L1120 2010

What is the L1120

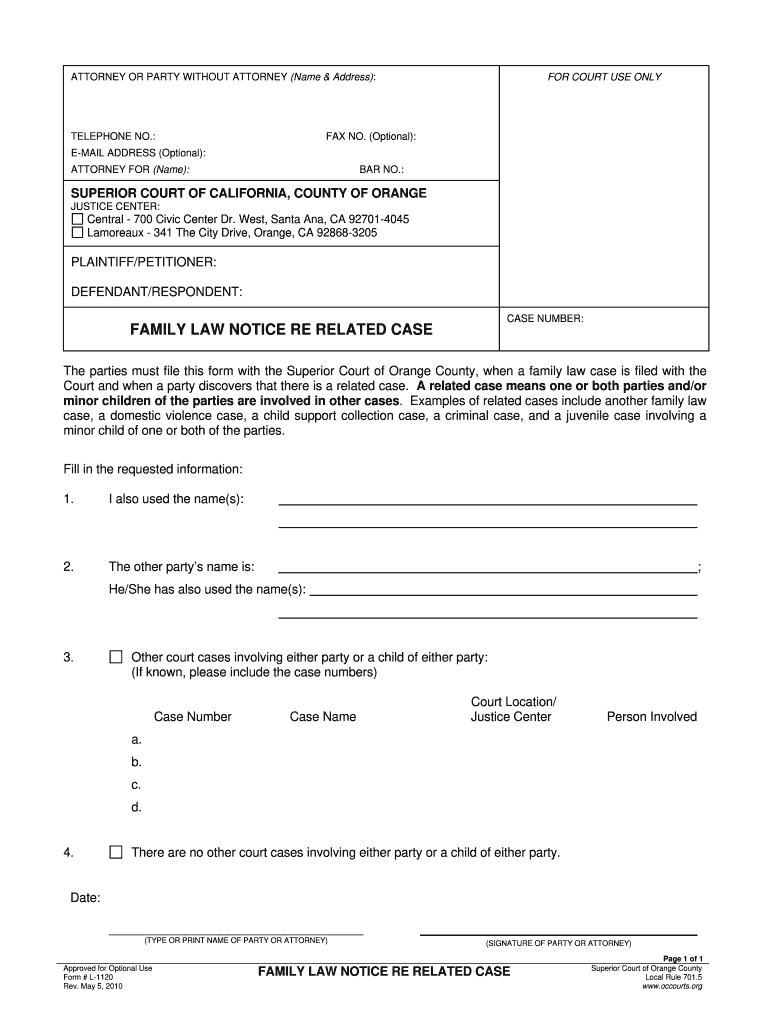

The L1120 form is a tax document used by certain business entities in the United States to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is specifically designed for corporations, allowing them to provide a comprehensive overview of their financial activities for the tax year. By accurately completing the L1120, businesses ensure compliance with federal tax laws and facilitate the proper assessment of their tax obligations.

How to use the L1120

Using the L1120 form involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form with precise information regarding revenue, expenses, and applicable tax credits. It is crucial to follow IRS guidelines closely to avoid errors that could lead to penalties. Once completed, the form can be submitted electronically or via mail, depending on the preference of the business and the requirements set forth by the IRS.

Steps to complete the L1120

Completing the L1120 form requires careful attention to detail. Follow these steps for a successful submission:

- Collect all relevant financial documents, including income statements and expense records.

- Begin filling out the form by entering your business information, such as name, address, and Employer Identification Number (EIN).

- Report your total income, including sales and other revenue sources.

- Detail all deductions, including operating expenses, salaries, and other allowable costs.

- Calculate your taxable income and any credits that may apply.

- Review the completed form for accuracy, ensuring all figures are correct and all necessary information is included.

- Submit the form electronically through approved e-filing software or mail it to the appropriate IRS address.

Legal use of the L1120

The L1120 form is legally binding when accurately completed and submitted in accordance with IRS regulations. It must be filed by the due date to avoid penalties. The information provided on the form is used by the IRS to assess the corporation's tax liability and ensure compliance with federal tax laws. Failure to file or inaccuracies in reporting can result in legal consequences, including fines or audits. Therefore, it is essential for businesses to use reliable tools, such as digital platforms, to complete and submit their L1120 forms securely.

IRS Guidelines

The IRS provides specific guidelines for completing the L1120 form, which must be followed to ensure compliance. These guidelines include instructions on how to report income, deductions, and credits accurately. Businesses should refer to the latest IRS publications related to corporate tax filing for updates on any changes to the form or filing requirements. Adhering to these guidelines helps prevent errors and potential audits, ensuring a smooth filing process.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the L1120 form. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the L1120 must be filed by April fifteenth. If the deadline falls on a weekend or holiday, it is extended to the next business day. Businesses should also be aware of any extensions available for filing, which may require additional forms to be submitted.

Quick guide on how to complete l1120

Complete L1120 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage L1120 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign L1120 without any hassle

- Find L1120 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your delivery preference for your form, whether by email, SMS, or invite link, or download it to your computer.

No more dealing with lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign L1120 and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct l1120

Create this form in 5 minutes!

How to create an eSignature for the l1120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is l 1120 and how does it relate to airSlate SignNow?

l 1120 is an IRS tax form that corporate businesses use to report their income, deductions, and credits. airSlate SignNow provides an efficient way for businesses to electronically sign and submit their l 1120 forms, ensuring compliance and reducing paperwork.

-

How can I use airSlate SignNow to streamline my l 1120 filing process?

By utilizing airSlate SignNow, you can upload your l 1120 document, add necessary signatures, and share it with stakeholders for approval. This simplifies the process, allowing your team to collaborate efficiently and file on time without the hassle of printing or scanning.

-

Is there a cost associated with using airSlate SignNow for filing l 1120 forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Even with associated costs, many users find that the time and resources saved in managing l 1120 filings make it a cost-effective solution.

-

What features does airSlate SignNow offer for businesses dealing with l 1120 forms?

airSlate SignNow includes features like customizable templates, advanced document tracking, and secure eSignature capabilities. These features help businesses efficiently manage their l 1120 filings while ensuring document integrity and legality.

-

Can airSlate SignNow integrate with accounting software to assist in l 1120 preparation?

Yes, airSlate SignNow can integrate seamlessly with popular accounting software, enabling you to import necessary data directly into your l 1120 forms. This integration saves time and enhances accuracy in your filing process.

-

What are the benefits of using airSlate SignNow for eSigning my l 1120 forms?

Using airSlate SignNow for eSigning your l 1120 forms enhances efficiency and security. It eliminates the need for physical signatures, speeds up the filing process, and provides a secure method to store and access your signed documents.

-

Is airSlate SignNow compliant with regulations for filing l 1120 documents?

Absolutely, airSlate SignNow complies with the necessary electronic signature regulations, ensuring that your l 1120 documents are signed and submitted legally. This compliance helps protect your business during the filing process.

Get more for L1120

Find out other L1120

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form