Form Mt 903 Instructions

What is the Form Mt 903 Instructions

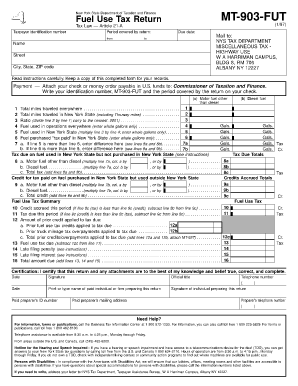

The Form Mt 903 is a specific tax form used in Minnesota for various reporting purposes. It is essential for individuals and businesses to understand the instructions associated with this form to ensure accurate completion and compliance with state regulations. The instructions provide guidance on how to fill out the form correctly, including the necessary information that must be provided, such as taxpayer identification details and financial data relevant to the reporting period.

Steps to Complete the Form Mt 903 Instructions

Completing the Form Mt 903 involves several key steps to ensure accuracy and compliance. Start by gathering all required documentation, including income statements and identification numbers. Next, carefully read the instructions to understand the specific sections of the form. Fill out each section methodically, ensuring that all information is complete and accurate. Double-check your entries for any errors before submitting the form. Finally, retain a copy of the completed form for your records.

Legal Use of the Form Mt 903 Instructions

The legal use of the Form Mt 903 is grounded in state tax regulations, which dictate how and when this form should be filed. It is crucial to adhere to these guidelines to avoid potential penalties or legal issues. The form must be completed accurately, as any discrepancies can lead to audits or fines. Understanding the legal implications of the form ensures that individuals and businesses remain compliant with Minnesota tax laws.

Required Documents for Form Mt 903

To successfully complete the Form Mt 903, certain documents are required. These typically include:

- Taxpayer identification number

- Income statements (W-2s, 1099s)

- Documentation of any deductions or credits claimed

- Previous year’s tax return for reference

Having these documents on hand will facilitate the completion of the form and help ensure that all necessary information is accurately reported.

Form Submission Methods

The Form Mt 903 can be submitted through various methods, depending on personal preference and requirements. The options typically include:

- Online submission through the Minnesota Department of Revenue website

- Mailing a printed copy to the appropriate state tax office

- In-person submission at designated state tax offices

Choosing the right submission method can impact processing times, so it is advisable to consider the most efficient option based on individual circumstances.

Examples of Using the Form Mt 903 Instructions

Understanding practical examples of how to use the Form Mt 903 can clarify its application. For instance, a small business owner may use this form to report income earned from their services. Similarly, an individual taxpayer might need to file the form to report freelance income. Each scenario requires careful adherence to the instructions to ensure that all relevant income and deductions are accurately reported.

Quick guide on how to complete form mt 903 instructions

Effortlessly Prepare Form Mt 903 Instructions on Any Device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form Mt 903 Instructions on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related operation today.

The Easiest Way to Edit and eSign Form Mt 903 Instructions with Ease

- Locate Form Mt 903 Instructions and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, such as email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiring form navigation, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form Mt 903 Instructions and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mt 903 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the MT 903 instructions 2024?

The MT 903 instructions 2024 provide guidance for processing wire transfers through the SWIFT network. They detail the necessary information required, ensuring that transactions are executed correctly and efficiently. Understanding these instructions is crucial for financial institutions and businesses engaging in international trade.

-

How can I access the MT 903 instructions 2024?

You can access the MT 903 instructions 2024 through official SWIFT documentation or financial service providers that facilitate your transactions. Additionally, our platform, airSlate SignNow, offers resources and support to help you understand and implement these instructions seamlessly in your workflows.

-

What features does airSlate SignNow offer for handling MT 903 instructions 2024?

airSlate SignNow provides features that enable users to easily create, send, and eSign documents, which can include MT 903 forms. Our platform streamlines the workflow, ensuring that all necessary details are captured correctly according to the MT 903 instructions 2024, thus enhancing accuracy and compliance.

-

Is airSlate SignNow cost-effective for processing MT 903 instructions 2024?

Yes, airSlate SignNow offers a cost-effective solution for businesses that frequently handle MT 903 transactions. Our pricing plans are designed to suit various business sizes and needs, helping you save on operational costs while meeting the requirements laid out in the MT 903 instructions 2024.

-

How can airSlate SignNow integrate with my existing systems for MT 903 instructions 2024?

airSlate SignNow can seamlessly integrate with various applications and platforms you may currently use, allowing for smooth handling of MT 903 instructions 2024. Our API provides the flexibility to connect with CRM systems, accounting software, and more, ensuring all your workflows are aligned.

-

What are the benefits of using airSlate SignNow for MT 903 instructions 2024?

Using airSlate SignNow for MT 903 instructions 2024 simplifies the document management process, reduces errors, and enhances compliance with financial regulations. The platform's user-friendly interface allows for quick eSigning and document tracking, ensuring efficiency in handling financial transactions.

-

Can airSlate SignNow help with international compliance regarding MT 903 instructions 2024?

Absolutely, airSlate SignNow is designed to help businesses comply with international standards, including those outlined in the MT 903 instructions 2024. We provide tools and resources that assist in managing documentation according to global regulations, reducing the risk of non-compliance.

Get more for Form Mt 903 Instructions

Find out other Form Mt 903 Instructions

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast