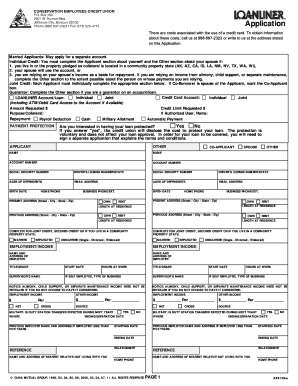

Loanliner Forms

What are loanliner forms?

Loanliner forms are essential documents used in the loan application process, facilitating the collection of necessary information from borrowers. These forms typically include details such as personal identification, financial history, and the specifics of the loan being requested. By standardizing the information required, loanliner forms streamline the application process for both lenders and borrowers, ensuring that all critical data is captured efficiently.

How to use loanliner forms

Using loanliner forms is straightforward. First, access the form through a secure digital platform. Next, fill in the required fields accurately, ensuring that all information is complete. Once the form is filled out, review it for any errors or omissions. After confirming the accuracy of the information, you can electronically sign the document. This process not only saves time but also enhances security and compliance with legal standards.

Steps to complete loanliner forms

Completing loanliner forms involves several key steps:

- Gather necessary documents, such as identification and financial statements.

- Access the loanliner form through a trusted platform.

- Fill out the form, ensuring all required fields are completed.

- Review the form for accuracy and completeness.

- Sign the form electronically to validate your submission.

- Submit the form as directed, either online or via other specified methods.

Legal use of loanliner forms

Loanliner forms must comply with various legal standards to be considered valid. In the United States, electronic signatures on these forms are recognized under the ESIGN Act and UETA, provided that certain conditions are met. This includes ensuring that the signer has consented to use electronic records and that the form is stored securely. By adhering to these regulations, borrowers can ensure that their loanliner forms are legally binding and enforceable.

Key elements of loanliner forms

Key elements of loanliner forms typically include:

- Borrower Information: Personal details such as name, address, and contact information.

- Loan Details: Information about the type and amount of the loan being requested.

- Financial Information: Income, expenses, and credit history.

- Signatures: Required electronic signatures to validate the form.

- Date of Submission: The date when the form is completed and submitted.

Examples of using loanliner forms

Loanliner forms can be utilized in various scenarios, such as:

- Applying for a personal loan to cover unexpected expenses.

- Securing a mortgage for purchasing a new home.

- Obtaining a business loan to expand operations.

- Refinancing existing loans to achieve better interest rates.

Quick guide on how to complete loanliner forms

Prepare Loanliner Forms easily on any device

Online document management has become popular with companies and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without hold-ups. Manage Loanliner Forms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign Loanliner Forms effortlessly

- Obtain Loanliner Forms and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require you to print new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Loanliner Forms and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loanliner forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is loanliner and how can it benefit my business?

Loanliner is a robust digital platform that allows businesses to streamline their loan processes. By utilizing the loanliner solution, you can efficiently manage documents, reduce processing times, and enhance customer satisfaction through seamless eSigning capabilities.

-

How much does loanliner cost?

The pricing for loanliner varies based on your business needs and the number of users. airSlate SignNow offers affordable plans tailored for different organizations, ensuring that you get the functionality you need without overspending.

-

What features does loanliner offer?

Loanliner includes a variety of features such as intuitive document management, customizable templates, and advanced eSignature capabilities. This allows businesses to create, send, and track loan documents securely and efficiently.

-

Can loanliner be integrated with other software?

Yes, loanliner provides seamless integrations with popular CRM systems, cloud storage solutions, and more. This ensures that your existing tools work harmoniously with loanliner, enhancing your workflow.

-

Is loanliner user-friendly?

Absolutely! Loanliner is designed with user experience in mind, offering an intuitive interface that allows users of all skill levels to easily navigate the platform. This minimizes training time and increases adoption within your team.

-

How does loanliner ensure document security?

Loanliner prioritizes document security by implementing industry-standard encryption and secure access protocols. You can be confident that sensitive loan documents are protected when using loanliner for your eSourcing needs.

-

What types of documents can I send using loanliner?

You can send a wide range of documents using loanliner, including loan applications, agreements, and disclosures. The platform’s versatility allows businesses to manage all necessary paperwork in one convenient location.

Get more for Loanliner Forms

- Police verification form punjab

- How to fill essentiality certificate form

- Vermont purchase and sale agreement form

- Union bank fixed deposit form download pdf

- Pa addendum to agreement of sale pdf form

- Georgia apartment association lease pdf form

- My maintenance self care worksheet form

- Case assignment area designation and case information cover sheet

Find out other Loanliner Forms

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe