Maryland Resale Certificate Form

What is the Maryland Resale Certificate

The Maryland resale certificate is a legal document that allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. This certificate is essential for retailers and wholesalers in Maryland, as it helps streamline the purchasing process and ensures compliance with state tax regulations. By presenting a valid resale certificate, businesses can avoid the upfront costs of sales tax, which they will collect from customers when the goods are sold.

How to Obtain the Maryland Resale Certificate

To obtain a Maryland resale certificate, a business must first register with the Maryland Comptroller's office to receive a sales tax identification number. This registration can typically be completed online or by submitting a paper application. Once registered, businesses can fill out the Maryland resale certificate form, which requires basic information such as the purchaser's name, address, and sales tax identification number. It is important to ensure that all information is accurate to avoid any issues during the purchasing process.

Steps to Complete the Maryland Resale Certificate

Completing the Maryland resale certificate involves several straightforward steps:

- Gather necessary information, including your business name, address, and sales tax identification number.

- Access the Maryland resale certificate form, which can be found online or obtained from the Maryland Comptroller's office.

- Fill in the required fields accurately, ensuring that all details match your registered business information.

- Sign and date the certificate to validate it.

- Present the completed certificate to your supplier when making a purchase.

Legal Use of the Maryland Resale Certificate

The Maryland resale certificate must be used in compliance with state laws. It is intended solely for the purchase of goods that will be resold in the regular course of business. Misusing the certificate, such as using it for personal purchases or for items not intended for resale, can lead to penalties and fines. Businesses should maintain accurate records of all transactions involving the resale certificate to ensure compliance and facilitate any potential audits by tax authorities.

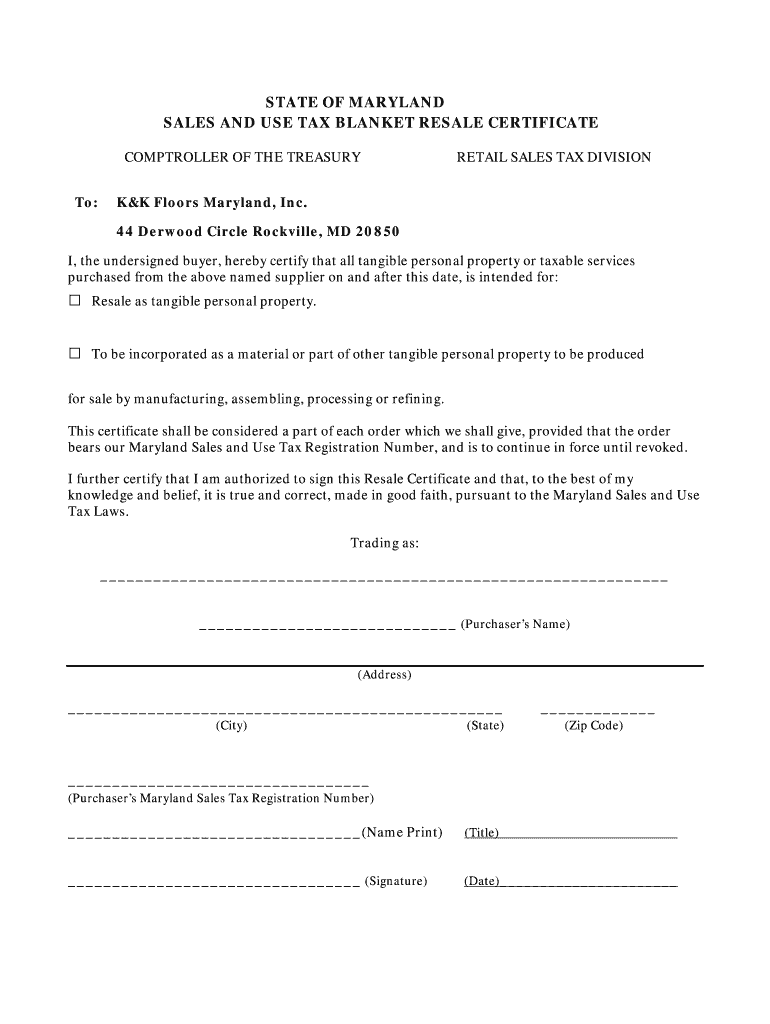

Key Elements of the Maryland Resale Certificate

Several key elements must be included on the Maryland resale certificate for it to be considered valid:

- Purchaser's Name: The legal name of the business or individual purchasing the goods.

- Address: The physical address of the purchaser.

- Sales Tax Identification Number: The unique number assigned to the business by the Maryland Comptroller.

- Description of Goods: A brief description of the items being purchased for resale.

- Signature: The signature of the purchaser or an authorized representative.

Examples of Using the Maryland Resale Certificate

Businesses can use the Maryland resale certificate in various scenarios, such as:

- A retailer purchasing clothing from a wholesaler to sell in their store.

- A restaurant buying food supplies intended for resale to customers.

- A contractor acquiring materials for a project that will be billed to a client.

In each case, the resale certificate allows the business to avoid paying sales tax on items that will ultimately be sold to consumers.

Quick guide on how to complete maryland sales and use tax resale certificate form

Your assistance manual on how to prepare your Maryland Resale Certificate

If you wish to learn how to create and transmit your Maryland Resale Certificate, here are some straightforward recommendations to facilitate tax submission.

Initially, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to alter, produce, and finalize your tax papers effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify responses as necessary. Streamline your tax organization with advanced PDF editing, eSigning, and convenient sharing.

Adhere to the instructions below to finalize your Maryland Resale Certificate in just a few moments:

- Establish your account and begin working on PDFs in a matter of minutes.

- Utilize our catalog to locate any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Maryland Resale Certificate in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to affix your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Refer to this manual to electronically submit your taxes with airSlate SignNow. Please be aware that filing on paper may lead to increased return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS site for submission guidelines in your state.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

-

If I publish on Smashwords and tick on the option to take a 30 percent tax, do I still need to fill out the tax form?

If you want to get any of that tax money back in your pocket, you will have to fill out the forms.Are you a US citizen? If not, you will need to obtain an ITIN using IRS form W-7. This will allow you to file the appropriate US tax return forms and claim a refund. Depending on your country of residence, the refund could be up to 100% of the tax collected. With an ITIN, you will usually be exempt from the 30% withholding and will not be required to fill out any US tax returns at the end of the year (unless you actually reside in the US, but that is a far more complicated situation). The ITIN application process can be a royal pain in the behind, especially if you wait until after the taxes have been withheld.If your book only makes a few dollars, the hassle is not worth it. But if you hit the self-publishing lottery, you will definitely want to apply for that refund.

Create this form in 5 minutes!

How to create an eSignature for the maryland sales and use tax resale certificate form

How to create an eSignature for the Maryland Sales And Use Tax Resale Certificate Form in the online mode

How to create an eSignature for the Maryland Sales And Use Tax Resale Certificate Form in Google Chrome

How to create an eSignature for putting it on the Maryland Sales And Use Tax Resale Certificate Form in Gmail

How to generate an electronic signature for the Maryland Sales And Use Tax Resale Certificate Form right from your smart phone

How to make an electronic signature for the Maryland Sales And Use Tax Resale Certificate Form on iOS devices

How to make an electronic signature for the Maryland Sales And Use Tax Resale Certificate Form on Android OS

People also ask

-

What is a state of Maryland resale certificate?

A state of Maryland resale certificate is a document that allows businesses to purchase goods tax-free, with the intent of reselling them. This certificate is essential for retailers and wholesalers in Maryland to avoid paying sales tax on inventory that will be sold to customers.

-

How can I obtain a state of Maryland resale certificate?

To obtain a state of Maryland resale certificate, you need to apply through the Maryland State Comptroller's website or fill out the appropriate form. Ensure that your business is registered and that you maintain all necessary permits, as the certificate will be linked to your business's tax ID.

-

What is the cost associated with getting a state of Maryland resale certificate?

There is typically no fee to obtain a state of Maryland resale certificate; however, you may incur costs related to registering your business or maintaining other licenses. It's important to check Maryland's official resources for any specific fees that could apply to your business sector.

-

How does the airSlate SignNow platform help with managing resale certificates?

The airSlate SignNow platform enables businesses to easily send, eSign, and manage their state of Maryland resale certificate documents online. With intuitive features and templates, you can quickly create and store your resale certificates securely, ensuring compliance and efficient record management.

-

What are the benefits of using airSlate SignNow for eSigning my state of Maryland resale certificate?

Using airSlate SignNow for eSigning your state of Maryland resale certificate provides a fast, secure, and legally binding way to complete transactions. The platform enhances productivity by reducing the time spent on paperwork and ensures that your documents are accessible anytime, anywhere.

-

Can I integrate airSlate SignNow with my existing business software?

Yes, airSlate SignNow offers seamless integrations with various business software solutions, enhancing your ability to manage the state of Maryland resale certificate process alongside your other operations. These integrations help streamline workflows and improve overall efficiency for your team.

-

Is airSlate SignNow compliant with Maryland state laws regarding resale certificates?

Absolutely! airSlate SignNow is designed to comply with the latest Maryland state laws and regulations concerning resale certificates. You can trust that your electronic documents, including the state of Maryland resale certificate, remain legally valid and secure.

Get more for Maryland Resale Certificate

- Tata motors project report pdf form

- Kanzen jisatsu manyuaru download form

- Business permit application form pila laguna

- Sec registration form 30418497

- Apartment search checklist template form

- Kindergarten w apt summary scoring sheet form

- Oklahoma labor board complaints form

- Application for widows or widowers insurance benefits form

Find out other Maryland Resale Certificate

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template