Quarterly Commercial Tax Return Form

What is the Quarterly Commercial Tax Return Form

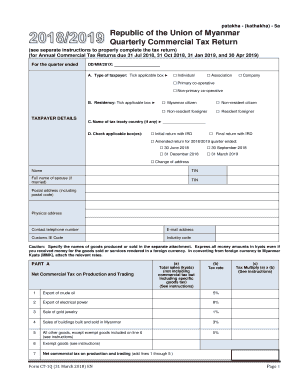

The Quarterly Commercial Tax Return Form is a vital document for businesses operating in Myanmar. It serves as a means for companies to report their commercial tax obligations to the government. This form is essential for ensuring compliance with local tax regulations and maintaining good standing with tax authorities. It typically includes details about the business's revenue, tax calculations, and any deductions that may apply.

How to use the Quarterly Commercial Tax Return Form

Using the Quarterly Commercial Tax Return Form involves several key steps. First, businesses must gather all necessary financial data, including sales figures and any applicable expenses. Next, they complete the form by accurately entering this information. It is crucial to follow the guidelines provided by the tax authority to ensure that all required sections are filled out correctly. Once completed, the form must be submitted by the specified deadline to avoid penalties.

Steps to complete the Quarterly Commercial Tax Return Form

Completing the Quarterly Commercial Tax Return Form requires careful attention to detail. Here are the steps involved:

- Gather financial records for the quarter, including sales and expenses.

- Access the form, either online or in printed format.

- Fill in the business information, including name, address, and tax identification number.

- Input revenue figures and calculate the commercial tax owed.

- Review all entries for accuracy and completeness.

- Submit the form by the deadline, either electronically or by mail.

Legal use of the Quarterly Commercial Tax Return Form

The legal use of the Quarterly Commercial Tax Return Form is governed by tax laws in Myanmar. To ensure that the form is legally binding, it must be filled out accurately and submitted on time. Failure to comply with these regulations can result in penalties, including fines or additional scrutiny from tax authorities. Businesses should retain copies of submitted forms for their records, as they may be required for future audits or inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Quarterly Commercial Tax Return Form are critical for compliance. Businesses must be aware of specific dates each quarter when the form must be submitted. Generally, these deadlines fall at the end of each quarter, but it is essential to verify the exact dates with the local tax authority. Missing a deadline can lead to penalties and interest on unpaid taxes.

Required Documents

To complete the Quarterly Commercial Tax Return Form, several documents are typically required. These may include:

- Financial statements for the quarter.

- Sales invoices and receipts.

- Records of any deductions or credits claimed.

- Previous tax returns for reference.

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete quarterly commercial tax return form

Complete Quarterly Commercial Tax Return Form smoothly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Quarterly Commercial Tax Return Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Quarterly Commercial Tax Return Form effortlessly

- Obtain Quarterly Commercial Tax Return Form and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of your documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Quarterly Commercial Tax Return Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quarterly commercial tax return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 31 sample in Myanmar?

A form 31 sample in Myanmar is a specific document template used for various administrative and legal purposes. It typically includes necessary fields to ensure compliance with local regulations. Utilizing a form 31 sample in Myanmar can streamline your document preparation and improve accuracy.

-

How can airSlate SignNow help with form 31 samples in Myanmar?

airSlate SignNow simplifies the process of creating and signing form 31 samples in Myanmar through its user-friendly platform. With features like drag-and-drop document editing and eSignatures, you can quickly customize and send your forms. This enhances efficiency and ensures you meet compliance requirements effortlessly.

-

What are the pricing options for airSlate SignNow related to form 31 samples in Myanmar?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those requiring form 31 samples in Myanmar. You can choose from different subscription tiers to access tailored features that fit your budget. Our plans are designed to provide value without sacrificing quality.

-

Can I integrate airSlate SignNow with other applications for handling form 31 samples in Myanmar?

Yes, airSlate SignNow integrates seamlessly with numerous applications, allowing you to manage form 31 samples in Myanmar alongside your existing tools. With integrations with popular software like Google Drive, Salesforce, and more, you can automate your workflow and improve productivity.

-

What features does airSlate SignNow offer for managing form 31 samples in Myanmar?

airSlate SignNow offers a range of features tailored for managing form 31 samples in Myanmar, including customizable templates, secure eSigning, and collaboration tools. These features make it easy to create, edit, and share your forms efficiently. Furthermore, the platform ensures document security and compliance, giving you peace of mind.

-

Are there any benefits of using airSlate SignNow for form 31 samples in Myanmar?

Using airSlate SignNow for form 31 samples in Myanmar provides several benefits, including enhanced speed in document processing and reduced paper usage. The eSignature functionality eliminates the need for physical signatures, streamlining your workflow. Additionally, the platform's compliance features help mitigate risks associated with document handling.

-

Is it easy to learn how to use airSlate SignNow for form 31 samples in Myanmar?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for anyone to use when handling form 31 samples in Myanmar. With intuitive navigation and helpful resources such as tutorials and customer support, you'll quickly become proficient in managing your documents.

Get more for Quarterly Commercial Tax Return Form

- Homeless letter for housing authority form

- Progressive id card form

- Pge bill template form

- Statutory declaration qld 100829474 form

- Vos justificatifs hello bank form

- Social security payee form

- Office of policy procedures and training policy bulletin form

- Clubhouse reservation form hide a way on the gulf poa

Find out other Quarterly Commercial Tax Return Form

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA