Karnataka Bank Fatca Form

What is the Karnataka Bank FATCA Form

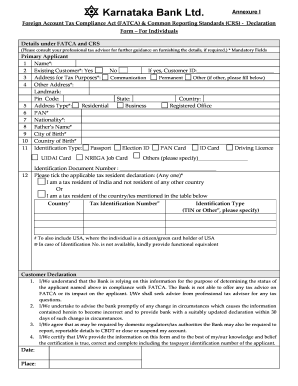

The Karnataka Bank FATCA form is a crucial document designed for compliance with the Foreign Account Tax Compliance Act (FATCA). This form is specifically tailored for individuals and entities holding accounts with Karnataka Bank who are required to disclose their foreign financial interests. The FATCA full form emphasizes the need for transparency in reporting foreign assets to the IRS, ensuring that U.S. taxpayers meet their tax obligations. It is essential for individuals to understand the implications of this form, as it plays a significant role in maintaining compliance with U.S. tax laws.

Steps to Complete the Karnataka Bank FATCA Form

Completing the Karnataka Bank FATCA form involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary personal and financial information, including your taxpayer identification number (TIN) and details of foreign accounts. Next, carefully fill out each section of the form, ensuring that all information is current and accurate. It is advisable to review the completed form for any errors before submission. Finally, submit the form through the designated method, which may include online submission or in-person delivery at a bank branch.

Legal Use of the Karnataka Bank FATCA Form

The legal use of the Karnataka Bank FATCA form is paramount for individuals and entities with financial ties to the United States. This form serves as a declaration of compliance with FATCA requirements, which aim to prevent tax evasion by U.S. taxpayers holding foreign accounts. By accurately completing and submitting this form, individuals affirm their commitment to adhering to U.S. tax laws. Non-compliance can result in significant penalties, making it essential to understand the legal implications of the form.

Required Documents for the Karnataka Bank FATCA Form

To successfully complete the Karnataka Bank FATCA form, certain documents are required. These typically include identification documents such as a passport or driver's license, proof of residency, and any relevant financial statements from foreign accounts. Additionally, individuals may need to provide their Social Security number or Individual Taxpayer Identification Number (ITIN). Having these documents ready will streamline the completion process and help ensure compliance with FATCA regulations.

Form Submission Methods

The Karnataka Bank FATCA form can be submitted through various methods, providing flexibility for users. Common submission methods include online submission via the bank's official portal, mailing the completed form to the designated address, or delivering it in person at a local branch. Each method has its own processing times and requirements, so it is important to choose the most convenient option based on individual circumstances.

Penalties for Non-Compliance

Failure to comply with the requirements outlined in the Karnataka Bank FATCA form can lead to severe penalties. Individuals who do not report their foreign accounts may face substantial fines, which can amount to thousands of dollars. Additionally, non-compliance may result in increased scrutiny from tax authorities, potentially leading to further legal complications. Understanding these penalties emphasizes the importance of accurately completing and submitting the FATCA form.

Quick guide on how to complete karnataka bank fatca form

Complete Karnataka Bank Fatca Form effortlessly on any device

Online document management has gained signNow traction among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow delivers all the resources you need to swiftly create, modify, and electronically sign your documents without interruptions. Manage Karnataka Bank Fatca Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Karnataka Bank Fatca Form with ease

- Locate Karnataka Bank Fatca Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that function.

- Generate your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Karnataka Bank Fatca Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the karnataka bank fatca form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an in bank declaration?

An in bank declaration is a document provided by a financial institution that verifies the account balance and statement of an individual or business. It is essential for various financial transactions and often required for loan applications, proving financial stability.

-

How does airSlate SignNow support in bank declaration processing?

airSlate SignNow provides a streamlined platform to create, send, and eSign in bank declarations efficiently. By utilizing smart forms and templates, you can gather the necessary information and signatures quickly, reducing the time spent on paperwork.

-

What are the benefits of using airSlate SignNow for in bank declarations?

Using airSlate SignNow for in bank declarations offers several benefits, such as improved efficiency, reduced paper usage, and enhanced security. You can track the status of your documents in real-time and ensure compliance with legal requirements.

-

Is there a cost associated with using airSlate SignNow for in bank declarations?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can choose a plan that provides access to features specifically tailored for managing in bank declarations and other document workflows.

-

Can I integrate airSlate SignNow with my existing systems for in bank declarations?

Absolutely! airSlate SignNow integrates seamlessly with many popular platforms such as CRM systems and cloud storage services. This integration makes it easier to manage your in bank declaration processes without disrupting your current workflow.

-

What features does airSlate SignNow offer for creating in bank declarations?

airSlate SignNow offers a range of features for creating in bank declarations, including customizable templates, drag-and-drop functionality, and secure eSignature options. These tools make it simple to generate compliant and legally binding documents.

-

How secure is airSlate SignNow for handling in bank declarations?

Security is a priority at airSlate SignNow. The platform employs advanced encryption protocols and complies with industry standards, ensuring that your in bank declarations and sensitive information are protected throughout the signing process.

Get more for Karnataka Bank Fatca Form

Find out other Karnataka Bank Fatca Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors