form for accuracy and ensure all required information is included.

- Submit the form by the designated deadline, either online, by mail, or in person, as per the city's guidelines.

Required Documents for the Business and Occupation Tax Return City of Longview, WA

When preparing to file the Business and Occupation Tax Return, businesses should have the following documents ready:

- Financial statements detailing gross receipts.

- Records of any deductions that may apply to your business.

- Previous tax returns, if applicable, for reference.

- Any correspondence from the City of Longview regarding tax obligations.

Filing Deadlines for the Business and Occupation Tax Return City of Longview, WA

It is crucial for businesses to be aware of the filing deadlines for the Business and Occupation Tax Return. Typically, the return is due annually, and businesses should check the City of Longview's official resources for specific dates. Late submissions may incur penalties, so timely filing is essential to avoid unnecessary fees.

Legal Use of the Business and Occupation Tax Return City of Longview, WA

The Business and Occupation Tax Return is a legally binding document that must be filed in accordance with the regulations set forth by the City of Longview. Accurate reporting is vital, as discrepancies can lead to audits or penalties. Businesses are encouraged to maintain thorough records and consult with tax professionals if needed to ensure compliance with local tax laws.

Examples of Using the Business and Occupation Tax Return City of Longview, WA

Businesses of various types, such as retail stores, service providers, and manufacturers, utilize the Business and Occupation Tax Return to report their earnings. For instance, a local restaurant would report its total sales, including food and beverage sales, while a consulting firm would report its service income. Each business must calculate its tax based on the specific rate applicable to its industry.

Quick guide on how to complete business and occupation tax return city of longview wa

Effortlessly Prepare Business And Occupation Tax Return City Of Longview, WA on Any Device

The management of online documents has gained traction among businesses and individuals. It serves as a remarkable eco-friendly substitute for traditional printed and signed documents, allowing for easy access to the correct form and safe online storage. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Business And Occupation Tax Return City Of Longview, WA on any platform using the airSlate SignNow apps for Android or iOS, and simplify your document-centric processes today.

How to Modify and Electronically Sign Business And Occupation Tax Return City Of Longview, WA with Ease

- Obtain Business And Occupation Tax Return City Of Longview, WA and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and electronically sign Business And Occupation Tax Return City Of Longview, WA to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business and occupation tax return city of longview wa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Longview B O tax and how does it apply to my business?

The city of Longview B O tax refers to the Business and Occupation tax imposed on businesses operating within Longview. Understanding this tax is crucial for compliance and financial planning. AirSlate SignNow enables businesses to manage relevant documentation efficiently, ensuring that you stay on top of your tax obligations in the city of Longview.

-

How can airSlate SignNow help me with the city of Longview B O tax documentation?

AirSlate SignNow provides a streamlined solution for sending and eSigning necessary documents related to the city of Longview B O tax. With user-friendly features, you can easily create, sign, and manage forms that keep you compliant with local regulations. This not only saves you time but also reduces the risk of errors in important tax documents.

-

What features does airSlate SignNow offer that are beneficial for managing city of Longview B O tax documents?

Our platform offers features like customizable templates, secure cloud storage, and real-time document tracking, all of which are particularly beneficial for managing city of Longview B O tax documents. These tools allow you to generate compliant forms quickly and securely share them with stakeholders. You'll appreciate the efficiency and transparency that come with our eSignature solution.

-

Is airSlate SignNow cost-effective for small businesses dealing with the city of Longview B O tax?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses dealing with the city of Longview B O tax. Our flexible pricing plans allow you to choose a package that best fits your budget while providing essential eSignature capabilities. This affordability can help small businesses manage their tax documentation without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software for city of Longview B O tax purposes?

Absolutely! airSlate SignNow offers integrations with various accounting software solutions to help you streamline your financial processes, including the city of Longview B O tax documentation. By syncing data between platforms, you can automate tasks and ensure a seamless workflow, making tax management more efficient.

-

What benefits does using airSlate SignNow offer for handling city of Longview B O tax?

Using airSlate SignNow for handling city of Longview B O tax provides several benefits, including increased efficiency and reduced paperwork. You'll enjoy faster document turnaround times and an easy-to-use interface that simplifies the signing process. These advantages empower businesses to focus more on growth while maintaining compliance with local tax regulations.

-

Are there any security measures in place for documents related to the city of Longview B O tax in airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We employ advanced encryption and robust security protocols to protect your sensitive documents related to the city of Longview B O tax. You can have peace of mind knowing that your data is stored securely while you access and manage it conveniently from anywhere.

Get more for Business And Occupation Tax Return City Of Longview, WA

- Wisconsin landlord notice form

- Wi letter landlord form

- Letter tenant landlord agreement 497430583 form

- Wisconsin tenant landlord form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497430585 form

- Wisconsin repair form

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings wisconsin form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises wisconsin form

Find out other Business And Occupation Tax Return City Of Longview, WA

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free