Transit Tax Form City of Sandy

What is the Transit Tax Form City Of Sandy

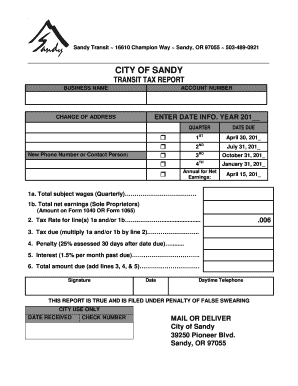

The Transit Tax Form City of Sandy is a document used by residents and businesses in Sandy, Oregon, to report and pay transit taxes. This form is essential for ensuring compliance with local tax regulations. It typically includes information about the taxpayer, the amount of tax owed, and the specific transit district to which the tax applies. Understanding this form is crucial for anyone subject to transit taxes in the area, as it helps fund public transportation services and infrastructure improvements.

How to use the Transit Tax Form City Of Sandy

Using the Transit Tax Form City of Sandy involves several steps. First, gather all necessary information, including your income details and any applicable deductions. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. Once the form is filled, review it for accuracy before submission. You can submit the form electronically or by mail, depending on your preference. Keeping a copy for your records is advisable for future reference and compliance verification.

Steps to complete the Transit Tax Form City Of Sandy

Completing the Transit Tax Form City of Sandy requires careful attention to detail. Follow these steps for a smooth process:

- Gather your financial documents, including income statements and previous tax returns.

- Obtain the latest version of the Transit Tax Form from the official city website or local tax office.

- Fill out the form, ensuring all personal and financial information is accurate.

- Calculate the total transit tax owed based on your income and applicable rates.

- Review the form for any errors or omissions.

- Submit the completed form by the designated deadline.

Legal use of the Transit Tax Form City Of Sandy

The legal use of the Transit Tax Form City of Sandy is governed by local tax laws. This form must be filled out accurately and submitted on time to avoid penalties. It serves as a legal document that confirms your tax obligations to the city. Failure to comply with the requirements can lead to fines or other legal repercussions. It is essential to understand the legal implications of this form and ensure adherence to all relevant regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Transit Tax Form City of Sandy are crucial for compliance. Typically, the form must be submitted annually by a specific date, often aligned with other tax deadlines. Missing these deadlines can result in penalties or interest charges on unpaid taxes. It is advisable to keep track of important dates throughout the tax year to ensure timely submission and avoid complications.

Penalties for Non-Compliance

Non-compliance with the Transit Tax Form City of Sandy can lead to significant penalties. These may include fines, interest on unpaid taxes, or additional legal actions. The city may impose these penalties to encourage timely and accurate reporting of transit taxes. Understanding the potential consequences of non-compliance is essential for taxpayers to maintain good standing with local tax authorities.

Quick guide on how to complete transit tax form city of sandy

Accomplish Transit Tax Form City Of Sandy effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Transit Tax Form City Of Sandy on any platform using airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

How to alter and eSign Transit Tax Form City Of Sandy with ease

- Locate Transit Tax Form City Of Sandy and click Obtain Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Complete button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow caters to your document management needs with just a few clicks from a device of your choice. Edit and eSign Transit Tax Form City Of Sandy to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transit tax form city of sandy

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is orsttw h, and how does it benefit businesses?

Orsttw h refers to the streamlined processes supported by the airSlate SignNow platform. This allows businesses to efficiently send and electronically sign documents, reducing time spent on paperwork. By utilizing orsttw h, companies can enhance productivity and ensure compliance with digital signatures.

-

What pricing plans does airSlate SignNow offer for orsttw h?

AirSlate SignNow offers flexible pricing plans designed to accommodate diverse business needs. The plans include various features suitable for individuals, small teams, and large enterprises leveraging orsttw h for document management. Each plan is competitively priced to ensure cost-effectiveness while maximizing functionality.

-

How user-friendly is airSlate SignNow's orsttw h interface?

The airSlate SignNow platform boasts an intuitive interface that simplifies the orsttw h experience for users of all skill levels. With a straightforward layout and easy navigation, users can quickly learn how to manage documents and signatures. This user-friendliness contributes to increased adoption and satisfaction among teams.

-

What features are included in the orsttw h solution?

AirSlate SignNow includes a robust set of features as part of its orsttw h solution, such as templates, automatic reminders, and real-time tracking of documents. These features help ensure efficient workflows while minimizing delays associated with manual procedures. Additionally, users can customize their document processes to fit their specific needs.

-

Can airSlate SignNow's orsttw h integrate with other applications?

Yes, airSlate SignNow's orsttw h seamlessly integrates with various applications, including CRM systems and cloud storage services. This integration capability enhances workflow efficiency by allowing teams to manage their documents without leaving their preferred tools. Such versatility is essential for businesses looking to streamline their operations.

-

What security measures does airSlate SignNow implement for orsttw h?

AirSlate SignNow prioritizes security within its orsttw h processes by employing industry-standard encryption techniques. This ensures that all signed documents and sensitive data remain protected from unauthorized access. Furthermore, compliance with regulations such as GDPR and HIPAA makes airSlate SignNow a trustworthy choice for businesses.

-

Is there a mobile app for airSlate SignNow's orsttw h?

Yes, airSlate SignNow offers a mobile app that provides users with access to orsttw h capabilities on the go. This mobile solution allows individuals to manage document signing and sending processes effortlessly, regardless of their location. The convenience of the mobile app enhances productivity for remote teams or traveling professionals.

Get more for Transit Tax Form City Of Sandy

- Scc767929 virginia state corporation commission scc virginia form

- Fairfax county fictitious name application 2013 form

- Virginia corp corporation form

- Fairfax county electrical inspection report and certification form 2001

- Virginia service request form

- City of petersburg business license form

- Va form 819 2011

- File delaware certificate of dissolution online form

Find out other Transit Tax Form City Of Sandy

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free