W4 Form

What is the W-4?

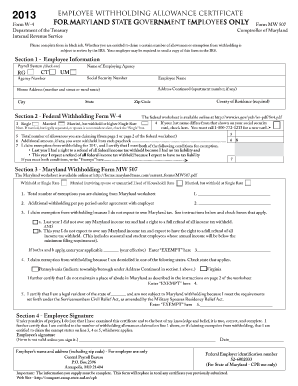

The W-4 form, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employer about the amount of federal income tax to withhold from their paychecks. This form helps ensure that the correct amount of tax is deducted based on the employee's financial situation, including factors such as marital status, number of dependents, and additional income. By accurately completing the W-4, employees can avoid overpaying or underpaying their taxes throughout the year.

Steps to complete the W-4

Completing the W-4 form involves several key steps to ensure accurate withholding. First, employees should provide their personal information, including name, address, Social Security number, and filing status. Next, they need to indicate the number of dependents they are claiming, which affects the withholding amount. Employees can also choose to have additional amounts withheld if they anticipate owing more taxes. Finally, signing and dating the form is essential for it to be valid. It is advisable to review the completed form for accuracy before submitting it to the employer.

Legal use of the W-4

The W-4 form is legally binding, meaning that the information provided must be accurate and truthful. Underreporting income or claiming incorrect deductions can lead to penalties from the IRS. Employers are required to maintain the confidentiality of the information provided on the W-4 and use it solely for the purpose of determining tax withholding. Additionally, employees have the right to update their W-4 at any time, especially after significant life changes such as marriage, divorce, or the birth of a child, which may affect their tax situation.

IRS Guidelines

The IRS provides specific guidelines for completing the W-4 form to help employees determine the correct amount of withholding. These guidelines include instructions on how to calculate the number of allowances based on personal circumstances, as well as the option to use the IRS Tax Withholding Estimator, an online tool designed to assist in determining the appropriate withholding amount. Employees are encouraged to review their W-4 periodically, especially when there are changes in income or family status, to ensure compliance with tax laws.

Form Submission Methods

Once the W-4 is completed, it must be submitted to the employer. This can typically be done in several ways, including online submission through the employer's payroll system, mailing a physical copy, or delivering it in person to the HR department. Employers may have specific preferences regarding submission methods, so it is important for employees to check their company's policies. Ensuring that the W-4 is submitted promptly helps prevent any issues with tax withholding in the upcoming pay periods.

Examples of using the W-4

Understanding how to use the W-4 effectively can help employees manage their tax liabilities. For instance, an employee who recently got married may choose to adjust their withholding to reflect their new filing status, potentially lowering their tax burden. Conversely, a single employee with additional income from freelance work might opt to have extra withholding to avoid owing taxes at the end of the year. These examples illustrate the importance of tailoring the W-4 to individual financial situations to achieve optimal tax outcomes.

Quick guide on how to complete w4

Effortlessly Prepare W4 on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily obtain the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle W4 on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Modify and Electronically Sign W4 with Ease

- Obtain W4 and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize important segments of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document administration requirements in just a few clicks from any device you choose. Edit and electronically sign W4 to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w4 2013 form and why is it important?

The w4 2013 form is the Employee's Withholding Certificate used by employers to determine the amount of federal income tax to withhold from employee paychecks. This form is crucial for ensuring that employees have the correct amount withheld based on their tax situation, which can affect their overall tax returns.

-

How can airSlate SignNow assist with the w4 2013 form?

airSlate SignNow makes it easy to fill out, send, and eSign the w4 2013 form electronically. With our user-friendly platform, you can create, share, and manage your w4 forms seamlessly, ensuring quick compliance with IRS requirements.

-

Are there any costs associated with using airSlate SignNow for the w4 2013 form?

While airSlate SignNow offers a free trial to explore our features, we have competitive pricing plans tailored to suit businesses of all sizes. Investing in airSlate SignNow for handling documents like the w4 2013 form can save you valuable time and resources.

-

What are the key features of airSlate SignNow related to the w4 2013?

Key features of airSlate SignNow for the w4 2013 form include user-friendly templates, secure eSignature capabilities, and the ability to track document status. These features streamline the document workflow, making it easier for both employers and employees to manage their tax withholding needs.

-

Is airSlate SignNow compatible with other software for managing w4 2013 forms?

Yes, airSlate SignNow integrates seamlessly with various HR and accounting software to help manage your w4 2013 forms efficiently. By connecting with tools like QuickBooks and Salesforce, you can ensure your employee data and tax documents are aligned.

-

Can I customize the w4 2013 template in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the w4 2013 form template to reflect your company's branding and specific requirements. This flexibility enables you to maintain a professional appearance while ensuring all necessary information is included.

-

What benefits does airSlate SignNow provide when handling the w4 2013 form?

Using airSlate SignNow to handle the w4 2013 form provides numerous benefits, including enhanced efficiency, improved accuracy, and a reduced risk of paperwork errors. Electronic signatures also speed up the process, allowing your team to focus on other important tasks.

Get more for W4

- Pdf form 170s authorizing direct deposit for survivors benefit orbit

- Unicare fitness reimbursement fill out and sign printable form

- Isa manager transfer form instruction to transfer an existing isa to an isa with lloyds bank share dealing isa manager transfer

- Isa manager transfer form instruction to transfer an existing isa to your lloyds bank e investments stocks and shares isa isa

- Incomplete without all pages life insurance annuity form

- Generic fire risk assessment templateshropshire fire form

- Vendor profile form template for worddocument hub

- Accord cancellation form

Find out other W4

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online