Local Tax Form

What is the Local Tax Form

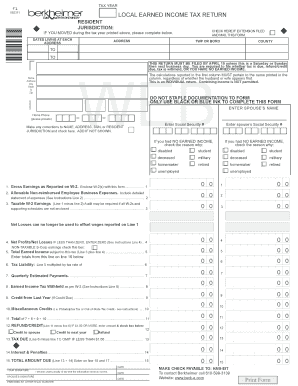

The local tax form is a document used by individuals and businesses to report and pay local income taxes. These taxes are typically levied by municipalities or local jurisdictions to fund public services such as schools, roads, and emergency services. The form may vary by state or locality, but it generally requires information about the taxpayer's income, deductions, and credits applicable to local tax regulations. Understanding the specific requirements of your local tax form is crucial for accurate reporting and compliance.

Steps to Complete the Local Tax Form

Filling out the local tax form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Review the instructions provided with the local tax form to understand specific requirements.

- Enter your personal information, including name, address, and Social Security number.

- Report your total income, including wages, self-employment income, and any other earnings.

- Claim any eligible deductions or credits that may reduce your taxable income.

- Calculate your total tax liability based on local tax rates.

- Sign and date the form, ensuring that all information is accurate and complete.

How to Obtain the Local Tax Form

Obtaining the local tax form is a straightforward process. Most local tax authorities provide the form on their official websites, where you can download and print it. Alternatively, you can visit local government offices to request a physical copy. Some jurisdictions may also offer the option to complete the form online through their tax portal. It is advisable to check the specific requirements and availability for your locality to ensure you have the correct version of the form.

Legal Use of the Local Tax Form

The local tax form is legally binding when completed and submitted according to the regulations of the issuing authority. To ensure its legal use, it is essential to follow all instructions accurately and provide truthful information. Any discrepancies or false statements may result in penalties or legal repercussions. Additionally, utilizing a reliable electronic signature tool can enhance the legal validity of the form, as it complies with eSignature laws such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for local tax forms can vary significantly by jurisdiction. Typically, local income tax forms are due on the same date as federal tax returns, which is usually April 15. However, some localities may have different deadlines, so it is important to verify the specific date for your area. Additionally, local tax authorities may provide extensions or have specific requirements for late filings, which should be reviewed to avoid penalties.

Required Documents

When completing the local tax form, certain documents are essential to ensure accurate reporting. These may include:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, if applicable.

- Previous year’s tax return for reference.

Having these documents on hand will streamline the process and help ensure compliance with local tax regulations.

Quick guide on how to complete local tax form

Accomplish Local Tax Form effortlessly on any device

Online document administration has become increasingly favored by companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Local Tax Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest approach to modify and eSign Local Tax Form effortlessly

- Find Local Tax Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or through an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Alter and eSign Local Tax Form and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the local tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is local income tax and how does it work?

Local income tax is a tax imposed by local governments on individuals or businesses based on their income. It varies by jurisdiction and is applied alongside state and federal taxes. Understanding your local income tax obligations is crucial for compliance and financial planning.

-

How can airSlate SignNow help with local income tax documentation?

airSlate SignNow simplifies the process of managing documents related to local income tax, allowing users to easily send and eSign forms and returns. This digital solution helps businesses streamline their tax documentation process, ensuring accuracy and timely submission. With our platform, you can keep all your important records organized and accessible.

-

Are there any additional costs associated with local income tax filings using airSlate SignNow?

Using airSlate SignNow to manage your local income tax filings typically does not incur additional costs outside of your regular subscription fees. However, it's essential to understand the local income tax regulations that may apply to your situation. Our platform offers a cost-effective solution to eSign and manage your tax documents efficiently.

-

What features does airSlate SignNow offer for local income tax management?

airSlate SignNow provides features like document templates, automated workflows, and secure eSigning for local income tax management. These tools help ensure that all tax-related documents are handled efficiently and securely. Our solution also allows users to track the status of documents in real time.

-

Can I integrate airSlate SignNow with my accounting software for local income tax?

Yes, airSlate SignNow offers integrations with various accounting software platforms that help manage local income tax calculations and filings. This seamless integration allows you to import and export documents easily, ensuring that your tax processes are synchronized. By combining both tools, you can optimize your workflow and stay compliant.

-

What benefits do businesses gain by using airSlate SignNow for local income tax?

Businesses using airSlate SignNow for local income tax can enjoy faster processing times, increased accuracy, and easier collaboration on tax documents. Our user-friendly platform is designed to save time and reduce the chances of errors. Additionally, you will have access to robust support to help navigate any challenges.

-

Is airSlate SignNow secure for handling local income tax documents?

Absolutely! airSlate SignNow prioritizes the security of your documents and data, including those related to local income tax. We employ advanced encryption protocols and comply with industry standards to ensure that your sensitive tax information remains safe and secure throughout the signing process.

Get more for Local Tax Form

Find out other Local Tax Form

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document