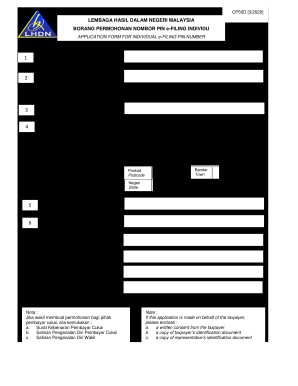

E Filing Pin Number Form

What is the e filing pin number

The e filing pin number is a unique identifier assigned to individuals for the purpose of electronically filing tax returns and other related documents. This number is crucial for ensuring the security and integrity of the filing process. It serves as a safeguard against unauthorized access and helps verify the identity of the taxpayer. The e filing pin number is typically required when submitting forms such as the Form CP55D online, allowing for a streamlined and efficient filing experience.

How to obtain the e filing pin number

To obtain your e filing pin number, you can follow a straightforward process. First, visit the official website of the relevant tax authority, such as the IRS for federal filings. You may need to provide personal information, including your Social Security number, date of birth, and filing status. After verifying your identity, the system will generate your unique e filing pin number. It is essential to keep this number secure, as it is necessary for future electronic filings.

Steps to complete the e filing pin number

Completing the e filing pin number involves several key steps. Begin by gathering the required personal information, including your Social Security number and other identifying details. Next, navigate to the appropriate online portal where you will enter this information. After submitting your details, you will receive your e filing pin number, which you should record securely. Finally, use this pin number during the electronic filing process to ensure your submission is processed correctly.

Legal use of the e filing pin number

The e filing pin number has legal significance in the context of electronic submissions. It acts as a digital signature, confirming the identity of the taxpayer and their consent to file the documents electronically. Compliance with federal regulations, such as the ESIGN Act, ensures that the use of the e filing pin number is legally binding. This means that any documents filed with this pin are treated as valid and enforceable as traditional paper submissions.

Required documents

When applying for or using the e filing pin number, certain documents may be required. These typically include:

- Personal identification, such as a driver's license or passport

- Social Security number

- Previous tax returns for verification purposes

- Any relevant forms that need to be filed electronically

Having these documents ready can expedite the process and ensure that your e filing pin number is issued without delays.

Filing deadlines / Important dates

It is crucial to be aware of the filing deadlines associated with the e filing pin number. Typically, the deadline for individual tax returns is April fifteenth of each year. However, extensions may be available under certain circumstances. Keeping track of these important dates helps ensure that you file your documents on time and avoid potential penalties.

Quick guide on how to complete e filing pin number

Complete E Filing Pin Number seamlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly and efficiently. Handle E Filing Pin Number on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and eSign E Filing Pin Number easily

- Obtain E Filing Pin Number and then click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for such tasks.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your updates.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign E Filing Pin Number and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e filing pin number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an e filing pin number, and why do I need it?

An e filing pin number is a unique code required to file certain documents electronically with tax authorities. It's essential for ensuring the security of your submissions and confirming your identity. Using an e filing pin number helps streamline the filing process and can prevent potential issues with document acceptance.

-

How do I obtain my e filing pin number?

You can obtain your e filing pin number through your tax preparation software or directly from your tax authority. The process typically involves verifying your identity and providing necessary personal information. Once issued, keep your e filing pin number secure, as it is vital for your electronic filings.

-

Is there a cost associated with using an e filing pin number?

Generally, obtaining an e filing pin number is free; however, you may incur costs depending on the tax software or services you choose to use. airSlate SignNow offers affordable solutions to help you manage your documents, making it easier to eSign and file without additional fees for pin retrieval.

-

Can I use airSlate SignNow to manage my e filing pin number?

Yes, airSlate SignNow provides a secure platform where you can manage all your essential documents, including those related to your e filing pin number. By keeping your information organized and easily accessible, you can streamline the tax filing process while ensuring the security of your sensitive data.

-

What features does airSlate SignNow offer for e filing?

airSlate SignNow offers a variety of features that simplify the e filing process, including easy document signing, tracking, and storage. With our platform, you can quickly upload, sign, and submit your documents while ensuring compliance with e filing requirements, including the use of an e filing pin number.

-

How secure is the submission of documents with an e filing pin number?

Using an e filing pin number enhances the security of your electronic submissions by verifying your identity. airSlate SignNow employs top-notch encryption and security protocols to ensure that all your documents and sensitive information, such as your e filing pin number, are protected during transmission and storage.

-

Are there any integrations available with airSlate SignNow for e filing?

Yes, airSlate SignNow integrates seamlessly with various tax preparation platforms, enabling you to streamline your e filing process. These integrations allow you to easily utilize your e filing pin number while managing your documents efficiently, reducing the time and effort needed for tax submissions.

Get more for E Filing Pin Number

Find out other E Filing Pin Number

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe