Tax Credit Questionnaire Form

What is the Tax Credit Questionnaire Form

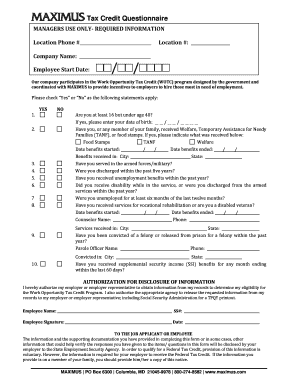

The work opportunity tax credit questionnaire is a crucial document used by employers to determine eligibility for the Work Opportunity Tax Credit (WOTC). This credit incentivizes businesses to hire individuals from specific target groups who face significant barriers to employment. The questionnaire collects essential information regarding the applicant's background, which helps employers assess whether they can claim the tax credit upon hiring.

How to Use the Tax Credit Questionnaire Form

Using the tax credit questionnaire form involves several steps. First, employers should provide the form to potential employees during the hiring process. The applicant must complete the form, providing accurate information about their eligibility. Once filled out, the employer reviews the responses to determine if the applicant qualifies for the WOTC. It is essential to ensure that the form is completed correctly to avoid delays in processing the tax credit.

Steps to Complete the Tax Credit Questionnaire Form

Completing the work opportunity tax credit questionnaire involves a systematic approach. Follow these steps:

- Begin by entering personal information, including name, address, and Social Security number.

- Answer questions regarding employment history and any previous participation in WOTC programs.

- Provide information about the target group status, such as being a veteran or receiving public assistance.

- Review all entries for accuracy before submission.

Accuracy is vital, as incorrect information can lead to disqualification from the tax credit.

Eligibility Criteria

To qualify for the Work Opportunity Tax Credit, applicants must meet specific eligibility criteria outlined in the questionnaire. These criteria include factors such as:

- Being a member of a targeted group, such as veterans or individuals receiving government assistance.

- Having a history of unemployment or underemployment.

- Meeting age requirements, typically being at least eighteen years old.

Understanding these criteria helps both employers and applicants navigate the questionnaire effectively.

Form Submission Methods

The work opportunity tax credit questionnaire can be submitted through various methods, ensuring flexibility for employers and applicants. Common submission methods include:

- Online submission via secure e-signature platforms, allowing for quick processing.

- Mailing the completed form to the appropriate tax authority.

- In-person submission at designated government offices or during tax preparation appointments.

Choosing the right submission method can streamline the process and facilitate timely access to the tax credit.

Required Documents

When completing the work opportunity tax credit questionnaire, certain documents may be required to validate the information provided. These documents can include:

- Proof of identity, such as a driver's license or state ID.

- Documentation of previous employment or government assistance.

- Any relevant military service records for veteran applicants.

Having these documents ready can expedite the completion and submission of the questionnaire.

Quick guide on how to complete tax credit questionnaire form

Easily prepare Tax Credit Questionnaire Form on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers since you can obtain the correct template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Tax Credit Questionnaire Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Tax Credit Questionnaire Form effortlessly

- Obtain Tax Credit Questionnaire Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the papers or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Tax Credit Questionnaire Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax credit questionnaire form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a work opportunity tax credit questionnaire?

The work opportunity tax credit questionnaire is a document designed to help employers determine their eligibility for tax credits when hiring individuals from targeted groups. By completing this questionnaire, businesses can potentially benefit from signNow tax savings while supporting diverse hiring practices.

-

How does airSlate SignNow assist with the work opportunity tax credit questionnaire?

airSlate SignNow simplifies the process of completing the work opportunity tax credit questionnaire by allowing businesses to easily send and eSign the document online. This ensures a streamlined experience, reducing paperwork and helping employers take full advantage of potential tax credits.

-

What features does airSlate SignNow offer for the work opportunity tax credit questionnaire?

AirSlate SignNow provides features such as customizable templates, automated workflows, and secure electronic signatures for the work opportunity tax credit questionnaire. These tools help businesses efficiently manage their documentation and compliance needs without the hassle of traditional methods.

-

Is there a cost associated with using airSlate SignNow for the work opportunity tax credit questionnaire?

Yes, while airSlate SignNow offers various pricing plans, the costs are designed to be cost-effective for businesses of all sizes. Depending on the features and number of users, companies can select a plan that fits their budget while still gaining access to essential tools for managing the work opportunity tax credit questionnaire.

-

Can airSlate SignNow integrate with other software for managing the work opportunity tax credit questionnaire?

Absolutely! airSlate SignNow integrates seamlessly with popular productivity tools and CRMs, making it easy to incorporate the work opportunity tax credit questionnaire into existing workflows. These integrations help streamline operations and enhance data accuracy across multiple platforms.

-

What are the benefits of using airSlate SignNow for the work opportunity tax credit questionnaire?

Using airSlate SignNow for the work opportunity tax credit questionnaire allows businesses to enhance their efficiency, save time, and reduce errors associated with manual documentation. Additionally, it fosters better compliance and maximizes potential tax credits, ultimately supporting financial growth.

-

How long does it take to complete the work opportunity tax credit questionnaire with airSlate SignNow?

The time to complete the work opportunity tax credit questionnaire using airSlate SignNow can vary, but the platform is designed for efficiency. Most users can finish the questionnaire quickly, often within minutes, thanks to streamlined electronic processes and user-friendly features.

Get more for Tax Credit Questionnaire Form

Find out other Tax Credit Questionnaire Form

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word