Tsp 92d Form

What is the TSP 92D?

The TSP 92D form, also known as the Thrift Savings Plan (TSP) Beneficiary Designation form, is a crucial document used by federal employees and members of the uniformed services to designate beneficiaries for their TSP accounts. This form allows individuals to specify who will receive their account balance in the event of their death. Proper completion of the TSP 92D ensures that the intended beneficiaries receive their benefits without unnecessary delays or complications.

How to Use the TSP 92D

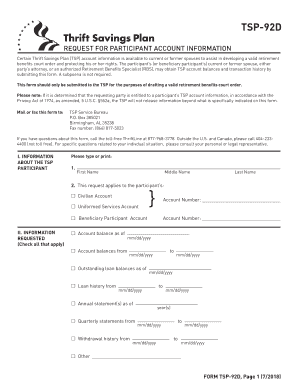

Using the TSP 92D form involves a straightforward process. First, obtain the form from the TSP website or through your agency's human resources office. Once you have the form, fill in your personal information, including your name, Social Security number, and TSP account number. Next, clearly indicate your chosen beneficiaries, including their names, relationships to you, and their Social Security numbers. After completing the form, sign and date it before submitting it to the appropriate TSP office.

Steps to Complete the TSP 92D

Completing the TSP 92D form requires careful attention to detail. Follow these steps:

- Obtain the TSP 92D form from the official TSP website or your agency.

- Fill in your personal details accurately, including your name and TSP account number.

- Designate your beneficiaries by providing their full names, relationships, and Social Security numbers.

- Review the completed form for accuracy to avoid any issues.

- Sign and date the form to validate your designations.

- Submit the form to the designated TSP office, either by mail or electronically if applicable.

Legal Use of the TSP 92D

The TSP 92D form is legally binding once it is properly completed and submitted. It must comply with federal regulations governing beneficiary designations. Ensure that your form is signed and dated to affirm its validity. In the event of a dispute regarding beneficiary claims, the TSP will refer to the most recent and correctly submitted form on file. Therefore, it is essential to keep your designations updated, especially after major life events such as marriage, divorce, or the birth of a child.

Who Issues the Form

The TSP 92D form is issued by the Federal Retirement Thrift Investment Board (FRTIB), which oversees the Thrift Savings Plan. This board is responsible for managing the TSP and ensuring that all forms and procedures comply with federal laws and regulations. As such, the TSP 92D form is an official document recognized by the federal government, making it essential for federal employees and service members to utilize it correctly.

Examples of Using the TSP 92D

There are various scenarios in which the TSP 92D form is used. For instance, a federal employee may wish to designate their spouse as the primary beneficiary and their children as contingent beneficiaries. Alternatively, a service member might decide to name a trust as the beneficiary to manage the funds for their dependents. Each of these examples highlights the flexibility of the TSP 92D in accommodating different personal circumstances and ensuring that benefits are distributed according to the individual's wishes.

Quick guide on how to complete tsp 92d

Prepare Tsp 92d seamlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers a superior eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without delays. Manage Tsp 92d on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

The easiest method to modify and eSign Tsp 92d effortlessly

- Find Tsp 92d and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Tsp 92d and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tsp 92d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tsp 92d and how does it relate to airSlate SignNow?

The tsp 92d is an electronic signature solution that streamlines document signing processes. airSlate SignNow incorporates the tsp 92d feature, allowing users to easily eSign documents with a legally binding electronic signature, making it an ideal option for businesses seeking efficiency.

-

How does airSlate SignNow pricing work for the tsp 92d feature?

airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes. The tsp 92d feature is included in these plans, providing users with access to powerful eSigning capabilities without any hidden fees. You can choose between monthly or annual billing options to suit your budget.

-

What are the key benefits of using the tsp 92d with airSlate SignNow?

Using the tsp 92d with airSlate SignNow provides numerous benefits, including enhanced efficiency, improved document turnaround times, and reduced paper usage. With this feature, businesses can easily send, sign, and manage documents electronically, leading to better productivity and cost savings.

-

Can I integrate the tsp 92d feature with other applications?

Yes, airSlate SignNow with tsp 92d can seamlessly integrate with a variety of applications, including CRM systems, storage solutions, and project management tools. These integrations help streamline workflow processes, ensuring all documents are easily accessible and manageable across platforms.

-

Is the tsp 92d electronic signature secure?

Absolutely! The tsp 92d electronic signatures in airSlate SignNow are built with security in mind. They comply with industry standards and regulations, ensuring that all signed documents are secure, tamper-proof, and legally valid, giving businesses peace of mind when handling sensitive information.

-

How user-friendly is the tsp 92d feature in airSlate SignNow?

The tsp 92d feature in airSlate SignNow is designed with user experience in mind. It offers an intuitive interface that allows users of all technical backgrounds to easily send and sign documents. Training and support are also provided to help users maximize their use of this feature.

-

What types of documents can I sign using tsp 92d?

With the tsp 92d feature in airSlate SignNow, you can sign a variety of document types, including contracts, agreements, and forms. This versatility makes it suitable for various industries, allowing businesses to digitize their document workflows effectively.

Get more for Tsp 92d

Find out other Tsp 92d

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors