Wth10001 Form

What is the Wth10001

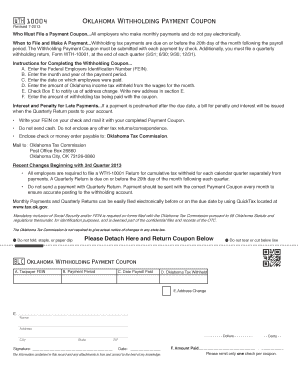

The Wth10001 form is a specific document used for various administrative purposes, often related to tax and legal compliance in the United States. It serves as a formal means for individuals or businesses to provide necessary information to government agencies or other entities. Understanding the purpose and requirements of the Wth10001 is crucial for ensuring accurate and timely submissions.

How to use the Wth10001

Using the Wth10001 form involves several steps to ensure that all required information is accurately filled out. Begin by downloading the form from a reliable source. Carefully read the instructions accompanying the form to understand what information is needed. Fill in the required fields with accurate data, and ensure that any necessary signatures are included. Once completed, the form can be submitted according to the specified guidelines, whether online, by mail, or in person.

Steps to complete the Wth10001

Completing the Wth10001 form requires attention to detail. Follow these steps for a successful submission:

- Download the form from an official source.

- Review the instructions thoroughly to understand the requirements.

- Gather all necessary documents and information needed to complete the form.

- Fill out the form accurately, ensuring all fields are completed as required.

- Sign the form where indicated, using a valid signature method.

- Submit the form according to the provided guidelines, either electronically or via traditional mail.

Legal use of the Wth10001

The legal use of the Wth10001 form hinges on compliance with relevant laws and regulations. It is essential to ensure that the form is filled out correctly and submitted within the designated timeframes. Electronic submissions must meet the standards set by the ESIGN Act and UETA, which validate electronic signatures and documents. Adhering to these legal frameworks ensures that the Wth10001 is recognized as a valid and enforceable document.

Key elements of the Wth10001

Several key elements define the Wth10001 form and its functionality:

- Identification Information: This includes personal or business details necessary for identification.

- Signature: A valid signature is required to authenticate the form.

- Date: The date of completion is crucial for tracking submission timelines.

- Supporting Documentation: Any required documents must be attached to substantiate the information provided.

Form Submission Methods

The Wth10001 form can be submitted through various methods, depending on the requirements set forth by the issuing agency. Common submission methods include:

- Online Submission: Many agencies allow for electronic submission through secure portals.

- Mail: Completed forms can often be sent via postal service to the designated address.

- In-Person: Some situations may require individuals to submit the form directly at an office.

Quick guide on how to complete wth10001

Complete Wth10001 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without any holdups. Handle Wth10001 on any system with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Wth10001 without hassle

- Locate Wth10001 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which only takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Wth10001 and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wth10001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is wth10001 and how does it relate to airSlate SignNow?

The term 'wth10001' refers to a unique identifier associated with specific features or packages within airSlate SignNow. It helps customers easily locate relevant options for sending and eSigning documents. Understanding this code can streamline your decision-making process when choosing the right plan for your business.

-

What pricing plans does airSlate SignNow offer for users interested in wth10001?

airSlate SignNow provides various pricing plans, including options that involve wth10001 features for customizable document workflows. Plans may include monthly or annual subscriptions to fit different budgets. Ensure you review each plan's details to find the best value that includes options linked to wth10001.

-

What are the key features included with wth10001 in airSlate SignNow?

The wth10001 designation incorporates essential features such as document tracking, customizable templates, and automated workflows. These features enhance efficiency and ensure that businesses can manage their eSigning processes seamlessly. Utilizing wth10001 features can lead to improved productivity and a better user experience.

-

How can airSlate SignNow assist businesses in scaling their document management with wth10001?

airSlate SignNow supports businesses in scaling their document management needs through its wth10001 functionalities. This includes bulk sending, advanced team collaboration tools, and robust security options. By leveraging these features, your organization can handle increased document volumes while maintaining compliance.

-

Are there integrations available for wth10001 within airSlate SignNow?

Yes, airSlate SignNow offers various integrations that work seamlessly with the wth10001 features. This includes connections with popular software like Salesforce, Google Drive, and Microsoft Office. These integrations help businesses streamline workflows and enhance productivity by connecting essential tools.

-

What benefits can users expect from choosing airSlate SignNow with wth10001?

Choosing airSlate SignNow with the wth10001 features allows users to enjoy enhanced document security, faster processing times, and an intuitive interface. This translates into a more efficient eSigning experience which is cost-effective. Many customers find that implementing wth10001 drastically reduces turnaround times for important documents.

-

Is customer support available for those using wth10001 services?

Absolutely! airSlate SignNow provides customer support for users utilizing the wth10001 features. You can access help through a range of channels including live chat, email, and comprehensive online resources, ensuring that assistance is always within signNow.

Get more for Wth10001

- 5500 request for driver license records and personal infomation form

- Form mo 1065 2021 partnership return of incomemo 941 employers return of income taxes withheldform mo 1065 2021 partnership

- Sba form 770 100652593

- Dormogovformsmo timedepartment use only form mmddyy mo time time zone

- Veteran application for admission iowa form

- Form 1776 missouri department of revenue

- State of iowa taxesiowa department of revenueiowa individual tax informationiowa department of revenuestate of iowa taxesiowa

- Supplemental security income in wisconsinwisconsinsupplemental security income in wisconsinwisconsinwisconsin dmv official form

Find out other Wth10001

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors