Homestead Fayette County Pa Form

What is the Homestead Fayette County Pa

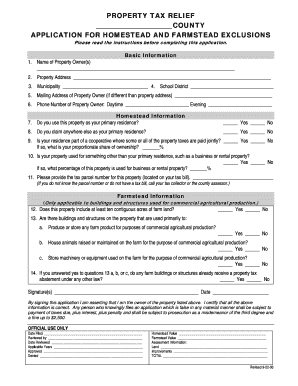

The Homestead Fayette County Pa form is a crucial document designed to provide property tax relief to eligible homeowners in Fayette County, Pennsylvania. This form allows homeowners to apply for a homestead exemption, which can significantly reduce the assessed value of their property for tax purposes. By lowering the taxable value, homeowners can benefit from reduced property tax bills, making homeownership more affordable. The exemption is typically available to those who occupy the property as their primary residence, ensuring that the benefits are directed towards individuals and families living in the community.

How to obtain the Homestead Fayette County Pa

To obtain the Homestead Fayette County Pa form, homeowners can visit the Fayette County official website or contact the county assessor's office directly. It is essential to ensure that you are using the most current version of the form, as updates may occur. Additionally, some local government offices may provide the form in person or via mail. Homeowners should check for any specific instructions or requirements that may accompany the form to ensure a smooth application process.

Steps to complete the Homestead Fayette County Pa

Completing the Homestead Fayette County Pa form involves several straightforward steps:

- Gather necessary documentation, including proof of residency and ownership.

- Fill out the form with accurate personal and property information.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate county office by the specified deadline.

Ensuring that all information is correct and submitted on time is crucial for the successful processing of the application.

Eligibility Criteria

Eligibility for the Homestead Fayette County Pa exemption typically requires that the applicant be the owner of the property and occupy it as their primary residence. Additional criteria may include:

- Being a legal resident of Pennsylvania.

- Meeting any income or age requirements set by local regulations.

- Not having received a homestead exemption on another property.

Homeowners should review local guidelines to confirm their eligibility before applying.

Legal use of the Homestead Fayette County Pa

The legal framework surrounding the Homestead Fayette County Pa form is designed to ensure that property tax relief is administered fairly and transparently. Homeowners must adhere to specific legal requirements, including accurately representing their residency and ownership status. Misrepresentation or failure to comply with the regulations can lead to penalties, including the loss of the exemption or additional fines. It is advisable for homeowners to familiarize themselves with the legal stipulations to maintain compliance.

Form Submission Methods (Online / Mail / In-Person)

Homeowners in Fayette County have several options for submitting the Homestead Fayette County Pa form. These methods include:

- Online Submission: Some counties may offer an online portal for form submission, allowing for a quick and efficient process.

- Mail: Homeowners can print the completed form and send it via postal mail to the designated county office.

- In-Person: Submitting the form in person at the county assessor's office is also an option, providing an opportunity to ask questions and receive immediate assistance.

Choosing the most convenient submission method can help ensure that the application is processed promptly.

Quick guide on how to complete homestead fayette county pa

Easily create Homestead Fayette County Pa on any device

Digital document handling has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to generate, modify, and eSign your documents quickly without delays. Manage Homestead Fayette County Pa on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Homestead Fayette County Pa effortlessly

- Obtain Homestead Fayette County Pa and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to preserve your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you select. Modify and eSign Homestead Fayette County Pa and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the homestead fayette county pa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the homestead exemption in Fayette County, PA?

The homestead exemption in Fayette County, PA, allows property owners to reduce their home's assessed value for tax purposes. This exemption can help lower your overall property taxes, making it easier to afford your home. To apply for this exemption, you need to meet specific eligibility criteria set by the county.

-

How can I apply for a homestead exemption in Fayette County, PA?

To apply for a homestead exemption in Fayette County, PA, you need to complete the application form provided by the county assessor's office. This form typically requires proof of residency and other relevant documentation. Once submitted, your application will be reviewed, and you’ll be notified of your status.

-

What are the benefits of the homestead exemption in Fayette County, PA?

The primary benefit of the homestead exemption in Fayette County, PA, is the reduction in property taxes, which can lead to signNow savings annually. This financial relief is particularly beneficial for low-income families, seniors, and first-time homeowners, allowing them to allocate funds toward other essential needs or investments.

-

Are there deadlines for applying for the homestead exemption in Fayette County, PA?

Yes, there are deadlines for applying for the homestead exemption in Fayette County, PA. Typically, the application must be filed by a specified date each year to receive the exemption for that tax year. It's crucial to check with the county assessor's office for exact dates and requirements to avoid missing out on potential savings.

-

Can the homestead exemption be transferred when selling a home in Fayette County, PA?

In Fayette County, PA, the homestead exemption does not automatically transfer to the new owner when selling a home. The new homeowner must apply for their own exemption based on their eligibility and residency status. It's advisable to inform potential buyers about this during the sale process.

-

What documents do I need to submit for the homestead exemption in Fayette County, PA?

To apply for the homestead exemption in Fayette County, PA, you typically need to submit proof of ownership and residency, such as a deed or mortgage statement, and a completed application form. Additional documentation may be required depending on your specific situation, so it's best to contact the county assessor's office for detailed guidance.

-

Is the homestead exemption available for rental properties in Fayette County, PA?

No, the homestead exemption in Fayette County, PA, is generally only available for primary residences, not rental properties. To qualify, the property must be your primary home, where you reside most of the year. Therefore, landlords and owners of vacation homes in Fayette County won't benefit from this exemption.

Get more for Homestead Fayette County Pa

- Wyoming trust 497432513 form

- Amendment to living trust wyoming form

- Living trust property record wyoming form

- Financial account transfer to living trust wyoming form

- Assignment to living trust wyoming form

- Notice of assignment to living trust wyoming form

- Revocation of living trust wyoming form

- Letter to lienholder to notify of trust wyoming form

Find out other Homestead Fayette County Pa

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit