Equitable Bank Solicitor Forms

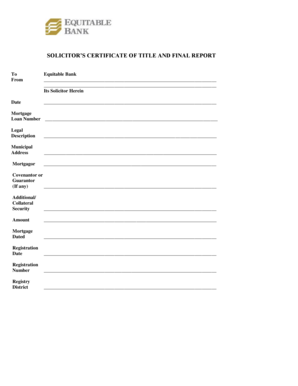

What are equitable bank solicitor forms?

Equitable bank solicitor forms are essential documents used in various legal and financial transactions involving equitable banks. These forms facilitate the execution of agreements, requests, and other formalities required for processing mortgage applications, payout requests, and other banking services. They ensure that all parties involved understand their rights and obligations, and they are designed to comply with relevant legal standards.

How to use equitable bank solicitor forms

Using equitable bank solicitor forms involves several straightforward steps. First, identify the specific form required for your transaction, such as a mortgage document or payout request. Next, download the form from the appropriate source or obtain a physical copy. Carefully read the instructions provided, as each form may have unique requirements. Fill out the form accurately, ensuring all necessary information is included. Finally, submit the completed form through the designated method, whether online, by mail, or in person.

Steps to complete equitable bank solicitor forms

Completing equitable bank solicitor forms requires attention to detail. Follow these steps for a successful submission:

- Gather all necessary information, including personal details and financial data.

- Download or obtain the required form.

- Read the instructions thoroughly to understand the requirements.

- Fill out the form, ensuring accuracy and completeness.

- Review the completed form for any errors or omissions.

- Submit the form through the specified method.

Key elements of equitable bank solicitor forms

Equitable bank solicitor forms typically include several key elements that must be addressed for the document to be valid. These elements include:

- Identification of the parties involved, including names and contact information.

- A clear description of the transaction or agreement being executed.

- Signature lines for all parties, along with dates of signing.

- Any necessary disclosures or terms relevant to the transaction.

Legal use of equitable bank solicitor forms

Equitable bank solicitor forms are legally binding when completed and executed according to applicable laws. To ensure their legal validity, the forms must meet specific requirements, such as obtaining proper signatures and adhering to state regulations. Additionally, using a reliable electronic signature platform, like signNow, can enhance the security and legality of the document by providing an electronic certificate of completion.

Form submission methods

Equitable bank solicitor forms can be submitted through various methods, depending on the bank's policies and the specific form type. Common submission methods include:

- Online submission via the bank's website or a secure portal.

- Mailing the completed form to the designated address.

- In-person delivery at a local bank branch.

Quick guide on how to complete equitable bank solicitor forms

Complete Equitable Bank Solicitor Forms seamlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly and without interruptions. Manage Equitable Bank Solicitor Forms on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest way to edit and electronically sign Equitable Bank Solicitor Forms effortlessly

- Locate Equitable Bank Solicitor Forms and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Equitable Bank Solicitor Forms and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the equitable bank solicitor forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are equitable bank solicitor forms and how can they be used?

Equitable bank solicitor forms are legal documents specifically tailored for transactions involving equitable banks. These forms can be utilized by solicitors to ensure compliance and streamline the documentation process. Using airSlate SignNow, you can easily create, customize, and eSign these forms, making your workflow efficient and secure.

-

How does airSlate SignNow simplify the use of equitable bank solicitor forms?

airSlate SignNow offers a user-friendly platform that allows you to electronically sign and manage equitable bank solicitor forms. Our intuitive interface enables you to fill out, send, and track these forms quickly while ensuring all legal requirements are met. This reduces the time and effort typically associated with handling such documents.

-

Are there any costs associated with using airSlate SignNow for equitable bank solicitor forms?

Yes, airSlate SignNow offers cost-effective plans tailored to your needs, including those who need to manage equitable bank solicitor forms. Pricing is transparent and flexible, allowing you to choose a plan that fits your budget and usage scenarios. Additionally, there are often trial options available to test our features before full commitment.

-

Can I integrate airSlate SignNow with other tools I use for equitable bank solicitor forms?

Absolutely! airSlate SignNow supports a wide range of integrations with popular software such as CRM systems, document management tools, and productivity suites. This means you can seamlessly incorporate the management of equitable bank solicitor forms into your existing workflows without disruption.

-

What security measures are in place for equitable bank solicitor forms on airSlate SignNow?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your equitable bank solicitor forms and data. Additionally, our platform complies with industry standards and regulations to ensure that your sensitive documents remain confidential and protected.

-

Are there templates available for equitable bank solicitor forms?

Yes, airSlate SignNow provides a variety of customizable templates specifically designed for equitable bank solicitor forms. These templates streamline the document creation process, allowing you to quickly fill in necessary information and ensure that all required elements are included. This can save you time and minimize errors.

-

How do I share equitable bank solicitor forms with clients using airSlate SignNow?

Sharing equitable bank solicitor forms is straightforward with airSlate SignNow. Once you have prepared the document, you can easily send it to clients via email or direct link. The platform also allows for real-time tracking of document status, ensuring you stay informed on when your clients have received and signed the forms.

Get more for Equitable Bank Solicitor Forms

- Notice of intention to do work or furnish materials corporation or llc rhode island form

- Renunciation and disclaimer of property from will by testate rhode island form

- Lis pendens form

- Quitclaim deed from individual to individual rhode island form

- Warranty deed from individual to individual rhode island form

- Rhode island llc form

- Rhode island deed 497325044 form

- Warranty deed to child reserving a life estate in the parents rhode island form

Find out other Equitable Bank Solicitor Forms

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now