Form 8919

What is the Form 8919

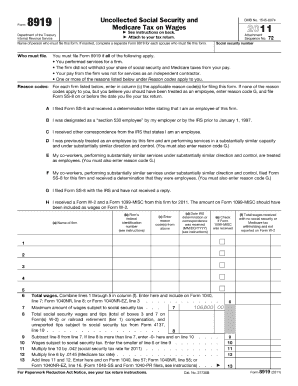

The Form 8919, also known as the Uncollected Social Security and Medicare Tax on Wages, is used by employees to report uncollected Social Security and Medicare taxes. This form is particularly relevant for individuals who have received wages from an employer who did not withhold these taxes. It allows taxpayers to calculate and report the amount of tax owed to the IRS, ensuring compliance with federal tax regulations.

How to use the Form 8919

To effectively use the Form 8919, individuals need to gather relevant information about their wages and the uncollected taxes. The form requires details such as the total wages received, the amount of uncollected Social Security and Medicare taxes, and the employer's information. Once completed, the form should be submitted with the individual’s tax return, ensuring that all calculations are accurate to avoid penalties.

Steps to complete the Form 8919

Completing the Form 8919 involves several key steps:

- Gather necessary documents, including your W-2 form and any other relevant tax documents.

- Fill out your personal information at the top of the form, including your name and Social Security number.

- Report your total wages and calculate the uncollected Social Security and Medicare taxes.

- Provide your employer's details, including their name and Employer Identification Number (EIN).

- Review the completed form for accuracy before submission.

Legal use of the Form 8919

The Form 8919 is legally binding when completed accurately and submitted in accordance with IRS guidelines. It is essential for taxpayers to ensure that they meet all eligibility criteria and comply with tax laws to avoid legal issues. The form serves as a formal declaration of uncollected taxes and must be filed correctly to maintain compliance with federal regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8919 align with the standard tax return deadlines. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. If additional time is needed, taxpayers can file for an extension, but it is important to ensure that any taxes owed are paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the Form 8919, individuals will need several key documents:

- Your W-2 form, which details your wages and taxes withheld.

- Any other documentation that supports your claim of uncollected taxes.

- Your Social Security number and personal identification details.

Penalties for Non-Compliance

Failure to file the Form 8919 or inaccuracies in reporting can result in penalties from the IRS. These penalties may include fines and interest on unpaid taxes. It is crucial for individuals to ensure that the form is completed accurately and submitted on time to avoid these consequences. Regularly reviewing IRS guidelines can help maintain compliance and prevent issues.

Quick guide on how to complete form 8919 253220

Effortlessly Prepare Form 8919 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a suitable eco-conscious alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents promptly without any hurdles. Handle Form 8919 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Form 8919 with Ease

- Find Form 8919 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Edit and eSign Form 8919 and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8919 253220

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8919 and why is it important?

Form 8919 is a tax form used by employees to report uncollected Social Security and Medicare taxes on their wages. It's important for ensuring that your tax obligations are accurately reported to the IRS, which can help avoid future tax issues.

-

How can airSlate SignNow assist with Form 8919?

airSlate SignNow provides a streamlined platform for electronically signing and sending Form 8919. With our easy-to-use interface, you can efficiently manage your documentation and ensure that your tax form is completed and submitted on time.

-

What features does airSlate SignNow offer for handling Form 8919?

airSlate SignNow offers features like customizable templates, real-time collaboration, and secure storage. These features make it easier to fill out and manage your Form 8919, ensuring compliance and accuracy.

-

Is there a cost associated with using airSlate SignNow for Form 8919?

airSlate SignNow offers a variety of pricing plans to suit different budgets. By providing an affordable solution, you can easily utilize our platform for preparing and submitting Form 8919 without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for Form 8919?

Yes, airSlate SignNow supports integration with various applications such as Google Drive, Dropbox, and CRM systems. This allows for seamless document management when dealing with Form 8919 and enhances your workflow efficiency.

-

What are the benefits of using airSlate SignNow for Form 8919?

Using airSlate SignNow for Form 8919 streamlines your document signing and submission process, saving you time and reducing stress. Additionally, our secure platform helps safeguard sensitive tax information, ensuring compliance and peace of mind.

-

How does airSlate SignNow ensure the security of Form 8919 submissions?

airSlate SignNow employs advanced encryption and security protocols to protect your Form 8919 submissions. Our commitment to data security means that your sensitive information is safe, allowing you to focus on other important tasks.

Get more for Form 8919

- Sheetrock drywall contractor package rhode island form

- Flooring contractor package rhode island form

- Trim carpentry contractor package rhode island form

- Fencing contractor package rhode island form

- Hvac contractor package rhode island form

- Landscaping contractor package rhode island form

- Commercial contractor package rhode island form

- Excavation contractor package rhode island form

Find out other Form 8919

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe