Metlife 401k Terms of Withdrawal Form

Understanding the Metlife 401k Terms of Withdrawal

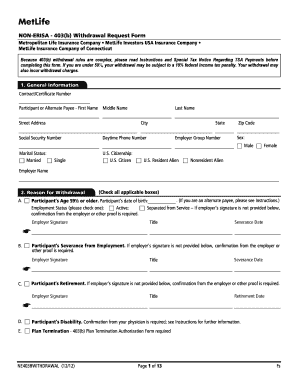

The Metlife 401k terms of withdrawal outline the specific conditions under which participants can access their retirement funds. These terms are crucial for ensuring compliance with both federal regulations and the specific policies set by Metlife. Generally, withdrawals can occur under circumstances such as retirement, disability, or financial hardship. Understanding these terms helps participants make informed decisions about their retirement savings and the implications of accessing those funds early.

Steps to Complete the Metlife 401k Withdrawal Process

Completing the Metlife 401k withdrawal process involves several important steps to ensure that your request is processed smoothly. First, gather all necessary documentation, including identification and any supporting financial documents. Next, fill out the Metlife rollover form accurately, ensuring that all information matches your records. After completing the form, review it for accuracy and submit it through the designated method, whether online, by mail, or in person. Keeping a copy of your submission for your records is advisable.

Required Documents for the Metlife Withdrawal

When preparing to submit your Metlife rollover form, it is essential to have the correct documents ready. Typically, you will need a government-issued identification, such as a driver's license or passport, to verify your identity. Additionally, any supporting documents that justify the reason for withdrawal, such as proof of financial hardship or medical records, may be required. Ensuring that all documents are complete and accurate will help avoid delays in processing your request.

Legal Considerations for Metlife Withdrawals

Legal compliance is a critical aspect of the Metlife withdrawal process. The terms of withdrawal must adhere to regulations set forth by the Internal Revenue Service (IRS) and other governing bodies. For example, early withdrawals may incur penalties or tax implications. It is important to understand the legal framework surrounding your withdrawal to avoid unexpected financial consequences. Consulting with a financial advisor or tax professional can provide clarity on these matters.

Eligibility Criteria for the Metlife 401k Withdrawal

Eligibility for withdrawing funds from a Metlife 401k plan is determined by several factors, including your age, employment status, and the specific terms of your plan. Generally, participants can withdraw funds upon reaching retirement age, experiencing a qualifying event such as disability, or facing financial hardship. Understanding these criteria is essential for making informed decisions regarding your retirement savings and ensuring compliance with Metlife's policies.

Form Submission Methods for the Metlife Rollover Form

Submitting the Metlife rollover form can be done through various methods, accommodating different preferences and needs. Participants can complete the form online through Metlife's secure portal, ensuring a quick and efficient process. Alternatively, the form can be printed and mailed to the appropriate address or submitted in person at a designated Metlife office. Each method has its own processing times, so it is beneficial to choose the one that best fits your timeline.

Potential Penalties for Non-Compliance with Metlife Withdrawal Policies

Failing to comply with Metlife's withdrawal policies can result in significant penalties. For instance, early withdrawals before the age of fifty-nine and a half typically incur a ten percent penalty in addition to regular income tax. Furthermore, non-compliance may lead to delays in processing your withdrawal request or even denial of the request altogether. Being aware of these potential penalties can help you navigate the withdrawal process more effectively and avoid costly mistakes.

Quick guide on how to complete metlife 401k terms of withdrawal

Prepare Metlife 401k Terms Of Withdrawal seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly substitute to traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle Metlife 401k Terms Of Withdrawal on any device with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Metlife 401k Terms Of Withdrawal with ease

- Obtain Metlife 401k Terms Of Withdrawal and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from your chosen device. Modify and eSign Metlife 401k Terms Of Withdrawal and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the metlife 401k terms of withdrawal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MetLife rollover form and why do I need it?

The MetLife rollover form is a necessary document used to transfer retirement assets between accounts without incurring tax penalties. It streamlines the process, ensuring that your funds move efficiently while maintaining their tax-deferred status. Completing this form is essential for anyone looking to manage their retirement funds effectively.

-

How can airSlate SignNow help with the MetLife rollover form?

airSlate SignNow offers an intuitive platform that simplifies the signing and submission of the MetLife rollover form. With our eSigning capabilities, you can complete the process quickly and securely, which is ideal for busy professionals. This saves you time and ensures your rollover is managed promptly.

-

Is there a cost associated with using airSlate SignNow for the MetLife rollover form?

airSlate SignNow provides a cost-effective solution for managing the MetLife rollover form. We offer various pricing plans that accommodate different needs, ensuring you only pay for what suits your business. Plus, with our current promotions, you may find great value in our services.

-

What features does airSlate SignNow offer for managing the MetLife rollover form?

When using airSlate SignNow for the MetLife rollover form, you gain access to features like secure eSigning, document templates, and cloud storage. These tools help to streamline the process and enhance your document management. We also provide real-time tracking for your forms, ensuring you know the status at all times.

-

Can I customize the MetLife rollover form in airSlate SignNow?

Yes, airSlate SignNow allows customization of the MetLife rollover form to fit your specific needs. You can add branding, logos, and personalized messages to enhance professionalism. This flexibility ensures your documents reflect your brand identity while remaining compliant.

-

How does airSlate SignNow ensure the security of my MetLife rollover form?

Security is a top priority at airSlate SignNow. We employ industry-leading encryption and compliance measures to protect sensitive information contained in the MetLife rollover form. You can confidently use our platform, knowing that your data is safeguarded against unauthorized access.

-

What integrations does airSlate SignNow offer for the MetLife rollover form?

airSlate SignNow integrates seamlessly with various tools to facilitate the completion of the MetLife rollover form. You can connect with applications like Google Drive, Dropbox, and CRMs to enhance your workflow. These integrations streamline processes and save time when managing your documents.

Get more for Metlife 401k Terms Of Withdrawal

Find out other Metlife 401k Terms Of Withdrawal

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation