Printable Nc Form D 410

What is the Printable NC Form D 410

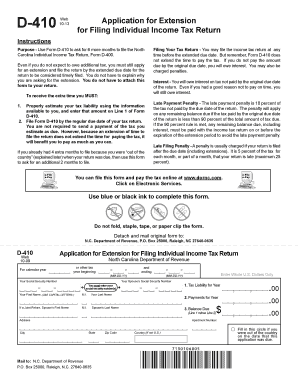

The printable NC Form D 410 is a tax form used by individuals and businesses in North Carolina to request an extension for filing their state income tax returns. This form allows taxpayers to extend the deadline for submitting their tax returns, providing additional time to gather necessary documentation and complete their filings accurately. It is essential for ensuring compliance with state tax regulations while avoiding penalties associated with late submissions.

How to Use the Printable NC Form D 410

To use the printable NC Form D 410, taxpayers must fill out the required information accurately. This includes personal details such as name, address, and Social Security number or taxpayer identification number. The form also requires the taxpayer to estimate their tax liability for the year. Once completed, the form can be submitted electronically or via mail to the North Carolina Department of Revenue. It is important to ensure that the form is submitted by the original tax filing deadline to avoid penalties.

Steps to Complete the Printable NC Form D 410

Completing the printable NC Form D 410 involves several key steps:

- Gather necessary documentation, including income statements and previous tax returns.

- Fill in personal information accurately, including your name, address, and Social Security number.

- Estimate your total tax liability for the year.

- Sign and date the form to certify the information provided is accurate.

- Submit the form before the tax filing deadline, either electronically or by mail.

Legal Use of the Printable NC Form D 410

The printable NC Form D 410 is legally recognized as a valid request for an extension of time to file state income tax returns in North Carolina. To ensure its legal standing, it must be completed accurately and submitted in accordance with state regulations. Compliance with the guidelines set forth by the North Carolina Department of Revenue is crucial for the extension to be honored and for avoiding potential penalties.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines associated with the printable NC Form D 410. The form should be submitted by the original due date of the tax return, which is typically April 15 for most individuals. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Failing to submit the form on time may result in penalties and interest on any unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The printable NC Form D 410 can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online Submission: Taxpayers can submit the form electronically through the North Carolina Department of Revenue's website.

- Mail: The completed form can be printed and mailed to the appropriate address provided on the form.

- In-Person: Taxpayers may also choose to deliver the form in person at designated Department of Revenue offices.

Quick guide on how to complete printable nc form d 410

Effortlessly Prepare Printable Nc Form D 410 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Printable Nc Form D 410 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Printable Nc Form D 410 with Ease

- Obtain Printable Nc Form D 410 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow supplies explicitly for that purpose.

- Craft your signature using the Sign tool, which takes moments and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or disorganized documents, cumbersome form navigating, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Printable Nc Form D 410 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable nc form d 410

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the printable nc form d 410 and how is it used?

The printable nc form d 410 is a North Carolina tax form that facilitates the reporting of certain tax-related information. It is essential for individuals and businesses who need to submit various tax documents efficiently. Using this form accurately ensures compliance with state tax regulations.

-

Is there a cost associated with obtaining the printable nc form d 410?

The printable nc form d 410 itself is typically available for free from the North Carolina Department of Revenue's website. However, using airSlate SignNow may involve subscription fees, which can vary based on the features you require. Investing in SignNow can streamline your document management and signing processes.

-

How does airSlate SignNow facilitate the use of the printable nc form d 410?

airSlate SignNow allows you to upload, fill, and electronically sign the printable nc form d 410 effectively. This platform provides user-friendly tools to ensure precision in completing your form, enhancing the overall experience and ensuring your document is legally compliant.

-

Can I integrate the printable nc form d 410 into my existing workflows?

Yes, you can easily integrate the printable nc form d 410 into your existing workflows using airSlate SignNow. The platform supports various integrations with popular applications, making it seamless to incorporate this tax form into your daily operations and improve efficiency.

-

What benefits does airSlate SignNow offer for managing forms like the printable nc form d 410?

Using airSlate SignNow for managing the printable nc form d 410 provides numerous benefits, including enhanced security for sensitive data and the convenience of electronic signatures. Additionally, the platform automates reminders and tracking, ensuring timely submissions and minimizing errors.

-

Are there templates available for the printable nc form d 410?

Absolutely! airSlate SignNow offers templates for the printable nc form d 410, allowing users to scale their document workflow efficiently. These templates save you time and ensure that all necessary fields are filled out correctly, reducing the chance of errors and rework.

-

How secure is airSlate SignNow for handling the printable nc form d 410?

airSlate SignNow implements robust security measures to protect your sensitive information when handling the printable nc form d 410. With encryption and secure data storage, you can trust that your documents are kept safe and compliant with industry standards.

Get more for Printable Nc Form D 410

Find out other Printable Nc Form D 410

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple