Irs Form 8554

What is the IRS Form 8554

The IRS Form 8554 is a tax form used by certain tax-exempt organizations to apply for or renew their tax-exempt status under Internal Revenue Code Section 501(c)(3). This form is essential for organizations seeking to maintain compliance with federal tax regulations. It provides the IRS with necessary information about the organization’s activities, governance, and financial status. Understanding the purpose of this form is crucial for any organization that wishes to operate as a tax-exempt entity in the United States.

Steps to Complete the IRS Form 8554

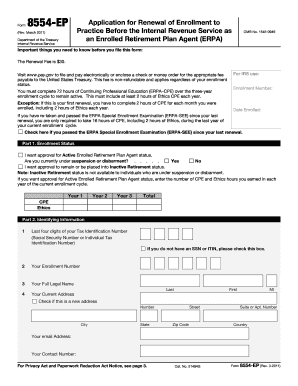

Completing the IRS Form 8554 involves several key steps to ensure accuracy and compliance. First, gather all required information, including the organization’s legal name, address, and Employer Identification Number (EIN). Next, provide details about the organization’s mission, activities, and governance structure. It is also important to include financial information, such as income and expenses, to demonstrate the organization’s operations. After filling out the form, review it carefully for any errors before submission. This thorough approach can prevent delays in processing and ensure that the organization maintains its tax-exempt status.

How to Obtain the IRS Form 8554

The IRS Form 8554 can be obtained directly from the IRS website. It is available as a downloadable PDF, which can be printed and filled out manually. Alternatively, organizations can access the form through various tax preparation software that supports IRS forms. Ensuring that you have the most current version of the form is essential, as tax laws and requirements may change. Always check the IRS website for updates or revisions to the form before starting the application process.

Legal Use of the IRS Form 8554

The legal use of the IRS Form 8554 is governed by federal tax regulations. Organizations must ensure that they meet all eligibility criteria outlined by the IRS to use this form. This includes maintaining accurate records and adhering to the operational guidelines set forth for tax-exempt entities. Compliance with these regulations not only protects the organization’s tax-exempt status but also ensures that it operates within the legal framework established by the IRS. Failure to comply can lead to penalties or loss of tax-exempt status.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8554 are critical for organizations wishing to maintain their tax-exempt status. Typically, organizations must file the form by the 15th day of the fifth month after the end of their tax year. For new organizations, the form should be submitted within 27 months of formation to ensure tax-exempt status from the date of formation. Keeping track of these important dates helps organizations avoid penalties and ensures timely compliance with IRS regulations.

Required Documents

When submitting the IRS Form 8554, organizations must include several required documents to support their application. These may include articles of incorporation, bylaws, and a statement of activities. Financial statements, such as balance sheets and income statements, are also necessary to demonstrate the organization’s financial health. Providing complete and accurate documentation is essential for the IRS to process the application efficiently and to verify the organization’s eligibility for tax-exempt status.

Penalties for Non-Compliance

Organizations that fail to comply with the requirements associated with the IRS Form 8554 may face significant penalties. These can include fines, loss of tax-exempt status, and back taxes owed. Non-compliance can also affect the organization’s ability to receive grants and donations, as many funders require proof of tax-exempt status. Understanding the implications of non-compliance is vital for organizations to safeguard their operations and maintain their standing with the IRS.

Quick guide on how to complete irs form 8554

Effortlessly Prepare Irs Form 8554 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hassle. Manage Irs Form 8554 on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Edit and Electronically Sign Irs Form 8554

- Obtain Irs Form 8554 and click on Get Form to begin.

- Use the tools provided to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your adjustments.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Irs Form 8554 while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8554

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 8554 instructions?

The form 8554 instructions provide detailed guidance on how to complete and submit the form, which is used by tax professionals to apply for an IRS e-file signature authorization. Following these instructions ensures proper compliance and prevents potential delays in processing.

-

How can airSlate SignNow assist with form 8554 instructions?

airSlate SignNow offers a streamlined platform to help users electronically sign and send documents, including those related to form 8554 instructions. With our solution, you can easily manage the entire signing process, ensuring quick and efficient submissions.

-

Are there any costs associated with obtaining form 8554 instructions through airSlate SignNow?

There are no specific costs for the form 8554 instructions themselves when using airSlate SignNow. However, the platform does offer various pricing plans that cater to different business needs for document management and e-signatures.

-

What features make airSlate SignNow ideal for following form 8554 instructions?

AirSlate SignNow is designed with user-friendly features, including customizable templates for form submissions and an intuitive e-signature process. This functionality simplifies the completion of form 8554, allowing for a smoother experience.

-

Can I integrate airSlate SignNow with other applications while working on form 8554 instructions?

Yes, airSlate SignNow offers seamless integrations with numerous applications, allowing you to easily manage documents while following form 8554 instructions. This flexibility enhances your workflow and streamlines the documentation process.

-

What benefits can I expect from using airSlate SignNow for form 8554 instructions?

Using airSlate SignNow for your form 8554 instructions provides benefits like enhanced security, easy access to templates, and quick turnaround times for document processing. These advantages can signNowly improve your overall experience.

-

Is technical support available for questions about form 8554 instructions?

Absolutely! AirSlate SignNow provides responsive technical support for all users, including assistance with form 8554 instructions and related queries. Our dedicated team is here to ensure you have the help you need to successfully navigate the process.

Get more for Irs Form 8554

Find out other Irs Form 8554

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast