Ncdor E 585 Form

What is the NC Form E 585

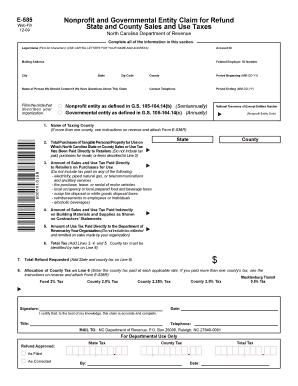

The NC Form E 585 is a document used in North Carolina for the purpose of reporting certain tax-related information. Specifically, it is utilized by businesses and individuals to report income that is not subject to withholding. This form is essential for ensuring compliance with state tax regulations and helps the North Carolina Department of Revenue (NCDOR) track income accurately. Understanding the purpose and requirements of the NC Form E 585 is crucial for taxpayers who need to report this type of income.

How to use the NC Form E 585

Using the NC Form E 585 involves several key steps. First, gather all necessary information, including details about the income being reported and the taxpayer's identification information. Next, complete the form accurately, ensuring that all fields are filled out as required. After completing the form, it must be submitted to the North Carolina Department of Revenue by the specified deadline. It is important to retain a copy for your records, as it serves as proof of compliance with state tax laws.

Steps to complete the NC Form E 585

Completing the NC Form E 585 requires careful attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the NC Form E 585 from the NCDOR website.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Report the income that is not subject to withholding accurately in the designated sections.

- Review the completed form for any errors or omissions.

- Sign and date the form to certify that the information provided is true and correct.

- Submit the form to the NCDOR by mail or electronically, as per the guidelines provided.

Legal use of the NC Form E 585

The legal use of the NC Form E 585 is governed by North Carolina tax laws. This form must be used to report income that is not subject to withholding, ensuring that taxpayers fulfill their obligations under state law. Failure to use the form correctly or to submit it on time can lead to penalties or additional scrutiny from the NCDOR. Therefore, understanding the legal implications of this form is essential for compliance and to avoid potential legal issues.

Key elements of the NC Form E 585

Several key elements are crucial for the NC Form E 585. These include:

- Taxpayer Information: Accurate identification of the taxpayer is necessary.

- Income Reporting: Detailed reporting of income not subject to withholding must be provided.

- Signature: The form must be signed and dated by the taxpayer to validate the information.

- Submission Guidelines: Adhering to submission methods and deadlines is essential for compliance.

Form Submission Methods

The NC Form E 585 can be submitted through various methods. Taxpayers may choose to file the form electronically via the NCDOR's online portal or submit a paper version by mail. It is important to check the latest submission guidelines, as electronic filing may offer quicker processing times and confirmation of receipt. Regardless of the method chosen, ensuring timely submission is critical to avoid penalties.

Quick guide on how to complete ncdor e 585

Complete Ncdor E 585 effortlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents rapidly without holdups. Handle Ncdor E 585 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Ncdor E 585 without strain

- Locate Ncdor E 585 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just moments and carries the same legal weight as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Ncdor E 585 and guarantee excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ncdor e 585

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nc form e 585 and why is it important?

The nc form e 585 is a tax form used in North Carolina for reporting income and withholding tax for certain payments. It is crucial for businesses to ensure compliance with state tax regulations and avoid penalties. Using tools like airSlate SignNow to manage the nc form e 585 can help simplify the filing process and ensure accurate submissions.

-

How can airSlate SignNow assist with managing the nc form e 585?

airSlate SignNow provides an efficient and user-friendly platform for creating, signing, and storing nc form e 585 documents. With its eSignature capabilities, users can streamline their workflows and easily collect necessary signatures, making it simpler to meet deadlines and stay compliant.

-

What are the pricing options for using airSlate SignNow for the nc form e 585?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Depending on the features you need for processing documents like the nc form e 585, plans range from affordable monthly subscriptions to comprehensive annual packages. This ensures that your business can find a cost-effective solution that fits your needs.

-

What features make airSlate SignNow ideal for eSigning the nc form e 585?

Key features of airSlate SignNow include an intuitive user interface, customizable templates, and secure eSignature capabilities. These tools enhance the eSigning experience for the nc form e 585, allowing businesses to streamline their document management processes while ensuring legal compliance and data security.

-

Can airSlate SignNow integrate with other software for filing the nc form e 585?

Yes, airSlate SignNow seamlessly integrates with various software applications such as CRM systems and document storage solutions. This integration allows businesses to enhance their workflows when preparing and submitting the nc form e 585, creating a more cohesive process across different platforms.

-

What are the benefits of using airSlate SignNow for eSigning the nc form e 585?

Using airSlate SignNow for the nc form e 585 offers several benefits, including time savings, improved accuracy, and enhanced security. The platform simplifies the document signing process, allowing users to complete transactions efficiently, while robust security features protect sensitive information.

-

Is there customer support available for assistance with the nc form e 585 on airSlate SignNow?

Absolutely! airSlate SignNow provides dedicated customer support to help users with any questions regarding the nc form e 585 and platform usage. Whether you need assistance with document preparation or eSigning, their support team is readily available to ensure a smooth experience.

Get more for Ncdor E 585

Find out other Ncdor E 585

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online