EXEMPTION CERTIFICATE ST 8 ST 8 2007

What is the EXEMPTION CERTIFICATE ST 8 ST 8

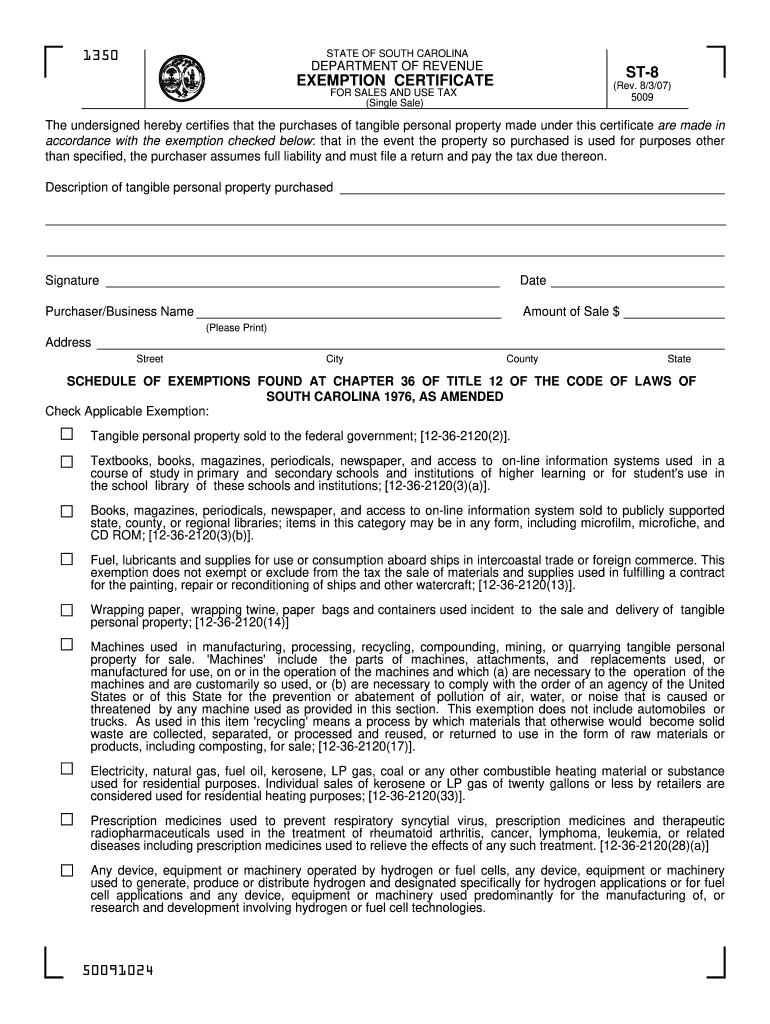

The EXEMPTION CERTIFICATE ST 8 ST 8 is a tax-related document used in the United States to claim exemption from sales tax for certain purchases. This certificate is typically utilized by organizations or individuals who qualify for tax-exempt status, such as non-profit entities, government agencies, or certain educational institutions. By presenting this certificate at the time of purchase, the buyer can avoid paying sales tax on eligible items, which can lead to significant cost savings.

How to use the EXEMPTION CERTIFICATE ST 8 ST 8

To effectively use the EXEMPTION CERTIFICATE ST 8 ST 8, the purchaser must fill out the certificate accurately, providing essential information such as the name of the buyer, the type of exemption being claimed, and details about the purchase. Once completed, this certificate should be presented to the seller at the point of sale. It is important to ensure that the seller accepts the certificate and understands its implications, as improper use can lead to penalties for both parties.

Steps to complete the EXEMPTION CERTIFICATE ST 8 ST 8

Completing the EXEMPTION CERTIFICATE ST 8 ST 8 involves several key steps:

- Gather necessary information, including the buyer's name, address, and tax identification number.

- Identify the specific exemption category that applies to your purchase.

- Clearly describe the items being purchased and their intended use.

- Sign and date the certificate to validate the claim.

- Provide the completed certificate to the seller during the transaction.

Legal use of the EXEMPTION CERTIFICATE ST 8 ST 8

The legal use of the EXEMPTION CERTIFICATE ST 8 ST 8 is governed by state laws and regulations. It is crucial for users to understand the specific exemptions allowed in their state, as misuse of the certificate can result in tax liabilities and potential penalties. Buyers should ensure that they qualify for the exemption and that the items purchased are eligible under the criteria established by state tax authorities.

Eligibility Criteria

Eligibility for using the EXEMPTION CERTIFICATE ST 8 ST 8 typically includes specific requirements, such as being a recognized non-profit organization, a government entity, or an educational institution. Additionally, the purchase must be for items that are directly related to the exempt purpose of the entity. Buyers should review their status and the nature of their purchases to confirm eligibility before using the certificate.

State-specific rules for the EXEMPTION CERTIFICATE ST 8 ST 8

Each state in the U.S. may have unique rules regarding the use of the EXEMPTION CERTIFICATE ST 8 ST 8. It is important for users to familiarize themselves with their state’s specific regulations, including the types of exemptions allowed, the documentation required, and any limits on the use of the certificate. Checking with the state’s department of revenue or tax authority can provide clarity on compliance and proper usage.

Quick guide on how to complete sc st 8 2007 form

Your assistance manual on how to prepare your EXEMPTION CERTIFICATE ST 8 ST 8

If you’re curious about how to generate and submit your EXEMPTION CERTIFICATE ST 8 ST 8, here are a few straightforward guidelines on how to simplify the tax submission process.

To begin, you simply need to register your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that enables you to modify, create, and finalize your income tax forms with ease. Using its editor, you can alternate between text, checkboxes, and eSignatures, and revisit to amend answers as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your EXEMPTION CERTIFICATE ST 8 ST 8 in just a few minutes:

- Set up your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse various versions and schedules.

- Click Get form to access your EXEMPTION CERTIFICATE ST 8 ST 8 in our editor.

- Complete the necessary fillable fields with your details (text, figures, check marks).

- Employ the Sign Tool to add your legally binding eSignature (if needed).

- Examine your record and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make the most of this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper may lead to return errors and delay refunds. Certainly, before e-filing your taxes, review the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct sc st 8 2007 form

FAQs

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Which W-8 form should I fill out as an LLC company?

How do they know to request a W-8 instead of a W-9? Are you Foreign?Assuming you need to submit a W-8 instead of a W-9, here are the questions to guide your W-8 decision.Do you have other members in your LLC? If you are the only member, a Single Member LLC is a Disregarded Entity taxed on your personal tax return. So you would submit the W-8BEN.If you have other members, are you subject to the default status or have you elected corporate status?If you are subject to the default status, your LLC is taxed as a partnership so submit the W-8IMYIf you elected Corporate status, submit the W-8BEN-E.https://www.irs.gov/pub/irs-pdf/...Other great answers here. Especially good advice from Carl and Mark, get to a CPA.

Create this form in 5 minutes!

How to create an eSignature for the sc st 8 2007 form

How to make an eSignature for your Sc St 8 2007 Form online

How to make an electronic signature for your Sc St 8 2007 Form in Google Chrome

How to make an electronic signature for putting it on the Sc St 8 2007 Form in Gmail

How to make an electronic signature for the Sc St 8 2007 Form right from your mobile device

How to make an eSignature for the Sc St 8 2007 Form on iOS devices

How to create an eSignature for the Sc St 8 2007 Form on Android devices

People also ask

-

What is an EXEMPTION CERTIFICATE ST 8 ST 8?

An EXEMPTION CERTIFICATE ST 8 ST 8 is a specific document used in certain states to exempt buyers from sales tax on qualifying purchases. This certificate is crucial for businesses that want to avoid unnecessary tax expenses. By utilizing the EXEMPTION CERTIFICATE ST 8 ST 8, companies can streamline their purchasing processes and ensure compliance with tax regulations.

-

How can airSlate SignNow assist with the EXEMPTION CERTIFICATE ST 8 ST 8?

airSlate SignNow provides a user-friendly platform for creating, signing, and managing your EXEMPTION CERTIFICATE ST 8 ST 8 and other vital documents. With our eSignature solution, you can quickly send the certificate for signatures and store it securely. This ensures that your exemption certificate is processed efficiently and is easily accessible when needed.

-

What are the benefits of using airSlate SignNow for my EXEMPTION CERTIFICATE ST 8 ST 8?

Using airSlate SignNow for your EXEMPTION CERTIFICATE ST 8 ST 8 allows for faster processing times and enhanced security. Our platform minimizes paperwork and reduces the time spent on manual tasks, enabling businesses to focus on their core activities. Additionally, you can track the status of your documents in real-time, ensuring you never miss an important deadline.

-

Is airSlate SignNow cost-effective for managing EXEMPTION CERTIFICATE ST 8 ST 8?

Yes, airSlate SignNow offers a cost-effective solution for managing your EXEMPTION CERTIFICATE ST 8 ST 8. With various pricing plans tailored to different business sizes, you can choose the option that fits your budget. Our solution helps reduce operational costs by streamlining document management and reducing the need for paper-based processes.

-

Can I integrate airSlate SignNow with other software to manage EXEMPTION CERTIFICATE ST 8 ST 8?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, including CRM and accounting platforms, to help you manage your EXEMPTION CERTIFICATE ST 8 ST 8 effectively. This integration allows for automatic updates and data sharing, enhancing the efficiency of your workflow and ensuring that your records are always up-to-date.

-

What features does airSlate SignNow offer for handling the EXEMPTION CERTIFICATE ST 8 ST 8?

airSlate SignNow offers a range of features for handling your EXEMPTION CERTIFICATE ST 8 ST 8, including customizable templates, secure eSigning, and automated workflows. These features make it simple to generate and manage your exemption certificates while ensuring compliance. Additionally, our platform provides robust tracking and reporting tools for better oversight.

-

How secure is my EXEMPTION CERTIFICATE ST 8 ST 8 with airSlate SignNow?

Security is a top priority at airSlate SignNow. Your EXEMPTION CERTIFICATE ST 8 ST 8 and all other documents are protected with advanced encryption and access controls. We comply with industry standards to ensure your sensitive information remains confidential and secure throughout the signing process.

Get more for EXEMPTION CERTIFICATE ST 8 ST 8

- Laws of exponents multiple choice test pdf form

- Addendum anne arundel countyrequired 4 doc annual report form

- Acknowledgement form template 40307252

- Anf 2b in word format

- Assent form

- Cr 162 order to surrender firearms in domestic form

- Crystal palace form

- 161011 inkom utlandsmyndighet inkom migrationsverk form

Find out other EXEMPTION CERTIFICATE ST 8 ST 8

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure