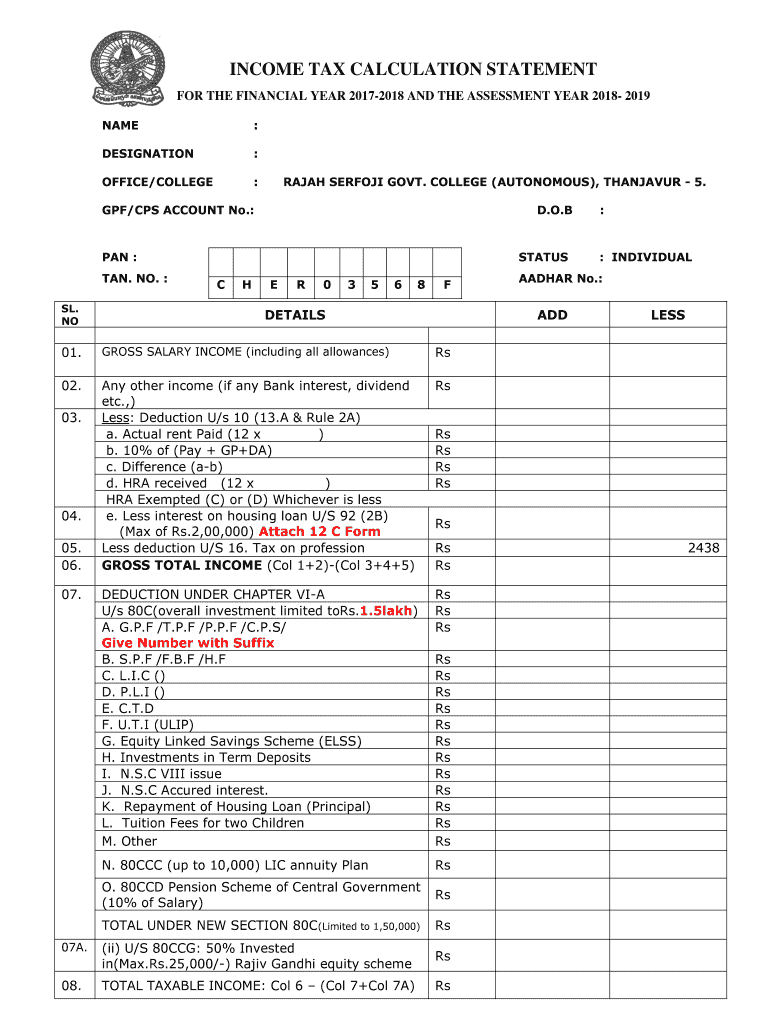

Tax Computation Statement Form

What is the Tax Computation Statement

The tax computation statement is a formal document that outlines an individual's or entity's taxable income, deductions, and tax liability. It serves as a summary of the financial information needed for tax reporting and compliance. This statement is essential for accurately calculating the amount owed to the Internal Revenue Service (IRS) or any state tax authority. It typically includes details such as gross income, allowable deductions, credits, and the resulting taxable income.

How to use the Tax Computation Statement

To effectively use the tax computation statement, one must first gather all relevant financial documents, including income statements, receipts for deductible expenses, and any applicable tax credits. Once the necessary information is compiled, the computation statement can be filled out by entering the total income, subtracting deductions, and applying the appropriate tax rates. This process helps ensure that the tax liability is calculated accurately, which is crucial for avoiding penalties and ensuring compliance with tax laws.

Steps to complete the Tax Computation Statement

Completing the tax computation statement involves several key steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and expense receipts.

- Determine your total gross income by summing all income sources.

- Identify and list allowable deductions, including business expenses, mortgage interest, and charitable contributions.

- Calculate your taxable income by subtracting total deductions from gross income.

- Apply the appropriate tax rates to determine your total tax liability.

- Review the computation for accuracy and ensure all figures are correctly entered.

Legal use of the Tax Computation Statement

The tax computation statement is legally binding when it is completed accurately and submitted to the appropriate tax authority. To ensure legal compliance, it must adhere to IRS guidelines and state regulations. This includes providing truthful information and maintaining proper documentation to support claims made on the statement. Failure to comply with legal standards can result in penalties, audits, or other legal repercussions.

Key elements of the Tax Computation Statement

Several key elements must be included in a tax computation statement to ensure its completeness and accuracy:

- Gross Income: Total income earned from all sources.

- Deductions: List of allowable deductions that reduce taxable income.

- Taxable Income: The amount used to calculate tax liability after deductions.

- Tax Rate: The applicable tax rates based on income brackets.

- Total Tax Liability: The final amount owed to the IRS or state tax authority.

Examples of using the Tax Computation Statement

Examples of using the tax computation statement include various taxpayer scenarios such as self-employed individuals, retirees, and students. For instance, a self-employed person may use the statement to report business income and deduct expenses related to their business operations. A retiree might utilize the statement to account for pension income and social security benefits, while a student may include part-time job earnings and education-related deductions. Each scenario highlights the importance of accurately completing the statement to reflect the unique financial situations of different taxpayers.

Quick guide on how to complete tax computation statement

Complete Tax Computation Statement seamlessly on any device

Online document administration has become increasingly favored by businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without interruptions. Manage Tax Computation Statement on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Tax Computation Statement effortlessly

- Locate Tax Computation Statement and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to missing or lost files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Computation Statement while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax computation statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a computation statement in airSlate SignNow?

A computation statement in airSlate SignNow refers to a detailed summary of the calculations and data that are incorporated into your digital documents. This feature enhances transparency and helps users ensure that all figures are accurate before finalizing any agreement.

-

How can I create a computation statement using airSlate SignNow?

Creating a computation statement with airSlate SignNow is straightforward. Once you draft your document, you can easily add fields that will automatically calculate totals, percentages, or other necessary data points, allowing you to generate a computation statement seamlessly.

-

Is airSlate SignNow suitable for businesses of all sizes?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes. Its features, including the computation statement functionality, allow teams from small startups to large enterprises to efficiently manage their document signing and computation needs.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow provides various pricing plans tailored to meet different business requirements. Each plan includes essential features like drafting documents and generating computation statements, ensuring businesses can select an option that best fits their budget and needs.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers numerous integrations with popular software such as Salesforce, Google Drive, and Microsoft Teams. This allows you to streamline your workflows, including the generation of computation statements, making the document lifecycle more efficient.

-

What are the key benefits of using airSlate SignNow for computation statements?

Using airSlate SignNow for computation statements automates calculations, reduces errors, and enhances the overall efficiency of your document workflow. With easy eSigning capabilities and secure document management, it streamlines processes while providing accurate and clearly presented computation statements.

-

Is the signing process secure with airSlate SignNow?

Yes, the signing process with airSlate SignNow is secure and compliant with industry standards. All documents, including those containing sensitive computation statements, utilize encryption to protect data, ensuring that your information remains confidential and tamper-proof.

Get more for Tax Computation Statement

- Cg 10 application form 6070254

- Supervision notes template form

- 30 day notice of moving out form

- Beauty salon feedback form pdf

- Gujrat chamber of commerce membership form

- Appsheet tutorial pdf form

- Life insurance needs analysis worksheet form

- Sa103f self employment full if youre self employed have more complex tax affairs and your annual business turnover was 73000 or form

Find out other Tax Computation Statement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now