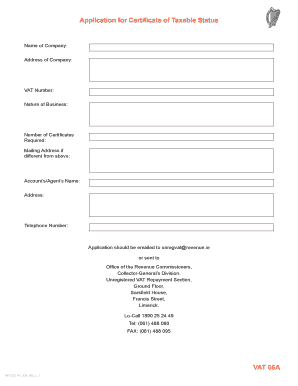

Vat66a Form

What is the Vat66a

The Vat66a is a specific form utilized for reporting unregistered value-added tax (VAT) revenue in the United States. It is essential for businesses that need to declare VAT they have collected but have not yet registered with the IRS. This form ensures compliance with tax regulations and helps maintain accurate financial records. Understanding the Vat66a is crucial for businesses to avoid penalties and ensure proper tax reporting.

Steps to complete the Vat66a

Completing the Vat66a requires careful attention to detail. Here are the key steps:

- Gather necessary information, including your business details and any relevant financial records.

- Fill out the Vat66a form accurately, ensuring all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate IRS office, either online or via mail.

Following these steps will help ensure that your Vat66a is completed correctly and submitted on time.

Legal use of the Vat66a

The Vat66a form must be used in compliance with IRS regulations to be considered legally valid. This includes ensuring that all information provided is accurate and truthful. The form serves as a declaration of unregistered VAT revenue and must be submitted within the specified deadlines to avoid penalties. Utilizing a reliable eSignature solution can further enhance the legal standing of your submission by providing verifiable signatures and maintaining compliance with electronic signature laws.

Required Documents

When preparing to complete the Vat66a, certain documents are necessary to ensure accuracy and compliance. These documents typically include:

- Business registration information

- Financial records detailing VAT collected

- Previous tax returns, if applicable

- Any correspondence with the IRS regarding VAT registration

Having these documents ready will facilitate a smoother completion process for the Vat66a.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines associated with the Vat66a to avoid late penalties. Typically, the form must be submitted annually, but specific deadlines may vary based on your business's fiscal year. It is advisable to check the IRS guidelines for the most current deadlines to ensure timely submission.

Who Issues the Form

The Vat66a form is issued by the IRS, which oversees the compliance and collection of taxes in the United States. Businesses must ensure they are using the most current version of the form, as updates may occur. Regularly checking the IRS website or consulting with a tax professional can provide clarity on any changes to the form or associated regulations.

Quick guide on how to complete vat66a

Effortlessly Prepare Vat66a on Any Device

The management of documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed papers, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents promptly without delays. Manage Vat66a on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

The easiest way to modify and electronically sign Vat66a with ease

- Find Vat66a and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important paragraphs in your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors requiring new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Modify and electronically sign Vat66a to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat66a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is vat66a and how does it relate to airSlate SignNow?

Vat66a is a crucial document related to VAT returns. With airSlate SignNow, you can conveniently fill out, send, and eSign your vat66a forms securely and efficiently, ensuring compliance and timely submissions.

-

How much does airSlate SignNow cost for vat66a processing?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. You can choose a plan that suits your needs for managing documents like vat66a, with options for monthly or annual subscriptions.

-

What features of airSlate SignNow can help me with vat66a forms?

AirSlate SignNow provides features like customizable templates, real-time tracking, and automated reminders specifically for vat66a forms. These functionalities streamline the eSigning process and ensure all necessary documents are processed efficiently.

-

Can I customize my vat66a documents in airSlate SignNow?

Yes, airSlate SignNow allows users to customize vat66a documents with branding and necessary fields. This customization ensures that your forms meet company standards while maintaining compliance with regulatory requirements.

-

Is airSlate SignNow secure for submitting vat66a forms?

Absolutely! airSlate SignNow adheres to strict security protocols, ensuring that your vat66a forms and sensitive information remain protected. Advanced encryption and authentication measures provide peace of mind for all users.

-

What integrations does airSlate SignNow offer for handling vat66a?

airSlate SignNow integrates seamlessly with several leading applications, enhancing your workflow when dealing with vat66a. These integrations allow for easy data synchronization and improve overall document management processes.

-

How do I get started with airSlate SignNow for vat66a?

Getting started with airSlate SignNow for vat66a is simple. Just sign up for an account, choose the appropriate plan, and begin uploading your documentation to manage your vat66a forms effortlessly.

Get more for Vat66a

Find out other Vat66a

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed