Mira Tax Clearance Form

What is the Mira Tax Clearance?

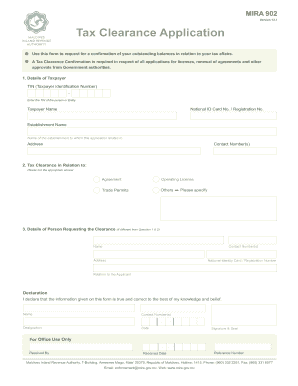

The Mira tax clearance form is an official document required by various state agencies to confirm that an individual or business has settled all tax obligations. This form serves as proof that the taxpayer is in good standing with the tax authorities, which is essential for various transactions, including applying for loans or permits. The form typically includes details about the taxpayer’s identification, tax history, and confirmation of no outstanding debts.

How to Obtain the Mira Tax Clearance

To obtain the Mira tax clearance, taxpayers must first ensure that all tax returns are filed and any outstanding balances are paid. The process usually involves the following steps:

- Visit the appropriate state tax authority's website or office.

- Complete any required forms or applications for the clearance.

- Provide necessary identification and documentation, such as Social Security numbers or business identification numbers.

- Submit the application, either online or in person, depending on state guidelines.

Steps to Complete the Mira Tax Clearance

Completing the Mira tax clearance form involves several key steps to ensure accuracy and compliance:

- Gather all relevant tax documents, including past returns and payment records.

- Fill out the form with accurate information, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to state guidelines, either online or by mail.

Legal Use of the Mira Tax Clearance

The Mira tax clearance form is legally binding and serves as a critical document in various legal and financial transactions. It is essential for individuals and businesses to understand that presenting this form can affect their ability to secure loans, permits, or licenses. Therefore, ensuring that the form is accurately completed and submitted is vital to avoid legal complications.

Required Documents for the Mira Tax Clearance

When applying for the Mira tax clearance, certain documents are typically required to verify the taxpayer’s identity and tax status. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport.

- Social Security number or Employer Identification Number (EIN).

- Copies of recent tax returns.

- Proof of any payments made towards outstanding tax obligations.

Form Submission Methods

The Mira tax clearance form can usually be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices or designated locations.

Quick guide on how to complete mira tax clearance

Complete Mira Tax Clearance effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly without delays. Manage Mira Tax Clearance on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and electronically sign Mira Tax Clearance without hassle

- Locate Mira Tax Clearance and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors requiring new document copies. airSlate SignNow takes care of your document management needs with just a few clicks from your chosen device. Edit and electronically sign Mira Tax Clearance and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mira tax clearance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mira tax clearance form and why is it important?

The mira tax clearance form is a crucial document that certifies your business has settled all tax obligations. It is important because many businesses require this clearance to proceed with contracts, secure permits, and maintain good standing with tax authorities.

-

How does airSlate SignNow facilitate the completion of the mira tax clearance form?

AirSlate SignNow streamlines the process of filling out the mira tax clearance form by allowing you to eSign and send documents easily. Our platform's user-friendly features enable seamless collaboration, ensuring you can complete and submit the form efficiently.

-

Is there a cost for using airSlate SignNow to handle the mira tax clearance form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including individuals and businesses handling the mira tax clearance form. Each plan provides access to a comprehensive suite of features that enhance document management and secure eSigning.

-

Can I integrate airSlate SignNow with other applications for managing the mira tax clearance form?

Absolutely! AirSlate SignNow integrates seamlessly with a range of applications like Google Drive, Dropbox, and CRM systems. This flexibility allows you to streamline the management of the mira tax clearance form and ensure that it aligns with your existing workflows.

-

What are the benefits of using airSlate SignNow for the mira tax clearance form?

Using airSlate SignNow for the mira tax clearance form offers numerous benefits, including enhanced efficiency, reduced paperwork, and a secure eSigning process. You’ll save time while ensuring compliance with tax regulations, which ultimately boosts your business operations.

-

How secure is airSlate SignNow when handling the mira tax clearance form?

AirSlate SignNow prioritizes security and employs advanced encryption protocols to protect your sensitive information, including the mira tax clearance form. Our platform meets industry standards for data protection, giving you peace of mind while managing your documents.

-

What features does airSlate SignNow offer for preparing the mira tax clearance form?

AirSlate SignNow provides essential features like customizable templates, bulk sending, and real-time tracking to streamline the preparation of the mira tax clearance form. These tools help ensure accuracy and save time, allowing you to focus on your core business activities.

Get more for Mira Tax Clearance

Find out other Mira Tax Clearance

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free