Wv State Withholding Forms Fillable

What is the WV State Tax Withholding Form?

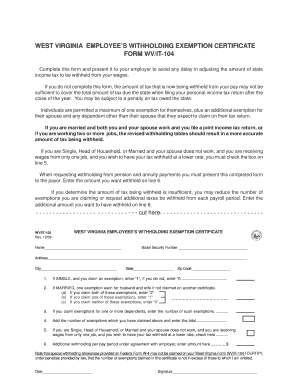

The WV state tax withholding form, commonly known as the WV IT-104, is a crucial document used by employers in West Virginia to determine the amount of state income tax to withhold from employees' wages. This form helps ensure that the correct amount of taxes is deducted, which is essential for both compliance with state tax laws and for employees' financial planning. The form is designed for use by individuals who are employed in West Virginia and need to report their withholding allowances.

Steps to Complete the WV State Tax Withholding Form

Completing the WV IT-104 form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Specify the number of withholding allowances you are claiming. This number can affect your tax liability.

- If applicable, include any additional amount you wish to have withheld from your paychecks.

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the WV State Tax Withholding Form

The WV state tax withholding form is legally binding when completed accurately and submitted to your employer. It complies with the West Virginia state tax regulations and is essential for ensuring proper withholding of state income tax. Employers are required to keep this form on file for their records and to submit the withheld amounts to the state. Failing to complete this form correctly can lead to under-withholding, resulting in potential penalties for both the employee and employer.

How to Obtain the WV State Tax Withholding Form

The WV IT-104 form can be easily obtained through various channels:

- Visit the West Virginia State Tax Department's official website to download a printable version of the form.

- Request a physical copy from your employer, who may have the forms readily available.

- Access tax preparation software that may include the form as part of their services.

Form Submission Methods

Once the WV IT-104 form is completed, it must be submitted to your employer. The submission can typically be done in the following ways:

- Hand-delivering the completed form directly to your employer's payroll department.

- Sending the form via email if your employer allows electronic submissions.

- Mailing the form to the employer's designated address, though this method is less common.

Key Elements of the WV State Tax Withholding Form

Understanding the key elements of the WV IT-104 is essential for accurate completion. The form includes:

- Your personal identification details, including name and Social Security number.

- Filing status options that affect your withholding rate.

- Space to claim allowances, which directly impacts the amount withheld from your paycheck.

- A signature line to verify the accuracy of the information provided.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines related to the WV state tax withholding form. Typically, the form should be submitted to your employer as soon as you start a new job or when your withholding status changes. Additionally, employers must ensure that all withheld taxes are submitted to the state on a regular basis, often coinciding with payroll schedules. Keeping track of these dates helps avoid penalties and ensures compliance with state tax laws.

Quick guide on how to complete wv state withholding forms fillable

Complete Wv State Withholding Forms Fillable effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Wv State Withholding Forms Fillable on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Wv State Withholding Forms Fillable with ease

- Find Wv State Withholding Forms Fillable and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your updates.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Wv State Withholding Forms Fillable and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wv state withholding forms fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wv it 140 form 2019?

The wv it 140 form 2019 is a tax form used by residents of West Virginia to report their income and calculate their state tax liability. It is important to fill out this form accurately to ensure compliance with state tax regulations. Using airSlate SignNow, you can easily eSign and send this document securely.

-

How can I fill out the wv it 140 form 2019 using airSlate SignNow?

Filling out the wv it 140 form 2019 with airSlate SignNow is simple. Users can upload the form, fill in the required information, and use our eSigning feature to sign the document electronically. This streamlines the submission process and ensures your form is completed correctly.

-

Is there a cost associated with using airSlate SignNow for the wv it 140 form 2019?

airSlate SignNow offers various pricing plans based on user needs, including a free trial. Utilizing our platform for the wv it 140 form 2019 provides a cost-effective solution compared to traditional printing and mailing methods. You can choose a plan that fits your budget and requirements.

-

What are the benefits of eSigning the wv it 140 form 2019?

ESigning the wv it 140 form 2019 is beneficial as it saves time and reduces paperwork. The process is quick, secure, and allows for immediate submission to the relevant authorities. Additionally, using airSlate SignNow helps keep your data safe with end-to-end encryption.

-

Can I integrate airSlate SignNow with other applications for the wv it 140 form 2019?

Yes, airSlate SignNow offers integrations with various applications, making it easier to manage documents related to the wv it 140 form 2019. You can connect it with services like Google Drive, Dropbox, and more, ensuring seamless access and storage for your tax forms.

-

Is mobile access available for the wv it 140 form 2019 on airSlate SignNow?

Absolutely! airSlate SignNow is designed to work on mobile devices, allowing you to manage the wv it 140 form 2019 on the go. You can fill out and eSign the form using your smartphone or tablet, making it convenient for busy users.

-

What if I need assistance with the wv it 140 form 2019 on airSlate SignNow?

If you require assistance with the wv it 140 form 2019, airSlate SignNow provides excellent customer support. Our team is available to answer questions and guide you through the process, ensuring you complete your form accurately and efficiently.

Get more for Wv State Withholding Forms Fillable

- Iowa nebraska norms form

- Boatsmart exam answers pdf form

- Battery maintenance checklist pdf form

- L1120 form

- Ptde instructor designation services request form

- Nhif claim form

- Form 07 extended health care bclaim formb writers39 coalition writerscoalition

- Hrvatska croatia hr punomo power of attorney form

Find out other Wv State Withholding Forms Fillable

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe