Colorado Form 112

What is the Colorado Form 112

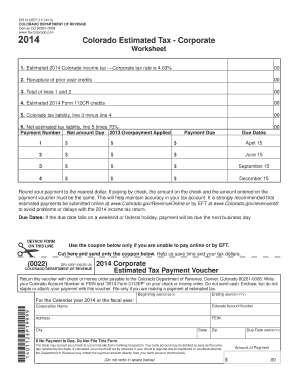

The Colorado Form 112 is a state tax return form specifically designed for corporations operating within Colorado. This form is utilized by C Corporations to report their income, deductions, and tax liability to the Colorado Department of Revenue. It is essential for corporations to accurately complete this form to ensure compliance with state tax laws and regulations.

How to use the Colorado Form 112

Using the Colorado Form 112 involves several key steps. First, gather all necessary financial documents, including income statements and expense reports. Next, accurately fill out the form by providing details about your corporation's income, deductions, and credits. It is crucial to ensure that all calculations are correct to avoid potential penalties. Once completed, the form can be submitted electronically or via mail to the Colorado Department of Revenue.

Steps to complete the Colorado Form 112

Completing the Colorado Form 112 requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial information, including revenue and expenses.

- Fill out the identification section with your corporation's name, address, and federal employer identification number (EIN).

- Report total income in the appropriate section, including any adjustments.

- List all deductions and credits your corporation is eligible for.

- Calculate the total tax due based on the provided tax rates.

- Review the form for accuracy and completeness before submission.

Legal use of the Colorado Form 112

The Colorado Form 112 must be used in accordance with state tax laws. It is legally binding when completed accurately and submitted on time. Corporations must ensure that they comply with all reporting requirements to avoid penalties. Using electronic filing methods can enhance the security and efficiency of the submission process, as long as the platform used complies with eSignature regulations.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the Colorado Form 112. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, the due date is April 15. It is important to file on time to avoid late fees and interest on unpaid taxes.

Form Submission Methods

The Colorado Form 112 can be submitted through various methods. Corporations have the option to file electronically using approved e-filing systems, which can streamline the process and reduce the likelihood of errors. Alternatively, the form can be mailed to the Colorado Department of Revenue. Ensure that the form is sent well in advance of the deadline to allow for processing time.

Quick guide on how to complete colorado form 112 33854853

Complete Colorado Form 112 effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any hold-ups. Manage Colorado Form 112 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Colorado Form 112 with ease

- Obtain Colorado Form 112 and then click Get Form to begin.

- Employ the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal significance as a standard wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Colorado Form 112 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado form 112 33854853

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the colorado form 112?

The colorado form 112 is a state income tax return form that businesses in Colorado use to report their income and calculate taxes owed. Understanding this form is crucial for compliance with state tax laws. Utilizing airSlate SignNow can simplify the electronic submission process of your colorado form 112.

-

How can airSlate SignNow help with the colorado form 112?

AirSlate SignNow provides a streamlined platform to fill out, sign, and send your colorado form 112 easily. With its user-friendly interface, businesses can ensure that their forms are completed accurately and submitted on time. This efficiency helps avoid any penalties related to tax filings.

-

What features does airSlate SignNow offer to assist with colorado form 112?

AirSlate SignNow offers features such as customizable templates for the colorado form 112, secure eSigning, and document tracking. These features make it easier for businesses to manage their tax documentation efficiently. You'll find that the process is not only simplified but also secure.

-

Is there a cost associated with using airSlate SignNow for the colorado form 112?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs while providing value for users preparing the colorado form 112. Whether you're a small business or an enterprise, there's a plan that will fit your budget and requirements. You can choose a plan that allows for unlimited signing and document management.

-

Can I integrate airSlate SignNow with other software for managing colorado form 112?

Absolutely! AirSlate SignNow integrates seamlessly with a host of applications, such as CRM systems and accounting software. This interoperability ensures that your data remains cohesive and supports efficient management of the colorado form 112 across your organization's platforms.

-

What benefits does airSlate SignNow provide for processing the colorado form 112?

Using airSlate SignNow for processing the colorado form 112 offers signNow benefits such as increased efficiency, reduced paper waste, and enhanced security for your documents. The platform's ease of use allows both businesses and clients to focus more on their financial goals rather than paperwork. Additionally, you can expect faster turnaround times for document signing.

-

How do I get started with using airSlate SignNow for the colorado form 112?

Getting started with airSlate SignNow for your colorado form 112 is easy! Simply sign up for an account, choose your pricing plan, and explore the features available for creating and managing your forms. There are helpful resources and customer support available to guide you through the entire process.

Get more for Colorado Form 112

- N 15 rev 2021 nonresident and part year resident income tax return forms 2021 fillable

- State of hawaii state tax collections and distribution department of form

- Schedule k 1 form n 20 rev 2021 partners share of income

- Form mcd 358 ampquottexas irp external applicationampquot texas

- Vehicle and vessel dealerwashington department of revenue form

- Real and personal property statements michigan form

- Real property taxdepartment of inland revenue form

- Pennsylvania form pa 40 pennsylvania income tax return printable pennsylvania income tax forms for tax year 2020pennsylvania

Find out other Colorado Form 112

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy