Park Ridge Transfer Stamps Form

What is the Park Ridge Transfer Stamps

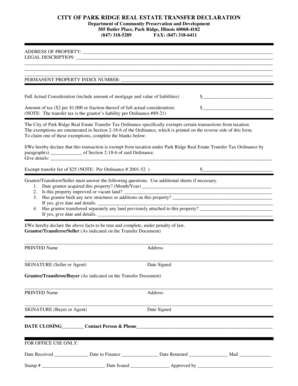

The Park Ridge Transfer Stamps are a crucial component in the process of transferring real estate ownership within the city of Park Ridge, Illinois. These stamps serve as proof that the appropriate transfer tax has been paid when a property changes hands. The stamps are typically required during the closing process of a real estate transaction and are essential for the legal recording of the deed. Without these stamps, the transfer may not be recognized by local authorities, potentially leading to complications for both buyers and sellers.

Steps to complete the Park Ridge Transfer Stamps

Completing the Park Ridge Transfer Stamps involves several key steps to ensure compliance with local regulations. First, the seller must determine the total transfer tax due based on the property's sale price. Next, the seller or their representative must visit the designated city office to purchase the transfer stamps. During this visit, necessary documentation, such as the sales contract and identification, may be required. After obtaining the stamps, they must be affixed to the deed before submission for recording. This process ensures that all legal requirements are met and that the property transfer is officially recognized.

Key elements of the Park Ridge Transfer Stamps

Key elements of the Park Ridge Transfer Stamps include the specific tax rate applied to the property transfer, which can vary based on the property's value and location. Additionally, the stamps must include the date of issuance, the property address, and the names of the parties involved in the transaction. It is important for individuals to ensure that all information is accurate and complete to avoid delays or issues during the recording process. Understanding these elements can help facilitate a smoother transaction and ensure compliance with local laws.

Legal use of the Park Ridge Transfer Stamps

The legal use of the Park Ridge Transfer Stamps is governed by local tax laws and regulations. These stamps must be purchased and properly affixed to the deed to validate the property transfer. Failure to comply with these regulations can result in penalties, including fines or delays in the property recording process. It is essential for both buyers and sellers to understand their responsibilities regarding these stamps to ensure a legally binding transfer of ownership. Legal counsel may be beneficial for those unfamiliar with the requirements.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Park Ridge Transfer Stamps can be done through various methods, depending on local regulations. Typically, the stamps must be acquired in person at the designated city office. However, some jurisdictions may offer online options for payment and form submission. It is advisable to check with the local authorities for the most current submission methods available. Ensuring that the correct method is used can help streamline the process and avoid unnecessary delays in the property transfer.

Required Documents

When applying for the Park Ridge Transfer Stamps, several documents are typically required to facilitate the process. These may include the property deed, a completed transfer declaration form, and identification for the seller or their representative. Additionally, proof of payment for the transfer tax may be necessary. Having these documents prepared in advance can help ensure a smoother transaction and compliance with local regulations, minimizing the risk of complications during the property transfer.

Quick guide on how to complete park ridge transfer stamps

Complete Park Ridge Transfer Stamps seamlessly on any gadget

Web-based document management has gained popularity among businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the features necessary to create, adjust, and eSign your documents swiftly without delays. Handle Park Ridge Transfer Stamps on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-oriented procedure today.

How to modify and eSign Park Ridge Transfer Stamps effortlessly

- Obtain Park Ridge Transfer Stamps and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Park Ridge Transfer Stamps and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the park ridge transfer stamps

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois estate transfer declaration?

The Illinois estate transfer declaration is a legal form that provides the necessary information regarding the transfer of real property upon a person's death. It helps ensure that taxes are accurately assessed and provides essential details to the local authorities. Understanding this declaration is crucial for anyone managing an estate in Illinois.

-

How can airSlate SignNow help with the Illinois estate transfer declaration?

airSlate SignNow simplifies the process of completing and signing the Illinois estate transfer declaration by providing an intuitive electronic signature platform. With our easy-to-use tools, you can fill out, send, and securely sign documents online, streamlining the estate transfer process. This makes managing estate paperwork much more efficient.

-

Is airSlate SignNow affordable for handling the Illinois estate transfer declaration?

Yes, airSlate SignNow offers cost-effective plans tailored for businesses dealing with legal documents like the Illinois estate transfer declaration. Our pricing is designed to fit various budgets while providing robust features that cater to estate management needs. You can start with a free trial to evaluate its value before making a commitment.

-

What features does airSlate SignNow provide for estate management?

airSlate SignNow comes equipped with features such as secure document signing, automated reminders, and customizable templates specifically for the Illinois estate transfer declaration. These tools enhance document workflow efficiency and ensure compliance with state laws. You can easily manage all your estate documentation electronically, saving time and resources.

-

How secure is the information shared through airSlate SignNow for the Illinois estate transfer declaration?

The security of your documents, including the Illinois estate transfer declaration, is our top priority at airSlate SignNow. We utilize industry-leading encryption protocols to protect your data and ensure confidentiality. Additionally, our platform complies with legal standards to provide peace of mind for all users managing sensitive estate information.

-

Can airSlate SignNow integrate with other tools for estate management?

Absolutely! airSlate SignNow offers integrations with various applications that cater to estate management, making it easier to manage the Illinois estate transfer declaration alongside other business processes. Whether it's project management software or cloud storage solutions, our integrations enhance your productivity and document handling capabilities.

-

Does airSlate SignNow provide templates for the Illinois estate transfer declaration?

Yes, airSlate SignNow provides customizable templates for the Illinois estate transfer declaration, making it straightforward to fill out and sign. These templates save time and reduce errors, ensuring you capture all necessary details for compliance. You can easily tailor each template to fit specific estate needs.

Get more for Park Ridge Transfer Stamps

Find out other Park Ridge Transfer Stamps

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation