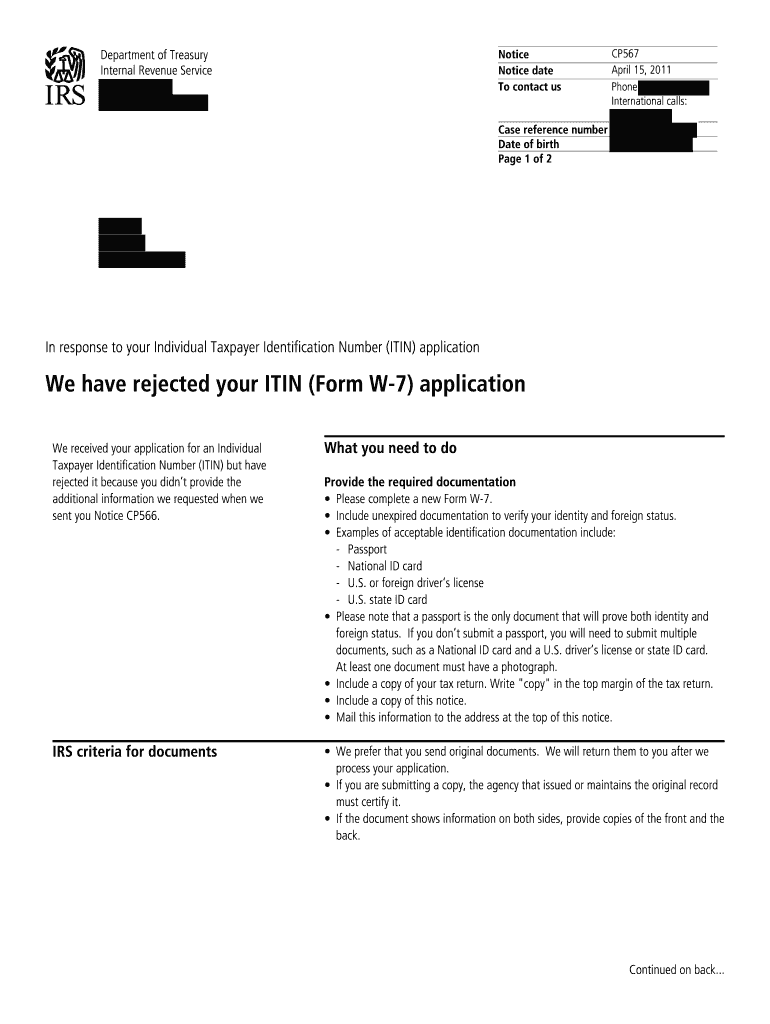

Cp567 Notice Form

What is the CP565 Notice

The CP565 notice is a document issued by the Internal Revenue Service (IRS) that serves as a notification regarding a taxpayer's account status. It typically informs individuals about specific actions or updates related to their tax filings or obligations. Understanding the CP565 notice is crucial for taxpayers to ensure compliance and address any issues that may arise with their tax accounts.

How to Use the CP565 Notice

Using the CP565 notice involves carefully reviewing the information provided by the IRS. Taxpayers should verify the details against their own records to ensure accuracy. If the notice indicates any discrepancies or actions required, it is important to follow the instructions outlined in the notice. This may involve submitting additional documentation or making corrections to previously filed returns.

Steps to Complete the CP565 Notice

Completing the CP565 notice requires a systematic approach. First, read the notice thoroughly to understand its contents. Next, gather any necessary documents that support your case or clarify the information in the notice. If further action is needed, such as responding to the IRS or correcting a filing, ensure that all responses are timely and accurate. Finally, keep a copy of the notice and any correspondence for your records.

Key Elements of the CP565 Notice

The CP565 notice includes several key elements that are essential for understanding its implications. These elements typically consist of the taxpayer's identification information, the specific issue being addressed, and instructions on how to resolve any discrepancies. Additionally, the notice may provide deadlines for responses or actions required by the taxpayer, making it vital to pay attention to these details.

IRS Guidelines for the CP565 Notice

The IRS provides guidelines on how to interpret and respond to the CP565 notice. Taxpayers are encouraged to refer to these guidelines to ensure compliance with tax laws. This includes understanding the rights and responsibilities associated with the notice, as well as the procedures for disputing any claims made by the IRS. Familiarity with these guidelines can help taxpayers navigate the complexities of their tax obligations more effectively.

Penalties for Non-Compliance with the CP565 Notice

Failure to comply with the instructions outlined in the CP565 notice can result in penalties. These penalties may include additional taxes owed, interest on unpaid amounts, or even legal action in severe cases. It is important for taxpayers to address the notice promptly to avoid these potential consequences. Understanding the implications of non-compliance can motivate timely action and ensure that taxpayers remain in good standing with the IRS.

Quick guide on how to complete cp567 notice

Effortlessly prepare Cp567 Notice on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly and efficiently. Handle Cp567 Notice on any device using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign Cp567 Notice with ease

- Locate Cp567 Notice and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize essential sections of your documents or obscure sensitive data with specific tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your PC.

Eliminate concerns over lost or mislaid files, tedious document searching, or errors requiring new copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Cp567 Notice to ensure exceptional communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp567 notice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cp565 notice and why is it important for my business?

The cp565 notice is a crucial tax form that businesses need to be aware of when reporting specific financial transactions. Understanding the cp565 notice can help ensure compliance with tax regulations and avoid potential penalties. By utilizing solutions like airSlate SignNow, you can easily manage, send, and sign important tax documents related to the cp565 notice.

-

How can airSlate SignNow assist with managing cp565 notice documents?

airSlate SignNow provides a user-friendly platform for sending, signing, and storing cp565 notice documents securely. With our easy-to-use interface, you can streamline document workflows, ensuring that your cp565 notice-related paperwork is efficiently processed and accessible anytime. This helps save time and reduces errors associated with manual document handling.

-

Are there costs associated with using airSlate SignNow for cp565 notice processing?

Yes, airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes, making it an affordable option for cp565 notice processing. You can choose from various subscription models, allowing you to select a plan that best fits your document management needs. Each plan provides essential features to handle the cp565 notice effectively.

-

Can airSlate SignNow integrate with other software for handling cp565 notice documents?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enhancing your workflow around cp565 notice documents. Whether you use CRM systems, cloud storage solutions, or accounting software, our integrations ensure that your cp565 notice management is smooth and efficient across platforms.

-

Is it safe to send cp565 notice documents using airSlate SignNow?

Yes, security is our top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your cp565 notice documents during transmission and storage. Our platform complies with industry standards, ensuring that sensitive information related to your cp565 notice is securely handled.

-

What features does airSlate SignNow offer for signing cp565 notice documents?

airSlate SignNow provides a range of features for signing cp565 notice documents, including electronic signatures, templates, and automatic reminders. These features allow for quicker signing processes while maintaining legal compliance. With airSlate SignNow, you can confidently and efficiently handle your cp565 notice documents.

-

How can electronic signatures help with the cp565 notice process?

Electronic signatures streamline the cp565 notice process by allowing you to obtain signatures instantly, eliminating the need for physical paperwork. This not only speeds up the filing process but also enhances accuracy and reduces overhead costs associated with managing physical documents. airSlate SignNow makes obtaining signatures for your cp565 notice straightforward.

Get more for Cp567 Notice

Find out other Cp567 Notice

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document