Where to Send Mf 001 Form

Where to send mf 001

When completing the mf 001 form, it is crucial to know the correct submission address to ensure timely processing. For residents of Wisconsin, the completed form should be sent to the Wisconsin Department of Revenue. The specific address for submission is:

Wisconsin Department of Revenue

P.O. Box 8901

Madison, WI 53

It is advisable to check for any updates or changes to the submission address on the Wisconsin Department of Revenue's official website to avoid any delays in processing.

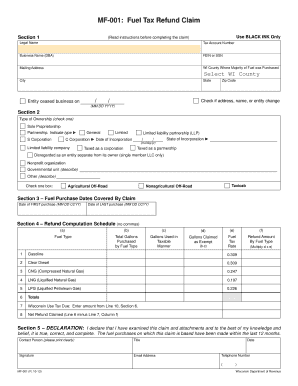

Steps to complete the mf 001

Completing the mf 001 form involves several key steps to ensure accuracy and compliance. Follow these steps for a smooth process:

- Gather necessary information: Collect all relevant details, including your personal information, tax identification number, and any supporting documentation required.

- Fill out the form: Carefully complete each section of the mf 001 form, ensuring that all information is accurate and legible.

- Review your entries: Double-check all information for accuracy. Mistakes can lead to processing delays or rejection.

- Sign the form: Ensure that you provide your signature where required. An electronic signature is acceptable if using a compliant platform.

- Submit the form: Send your completed mf 001 to the appropriate address, either by mail or electronically, if applicable.

Legal use of the mf 001

The mf 001 form is legally binding when completed and submitted according to the regulations set forth by the Wisconsin Department of Revenue. To ensure its legal standing, the form must adhere to specific guidelines:

- Compliance with eSignature laws: If signing electronically, ensure that the platform used complies with the ESIGN Act and UETA.

- Proper documentation: Include all necessary supporting documents to substantiate your claims or requests made on the form.

- Timely submission: Submit the form within the designated deadlines to avoid penalties or legal issues.

Form Submission Methods

There are various methods to submit the mf 001 form, each with its own advantages. Consider the following options:

- Mail: Print and complete the form, then send it via postal service to the designated address.

- Online submission: If available, use an online platform that complies with eSignature laws to submit the form electronically.

- In-person submission: Visit a local Wisconsin Department of Revenue office to submit the form directly, if preferred.

Required Documents

When submitting the mf 001 form, you may need to provide additional documentation to support your submission. Commonly required documents include:

- Proof of identity: This may include a driver's license or state ID.

- Tax identification number: Ensure you have your Social Security number or Employer Identification Number (EIN) available.

- Supporting tax documents: Any relevant tax returns or receipts that validate your claims on the mf 001 form.

Filing Deadlines / Important Dates

To avoid penalties and ensure timely processing, be aware of the filing deadlines associated with the mf 001 form. Key dates include:

- Annual filing deadline: Typically, the deadline for submitting the mf 001 is April 15 of each year.

- Extensions: If you require additional time, ensure you file for an extension before the original deadline.

Quick guide on how to complete where to send mf 001

Complete Where To Send Mf 001 seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed documents, as you can locate the right form and secure it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents rapidly without delays. Manage Where To Send Mf 001 on any device with airSlate SignNow Android or iOS applications and elevate any document-related task today.

How to modify and electronically sign Where To Send Mf 001 effortlessly

- Locate Where To Send Mf 001 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your requirements in document management with just a few clicks from any device of your choice. Modify and electronically sign Where To Send Mf 001 while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the where to send mf 001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mf 001 and how does it relate to airSlate SignNow?

mf 001 is a unique identifier for a specific product offering within airSlate SignNow that empowers businesses to manage document signing efficiently. It encompasses features designed to simplify the eSigning process, ensuring you can send, sign, and store documents seamlessly.

-

How much does the mf 001 plan cost?

The mf 001 plan offers competitive pricing tailored for businesses looking to enhance their document workflows. You can choose from various subscription tiers that fit your needs and budget, providing a cost-effective solution for eSigning.

-

What features are included in the mf 001 package?

The mf 001 package includes advanced features such as customizable templates, real-time tracking of document status, and seamless collaboration tools. These features are designed to streamline workflows and enhance productivity for all users.

-

What are the benefits of using airSlate SignNow with mf 001?

Using airSlate SignNow with mf 001 provides numerous benefits, including increased efficiency in document management, enhanced security with encrypted signings, and easy access from any device. It helps businesses save time and reduces manual errors in the signing process.

-

Can I integrate mf 001 with other applications?

Yes, mf 001 integrates seamlessly with various applications including CRMs, project management tools, and cloud storage services. This integration capability ensures that your eSigning experience is smooth and fits into your existing workflow.

-

Is there a free trial available for the mf 001 plan?

Yes, airSlate SignNow offers a free trial of the mf 001 plan, allowing you to explore its features and functionalities without any commitment. This trial is a great opportunity to assess how mf 001 can meet your document signing needs.

-

How secure is the mf 001 eSigning process?

The mf 001 eSigning process is highly secure, featuring end-to-end encryption and compliance with industry standards. With airSlate SignNow, you can have peace of mind knowing that your sensitive documents are protected throughout the signing process.

Get more for Where To Send Mf 001

- Wyoming tenant landlord form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles wyoming form

- Letter from tenant to landlord about landlords failure to make repairs wyoming form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497432213 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession wyoming form

- Letter from tenant to landlord about illegal entry by landlord wyoming form

- Letter from landlord to tenant about time of intent to enter premises wyoming form

- Wyoming tenant landlord 497432217 form

Find out other Where To Send Mf 001

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer