Form Rd 4279 1a

What is the Form Rd 4279 1a

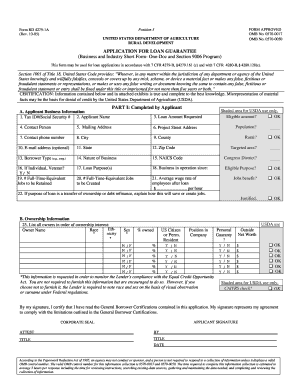

The Form Rd 4279 1a is a specific document used in the context of financial assistance programs, particularly those related to agricultural loans. This form is essential for applicants seeking to secure funding from government agencies for various agricultural projects. It collects pertinent information about the applicant's business, financial status, and the intended use of the funds. Understanding the purpose and requirements of this form is crucial for successful completion and submission.

How to use the Form Rd 4279 1a

Using the Form Rd 4279 1a involves several key steps to ensure that all required information is accurately provided. First, gather all necessary documentation, including financial statements and business plans. Next, fill out the form with precise details regarding your agricultural project, ensuring that all sections are completed. After completing the form, review it for accuracy and completeness before submission. Utilizing a digital signature solution can streamline this process, allowing for secure and efficient signing.

Steps to complete the Form Rd 4279 1a

Completing the Form Rd 4279 1a involves a systematic approach to ensure all information is accurately captured. Follow these steps:

- Gather required documents, including financial records and business plans.

- Fill out the personal and business information sections of the form.

- Provide details about the agricultural project, including budget and funding needs.

- Review the form for any errors or missing information.

- Sign the form electronically or in print, ensuring compliance with eSignature laws.

- Submit the completed form to the appropriate agency or organization.

Legal use of the Form Rd 4279 1a

The legal use of the Form Rd 4279 1a is governed by various regulations that ensure its validity in securing agricultural loans. To be legally binding, the form must be completed accurately and signed by the appropriate parties. Compliance with eSignature laws, such as the ESIGN Act and UETA, is essential when submitting the form electronically. Ensuring that all legal requirements are met helps protect both the applicant and the lending agency.

Key elements of the Form Rd 4279 1a

Key elements of the Form Rd 4279 1a include specific sections that require detailed information. These sections typically cover:

- Applicant's personal information, including name and contact details.

- Business information, such as the type of agricultural operation and structure.

- Financial details, including income statements and balance sheets.

- Project description, outlining the purpose and scope of the funding request.

Each of these elements plays a critical role in assessing the applicant's eligibility for funding and the viability of the proposed project.

Form Submission Methods

The Form Rd 4279 1a can be submitted through various methods, depending on the requirements of the issuing agency. Common submission methods include:

- Online submission via the agency's designated portal, which often allows for faster processing.

- Mailing a printed version of the form to the appropriate address, ensuring it is sent via a traceable service.

- In-person submission at designated offices, which may provide immediate feedback or assistance.

Choosing the right submission method can impact the speed and efficiency of the application process.

Quick guide on how to complete form rd 4279 1a

Complete Form Rd 4279 1a smoothly on any device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents promptly without any delays. Handle Form Rd 4279 1a on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The easiest way to alter and eSign Form Rd 4279 1a effortlessly

- Find Form Rd 4279 1a and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that task.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Alter and eSign Form Rd 4279 1a and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form rd 4279 1a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form Rd 4279 1a?

Form Rd 4279 1a is a document used for applications related to certain business loan programs. airSlate SignNow simplifies the process of filling out and electronically signing this form, making it accessible and straightforward for businesses.

-

How can airSlate SignNow help with Form Rd 4279 1a?

airSlate SignNow provides an intuitive platform for completing, signing, and managing Form Rd 4279 1a. Our solution ensures that you can efficiently gather necessary signatures and streamline your application process.

-

Is there a cost associated with using airSlate SignNow for Form Rd 4279 1a?

Yes, airSlate SignNow offers various pricing plans to accommodate your business needs. Each plan provides access to essential tools for managing Form Rd 4279 1a and other documents with ease and cost-effectiveness.

-

Can I integrate airSlate SignNow with other applications while handling Form Rd 4279 1a?

Absolutely! airSlate SignNow seamlessly integrates with popular applications that businesses often use. This integration allows you to manage Form Rd 4279 1a alongside your existing workflows, enhancing efficiency.

-

What features does airSlate SignNow offer for managing Form Rd 4279 1a?

airSlate SignNow includes features such as document templates, advanced signing options, and real-time collaboration. These tools are designed to optimize the handling of Form Rd 4279 1a, ensuring a smooth experience for users.

-

How secure is my data when using airSlate SignNow for Form Rd 4279 1a?

Security is a top priority at airSlate SignNow, and we employ industry-standard encryption protocols to protect your data. Rest assured that your Form Rd 4279 1a and other sensitive documents are stored securely.

-

Can I track the status of Form Rd 4279 1a with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of Form Rd 4279 1a as it moves through various stages. You’ll receive notifications and updates for every action taken, keeping you informed.

Get more for Form Rd 4279 1a

Find out other Form Rd 4279 1a

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors