What is a Non Tax Filer Statement Form

What is a non tax filer statement?

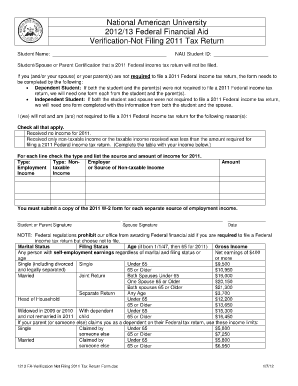

A non tax filer statement is a document that verifies an individual's status as a non-filer, meaning they did not file a federal tax return for a specific tax year. This statement is often required for various purposes, such as applying for financial aid, loans, or other assistance programs. It typically includes information about the individual's income, or lack thereof, and may be used to affirm that they are not required to file a tax return based on their income level or other criteria set by the IRS.

How to obtain a non tax filer statement

To obtain a non tax filer statement, individuals can request a verification of non-filing from the IRS. This can be done by completing Form 4506-T, which allows taxpayers to request a transcript of their tax return information. The form can be submitted online, by mail, or by fax. It is important to specify that you are requesting a verification of non-filing for the relevant tax year. Once the IRS processes the request, they will provide the necessary documentation confirming your non-filing status.

Steps to complete a non tax filer statement

Completing a non tax filer statement involves several key steps:

- Gather necessary information, including your Social Security number, date of birth, and any relevant financial details.

- Fill out Form 4506-T accurately, ensuring that you indicate the specific tax year for which you need verification.

- Submit the form through your preferred method (online, by mail, or fax) and keep a copy for your records.

- Wait for the IRS to process your request, which typically takes a few weeks.

- Receive your verification of non-filing, which you can then use as needed.

Legal use of a non tax filer statement

A non tax filer statement is legally recognized and can be used in various situations where proof of income status is required. For instance, educational institutions may request this document to determine eligibility for financial aid. Additionally, lenders may require it to assess a borrower's financial situation. It is essential to ensure that the statement is accurate and reflects your true financial status to avoid any legal complications.

IRS guidelines for non tax filers

The IRS provides specific guidelines regarding who qualifies as a non-filer. Generally, individuals who earn below a certain income threshold, or who do not meet other filing requirements, are considered non-filers. It is crucial to understand these guidelines to determine if you need to file a tax return or if a non tax filer statement is appropriate for your situation. The IRS also outlines the process for obtaining verification of non-filing, which can help streamline your application processes for loans or aid.

Required documents for a non tax filer statement

When preparing to request a non tax filer statement, you may need to provide certain documents to verify your identity and income status. Commonly required documents include:

- Social Security card or number

- Government-issued photo ID

- Any relevant financial documents that support your non-filing status, such as pay stubs or bank statements

Having these documents ready can facilitate a smoother application process when requesting your non tax filer statement.

Quick guide on how to complete what is a non tax filer statement

Effortlessly Prepare What Is A Non Tax Filer Statement on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage What Is A Non Tax Filer Statement on any device using airSlate SignNow's Android or iOS applications, and simplify any document-centric task today.

The Easiest Way to Modify and Electronically Sign What Is A Non Tax Filer Statement

- Obtain What Is A Non Tax Filer Statement and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the specialized tools offered by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign What Is A Non Tax Filer Statement and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is a non tax filer statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a non filer tax form?

A non filer tax form is a document used by individuals who are not required to file a federal income tax return. This form helps you declare your status and can provide proof of non-filing for various purposes. It's essential to understand the specifics around non filer tax forms to ensure compliance with IRS regulations.

-

How can airSlate SignNow help with creating a non filer tax form?

airSlate SignNow offers a user-friendly platform that simplifies the process of creating and eSigning non filer tax forms. With our intuitive interface, you can easily input your information and generate the document you need. This ensures that you can efficiently manage your tax paperwork without any hassle.

-

Is there a cost associated with using airSlate SignNow for non filer tax forms?

Yes, airSlate SignNow operates on a subscription model, providing various pricing tiers to fit your needs. Our competitive pricing ensures that you have access to a full suite of features for creating and managing non filer tax forms without breaking the bank. Explore our plans for more details.

-

What features does airSlate SignNow offer for non filer tax form management?

airSlate SignNow includes features such as document templates, eSigning, and secure cloud storage, specifically designed to streamline the management of non filer tax forms. Our platform supports collaboration, allowing multiple users to easily access and edit documents. Enjoy a seamless experience with our comprehensive toolkit.

-

Can I integrate airSlate SignNow with other software for my non filer tax forms?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software, making it easier to manage your non filer tax forms alongside your financial documents. These integrations help you centralize your paperwork and maintain greater accuracy in your records.

-

How secure is the information I submit for a non filer tax form?

Security is a top priority at airSlate SignNow. We use robust encryption and secure servers to protect your data, especially for sensitive documents such as non filer tax forms. You can trust that your information will remain confidential and safe while utilizing our platform.

-

What are the benefits of using airSlate SignNow for non filer tax forms?

Using airSlate SignNow for your non filer tax forms streamlines the entire process, allowing for quick and easy document creation and signing. Our platform reduces paper waste and simplifies workflow management, letting you focus on more important tasks. Enjoy the benefits of efficiency and convenience with our solution.

Get more for What Is A Non Tax Filer Statement

- Mvr 615 form

- Elevator checklist pdf form

- Article summary template form

- Ubc sleep disorders clinic referral form

- Teacher questionnaire for speech and language form

- Medication consent form template

- Important you may use this script to prove up an agreed or default divorce with children form

- Unfallmeldung ab dem 16 altersjahr egk gesundheitskasse form

Find out other What Is A Non Tax Filer Statement

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile