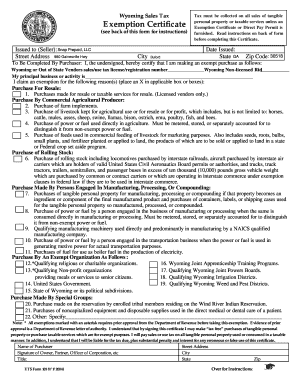

Sales Tax Exemption Certificate Form

What is the Sales Tax Exemption Certificate

The sales tax exemption certificate is a legal document that allows eligible buyers to make purchases without paying sales tax. This form is typically used by nonprofit organizations, government entities, and certain businesses that qualify under specific state laws. By presenting this certificate to sellers, buyers can avoid the additional cost of sales tax on eligible transactions, which can lead to significant savings over time.

How to use the Sales Tax Exemption Certificate

To effectively use the sales tax exemption certificate, a buyer must first ensure they meet the eligibility criteria set by their state. Once confirmed, the buyer should complete the certificate with accurate information, including their name, address, and the reason for the exemption. This completed form should then be presented to the seller at the time of purchase. It is essential for the seller to retain a copy of the certificate for their records, as it serves as proof of the tax-exempt status of the transaction.

Steps to complete the Sales Tax Exemption Certificate

Completing a sales tax exemption certificate involves several straightforward steps:

- Obtain the appropriate form from your state’s tax authority or website.

- Fill in the required fields, including your name, address, and the type of exemption you qualify for.

- Provide any necessary identification numbers, such as a tax identification number (TIN) or employer identification number (EIN).

- Sign and date the certificate to validate it.

- Present the completed certificate to the seller during the transaction.

Legal use of the Sales Tax Exemption Certificate

The legal use of the sales tax exemption certificate requires compliance with state laws and regulations. Each state has its own rules regarding who qualifies for tax exemptions and under what circumstances. Misuse of the certificate, such as using it for ineligible purchases, can result in penalties, including fines and back taxes. It is crucial to understand the specific legal framework in your state to ensure proper use of the certificate.

Key elements of the Sales Tax Exemption Certificate

Several key elements must be included in a sales tax exemption certificate for it to be valid:

- Purchaser Information: The name and address of the buyer.

- Seller Information: The name and address of the seller.

- Exemption Reason: A clear statement of the reason for the exemption.

- Identification Numbers: Any relevant tax identification numbers.

- Signature: The signature of the buyer or an authorized representative.

State-specific rules for the Sales Tax Exemption Certificate

Each state in the U.S. has its own regulations regarding the sales tax exemption certificate. These rules can define who is eligible for exemptions, the types of purchases that qualify, and the specific form that must be used. It is important for businesses and individuals to familiarize themselves with their state’s requirements to ensure compliance and avoid potential issues during audits or transactions.

Quick guide on how to complete sales tax exemption certificate

Complete Sales Tax Exemption Certificate effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed materials, as you can access the necessary form and securely preserve it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage Sales Tax Exemption Certificate on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Sales Tax Exemption Certificate with ease

- Locate Sales Tax Exemption Certificate and then click Get Form to begin.

- Utilize the features we provide to submit your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Sales Tax Exemption Certificate and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sales tax exemption certificate?

A sales tax exemption certificate is a document that allows businesses or individuals to purchase goods without paying sales tax. This certificate serves as proof that the buyer qualifies for tax exemption based on specific criteria. Using a sales tax exemption certificate can help save money for businesses by reducing operational costs.

-

How can airSlate SignNow help me with sales tax exemption certificates?

airSlate SignNow simplifies the process of managing sales tax exemption certificates by providing an easy-to-use platform to create, store, and send these documents electronically. With its robust features, you can streamline your workflow, ensuring that all necessary certificates are signed and filed correctly. This efficiency helps you stay compliant while saving time and resources.

-

Are there any costs associated with obtaining a sales tax exemption certificate through your service?

Obtaining a sales tax exemption certificate through airSlate SignNow does not incur additional costs beyond your standard subscription. Our platform offers a cost-effective solution for managing your documentation needs, including the creation and management of sales tax exemption certificates, allowing you to focus on your business.

-

What features does airSlate SignNow offer for managing sales tax exemption certificates?

airSlate SignNow offers numerous features for managing sales tax exemption certificates, including customizable templates, advanced eSigning capabilities, and secure document storage. Our user-friendly interface allows for easy tracking of certificate requests and status, ensuring your sales tax exemption documents are always organized and accessible.

-

Can I track the status of my sales tax exemption certificate requests?

Yes, airSlate SignNow provides the ability to track the status of your sales tax exemption certificate requests in real-time. You will receive notifications for when the document is viewed, signed, or completed, which keeps you informed throughout the signing process. This feature enhances transparency and helps you manage your certificates efficiently.

-

Does airSlate SignNow integrate with other software for managing sales tax exemption certificates?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage your sales tax exemption certificates alongside your existing software ecosystem. This integration ensures that your documents and customer information are synchronized, enhancing overall operational efficiency.

-

What are the benefits of using airSlate SignNow for sales tax exemption certificates?

Using airSlate SignNow for sales tax exemption certificates provides several benefits, including increased efficiency, cost savings, and improved compliance. Our platform allows you to automate the documentation process, reducing manual errors and ensuring timely submission of certificates. Additionally, the electronic nature of the service enhances security and accessibility for all users.

Get more for Sales Tax Exemption Certificate

Find out other Sales Tax Exemption Certificate

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple