Form 5208

What is the Form 5208

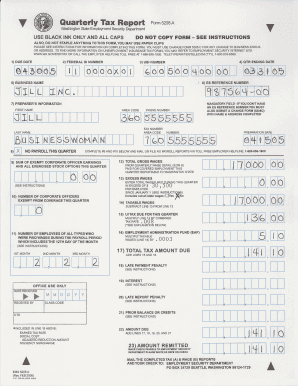

The Form 5208 is a state-specific document used primarily for tax reporting purposes in Washington State. This form serves as a quarterly tax report, allowing businesses to report their tax obligations accurately. It is essential for compliance with state tax regulations and helps ensure that businesses remain in good standing with the Washington State Department of Revenue.

How to use the Form 5208

To use the Form 5208 effectively, businesses must first gather all necessary financial information for the reporting period. This includes income, deductions, and any applicable credits. Once the information is compiled, the form can be filled out to reflect the business's tax liability accurately. It is crucial to ensure that all entries are correct to avoid penalties and ensure compliance with state laws.

Steps to complete the Form 5208

Completing the Form 5208 involves several key steps:

- Gather financial records for the reporting period, including income statements and expense reports.

- Fill out the form with accurate figures, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form by the designated filing deadline to avoid late fees.

Legal use of the Form 5208

The legal use of the Form 5208 is governed by Washington State tax laws. To be considered valid, the form must be completed accurately and submitted on time. Compliance with all relevant regulations, including maintaining accurate records and reporting all income, is essential. Failure to adhere to these legal requirements can result in penalties or legal consequences for the business.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5208 are typically quarterly, with specific due dates that businesses must adhere to. It is important to note these dates to avoid late submissions and potential penalties. Generally, the deadlines are as follows:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31

Form Submission Methods (Online / Mail / In-Person)

The Form 5208 can be submitted through various methods to accommodate different business needs. These methods include:

- Online submission through the Washington State Department of Revenue website.

- Mailing a completed paper form to the designated address.

- In-person submission at local Department of Revenue offices.

Quick guide on how to complete form 5208

Effortlessly Prepare Form 5208 on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it digitally. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without interruption. Manage Form 5208 on any device using airSlate SignNow’s Android or iOS applications and streamline your document-related processes today.

Simple Steps to Edit and eSign Form 5208

- Locate Form 5208 and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 5208 to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5208

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a blank form 5208?

The blank form 5208 is a customizable template designed for various business needs, allowing users to efficiently collect information and signatures. This form can be filled out electronically, ensuring a quick and seamless process for document management.

-

How can airSlate SignNow help with the blank form 5208?

airSlate SignNow simplifies the completion and eSigning of the blank form 5208 by providing an intuitive interface. You can easily share the form with clients or team members and track its completion status in real-time.

-

Is there a cost associated with using the blank form 5208 on airSlate SignNow?

While airSlate SignNow offers various pricing plans, the blank form 5208 is included in all packages. This cost-effective solution allows businesses to maximize their document workflow without additional fees.

-

What features are included with the blank form 5208 in airSlate SignNow?

With the blank form 5208, users receive features such as electronic signatures, automated reminders, and sharing options. These capabilities enhance productivity and streamline document processes.

-

Can I integrate the blank form 5208 with other applications?

Yes, airSlate SignNow allows seamless integration with a variety of business applications. This makes it easy to use the blank form 5208 across different platforms, enhancing your workflow efficiency.

-

What are the benefits of using a blank form 5208 instead of a physical form?

Using the blank form 5208 digitally eliminates the need for paper, reducing costs and environmental impact. Additionally, it speeds up the signing process, allowing for quicker turnaround times.

-

How secure is the blank form 5208 when using airSlate SignNow?

airSlate SignNow offers top-notch security features for the blank form 5208, including encryption and compliance with industry standards. This ensures that your documents are safe and confidential during the entire signing process.

Get more for Form 5208

Find out other Form 5208

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word