Chemours Spinoff Cost Basis Form

What is the Chemours Spinoff Cost Basis

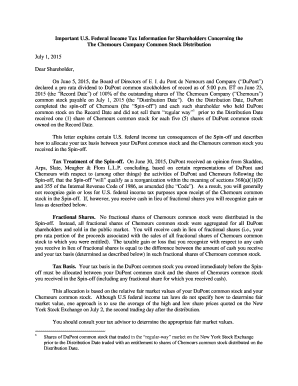

The Chemours spinoff cost basis refers to the original value assigned to shares of Chemours stock received by shareholders during the spinoff from DuPont. This cost basis is essential for determining capital gains or losses when shares are sold. Understanding the cost basis helps investors accurately report their financial transactions to the IRS and ensures compliance with tax regulations. The cost basis is typically calculated based on the market value of the shares at the time of the spinoff, adjusted for any relevant corporate actions.

How to Obtain the Chemours Spinoff Cost Basis

To obtain the Chemours spinoff cost basis, shareholders can refer to several resources. The first step is to check official communications from DuPont or Chemours, which may provide specific details on the cost basis calculations. Investors can also consult their brokerage statements, which often include adjusted cost basis information. Additionally, the IRS provides guidelines on how to determine cost basis for spinoffs, which can be helpful in ensuring accurate reporting.

Steps to Complete the Chemours Spinoff Cost Basis

Completing the Chemours spinoff cost basis involves several key steps:

- Gather necessary documentation, including original purchase records of DuPont shares.

- Identify the date of the spinoff and the number of shares received from Chemours.

- Determine the fair market value of Chemours shares on the spinoff date.

- Calculate the cost basis by applying the appropriate allocation method, often based on the proportion of Chemours shares to the total value of DuPont shares held.

- Document the calculations for future reference and tax reporting.

Legal Use of the Chemours Spinoff Cost Basis

The Chemours spinoff cost basis has legal implications, particularly in the context of tax reporting. Accurate reporting of the cost basis is crucial for compliance with IRS regulations. Failing to report the correct cost basis can lead to penalties or audits. It is important for shareholders to maintain thorough records and ensure that their calculations align with IRS guidelines to avoid any legal complications.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of cost basis for spinoffs. Shareholders must report the adjusted cost basis on their tax returns, which affects capital gains calculations. The IRS requires that taxpayers use the fair market value of the shares at the time of the spinoff to determine their cost basis. Additionally, the IRS may issue publications or updates that clarify rules surrounding spinoffs, making it essential for investors to stay informed.

Filing Deadlines / Important Dates

Filing deadlines for reporting the Chemours spinoff cost basis align with standard tax filing dates. Typically, individual taxpayers must file their federal tax returns by April 15 of each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important for shareholders to be aware of these dates to ensure timely reporting of their capital gains or losses associated with the Chemours shares.

Quick guide on how to complete chemours spinoff cost basis

Effortlessly Prepare Chemours Spinoff Cost Basis on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary template and securely store it online. airSlate SignNow equips you with all the features needed to create, modify, and eSign your documents swiftly and without any holdups. Handle Chemours Spinoff Cost Basis on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Chemours Spinoff Cost Basis with ease

- Find Chemours Spinoff Cost Basis and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all information and hit the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form searches, and mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Chemours Spinoff Cost Basis to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chemours spinoff cost basis

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the chemours spinoff cost basis and why is it important?

The chemours spinoff cost basis refers to the tax implications and calculated basis for shares received during the Chemours Company's spinoff. It's essential for investors as it helps determine capital gains or losses when selling shares. Understanding this cost basis ensures that you comply with tax regulations and maximize your investment returns.

-

How can airSlate SignNow assist with managing chemours spinoff cost basis documentation?

airSlate SignNow offers a streamlined solution for handling documents related to your chemours spinoff cost basis. You can easily send, sign, and store necessary paperwork digitally, reducing the risk of errors and enhancing tracking. This can be particularly useful during tax season to ensure you have all documents readily accessible.

-

Are there cost-effective pricing plans for managing chemours spinoff cost basis with airSlate SignNow?

Yes, airSlate SignNow provides various pricing plans that cater to both individuals and businesses, ensuring a cost-effective solution for managing your chemours spinoff cost basis. Each plan offers essential features needed to handle document workflows efficiently. You can choose a plan that aligns with your budget while still benefiting from powerful e-signature capabilities.

-

What features of airSlate SignNow help in calculating chemours spinoff cost basis?

Key features of airSlate SignNow, such as document templates and automated workflows, are beneficial for managing your chemours spinoff cost basis. With these tools, you can easily create and fill out necessary tax documents and maintain an organized record of your investments. This simplifies the process of determining your tax responsibilities related to the spinoff.

-

Can airSlate SignNow integrate with accounting software to manage chemours spinoff cost basis?

Absolutely! airSlate SignNow supports integrations with popular accounting software, which can aid in efficiently tracking your chemours spinoff cost basis. This integration helps synchronize your financial records directly with your documents, reducing manual entry errors and ensuring accurate calculations for tax reporting.

-

What are the benefits of using airSlate SignNow for managing chemours spinoff cost basis documentation?

Using airSlate SignNow for handling your chemours spinoff cost basis offers several benefits, including increased efficiency, enhanced accuracy, and better security for your sensitive documents. By going paperless, you can streamline your processes and quickly access your documentation from anywhere. This modern approach signNowly enhances your overall experience when managing tax-related queries.

-

Is airSlate SignNow suitable for all types of investors looking into chemours spinoff cost basis?

Yes, airSlate SignNow is designed to cater to all types of investors, whether you're an individual or a part of a larger organization, when dealing with chemours spinoff cost basis. Its user-friendly interface makes it accessible to everyone, enhancing the ability to manage important documentation effectively. The flexibility of our solution ensures it meets diverse needs and preferences.

Get more for Chemours Spinoff Cost Basis

- Spring graduation application concordia university form

- Forgot password paint sundries solutions form

- C01 record removal form to remove your details pl

- Failure to return this form to the alabama law enforcement agency will result in the cancellation of

- Qf48 job requisition form fugro

- Republique et canton de geneve dpartement de la sc form

- Eu pet certificate form

- Republique et canton de geneve dpartement de la sc 778819966 form

Find out other Chemours Spinoff Cost Basis

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure