Irs Form 1120 H and Cift 620

What is the IRS Form 1120-H and CIFT 620

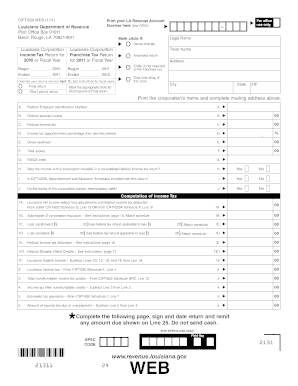

The IRS Form 1120-H is a tax return specifically designed for homeowners associations (HOAs) that qualify under certain criteria. It allows these organizations to report their income, expenses, and taxes owed. The CIFT 620 is a related form that may be used in conjunction with the 1120-H for specific tax situations. Understanding these forms is essential for ensuring compliance with IRS regulations and for accurate financial reporting.

How to use the IRS Form 1120-H and CIFT 620

Using the IRS Form 1120-H and CIFT 620 involves several steps. First, determine if your organization qualifies to file the 1120-H. This form is typically for HOAs that meet specific income and expense criteria. Next, gather all necessary financial documents, including income statements and expense reports. Complete the forms accurately, ensuring all information is current and correct. Finally, submit the forms by the appropriate deadline to avoid penalties.

Steps to complete the IRS Form 1120-H and CIFT 620

Completing the IRS Form 1120-H and CIFT 620 requires careful attention to detail. Follow these steps:

- Review the eligibility criteria for filing the 1120-H.

- Collect all relevant financial information, including income and expenses.

- Fill out the 1120-H form, ensuring accuracy in all fields.

- If applicable, complete the CIFT 620 form for additional reporting.

- Double-check all entries for errors or omissions.

- Submit the forms electronically or by mail, depending on your preference.

Legal use of the IRS Form 1120-H and CIFT 620

The legal validity of the IRS Form 1120-H and CIFT 620 hinges on compliance with IRS guidelines. These forms must be filled out accurately and submitted by the designated deadlines. Failure to comply can lead to penalties, including fines or audits. It is critical for organizations to maintain proper records and ensure that all information reported is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1120-H and CIFT 620 are crucial for compliance. Typically, the deadline for filing the 1120-H is the fifteenth day of the fourth month following the end of the tax year. For organizations operating on a calendar year, this means the due date is April 15. It is important to stay informed about any changes to these deadlines to avoid late fees.

Required Documents

To complete the IRS Form 1120-H and CIFT 620, several documents are necessary. These include:

- Financial statements detailing income and expenses.

- Records of any assessments or dues collected from members.

- Documentation of any applicable deductions or credits.

- Previous tax returns, if available, for reference.

Quick guide on how to complete irs form 1120 h and cift 620

Complete Irs Form 1120 H And Cift 620 effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Irs Form 1120 H And Cift 620 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign Irs Form 1120 H And Cift 620 effortlessly

- Find Irs Form 1120 H And Cift 620 and click on Get Form to initiate.

- Use the provided tools to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, laborious form searches, or mistakes necessitating new document prints. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Irs Form 1120 H And Cift 620 to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 1120 h and cift 620

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 1120 H and CFIT 620?

IRS Form 1120 H is used by homeowners associations to report their income, while CFIT 620 is utilized by certain charitable organizations. Understanding these forms is essential for compliance, especially as they relate to tax obligations. With airSlate SignNow, you can easily eSign and manage these documents.

-

How does airSlate SignNow simplify the filing of IRS Form 1120 H and CFIT 620?

AirSlate SignNow streamlines the process by allowing users to prepare, sign, and submit IRS Form 1120 H and CFIT 620 electronically. This reduces paperwork, minimizes errors, and accelerates the filing process. Businesses can efficiently manage their tax-related documents without hassle.

-

What are the pricing options for airSlate SignNow for filing IRS Form 1120 H and CFIT 620?

AirSlate SignNow offers various pricing tiers to suit different business needs, ensuring accessibility for all users. These plans enable seamless eSigning and document management for IRS Form 1120 H and CFIT 620. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for IRS Form 1120 H and CFIT 620 management?

Yes, airSlate SignNow provides integration capabilities with popular accounting and management software. This integration facilitates efficient handling of IRS Form 1120 H and CFIT 620, making it easier to keep track of your documents. You can enhance your workflow by connecting with tools you already use.

-

What features does airSlate SignNow offer for IRS Form 1120 H and CFIT 620?

AirSlate SignNow includes features such as document templates, eSigning, and status tracking specifically designed for IRS Form 1120 H and CFIT 620. These functionalities help users streamline their document processes, ensuring all necessary information is accurately captured and submitted. It’s a comprehensive solution for tax compliance.

-

Are there any security measures for handling IRS Form 1120 H and CFIT 620 with airSlate SignNow?

Absolutely! AirSlate SignNow prioritizes security by implementing strong encryption and compliance with industry standards. This protects sensitive information associated with IRS Form 1120 H and CFIT 620, ensuring peace of mind while you manage your tax documents. Your data remains secure throughout the entire process.

-

How can airSlate SignNow help with reminders for IRS Form 1120 H and CFIT 620 submissions?

With airSlate SignNow, users can set up automated reminders for important deadlines related to IRS Form 1120 H and CFIT 620 submissions. This feature keeps you organized and ensures you don’t miss critical tax filing dates. You can focus on your business while we help manage your submission timelines.

Get more for Irs Form 1120 H And Cift 620

Find out other Irs Form 1120 H And Cift 620

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple