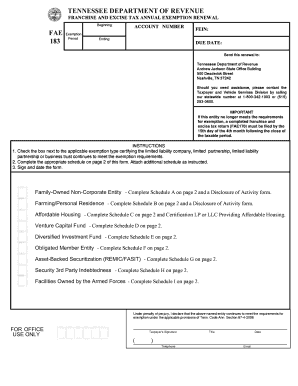

Tennessee Franchise and Excise Tax Exemption Form

What is the Tennessee Franchise and Excise Tax Exemption

The Tennessee Franchise and Excise Tax Exemption is a provision that allows certain businesses to be exempt from paying franchise and excise taxes in the state of Tennessee. This exemption is typically available to nonprofit organizations and specific types of corporations that meet the eligibility criteria established by the Tennessee Department of Revenue. Understanding the parameters of this exemption is crucial for businesses seeking to minimize their tax liabilities while remaining compliant with state regulations.

Eligibility Criteria for the Tennessee Franchise and Excise Tax Exemption

To qualify for the Tennessee Franchise and Excise Tax Exemption, businesses must meet specific eligibility criteria. Generally, this includes:

- Being classified as a nonprofit organization or a specific type of corporation.

- Operating primarily for charitable, educational, or similar purposes.

- Meeting the revenue and asset thresholds set by the state.

It is essential for applicants to review these criteria carefully to ensure compliance and to avoid potential penalties for non-compliance.

Steps to Complete the Tennessee Franchise and Excise Tax Exemption Renewal

Renewing the Tennessee Franchise and Excise Tax Exemption involves several steps to ensure that all necessary information is accurately submitted. The process typically includes:

- Gathering the required documentation, including financial statements and proof of nonprofit status.

- Completing the renewal form provided by the Tennessee Department of Revenue.

- Submitting the completed form and supporting documents either online or via mail.

- Awaiting confirmation of the renewal from the Department of Revenue.

Following these steps carefully can help streamline the renewal process and ensure compliance with state regulations.

Required Documents for the Tennessee Franchise and Excise Tax Exemption Renewal

When renewing the Tennessee Franchise and Excise Tax Exemption, specific documents must be submitted to the Tennessee Department of Revenue. These typically include:

- Financial statements for the previous fiscal year.

- Proof of nonprofit status, such as IRS determination letters.

- Any additional documentation requested by the Department of Revenue.

Having these documents prepared in advance can facilitate a smoother renewal process.

Form Submission Methods for the Tennessee Franchise and Excise Tax Exemption

Businesses can submit their Tennessee Franchise and Excise Tax Exemption renewal forms through various methods. The available options typically include:

- Online submission via the Tennessee Department of Revenue's website.

- Mailing the completed form and documents to the appropriate address.

- In-person submission at designated Department of Revenue offices.

Choosing the most convenient submission method can help ensure timely processing of the renewal application.

Penalties for Non-Compliance with the Tennessee Franchise and Excise Tax Exemption

Failure to comply with the requirements for the Tennessee Franchise and Excise Tax Exemption can result in significant penalties. These may include:

- Fines imposed by the Tennessee Department of Revenue.

- Loss of exemption status, leading to potential tax liabilities.

- Legal consequences for continued non-compliance.

Understanding these penalties can help businesses prioritize compliance and avoid unnecessary financial burdens.

Quick guide on how to complete tennessee franchise and excise tax exemption 11856024

Finalize Tennessee Franchise And Excise Tax Exemption effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, alter, and electronically sign your documents promptly without complications. Handle Tennessee Franchise And Excise Tax Exemption on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and electronically sign Tennessee Franchise And Excise Tax Exemption with ease

- Locate Tennessee Franchise And Excise Tax Exemption and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tennessee Franchise And Excise Tax Exemption and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tennessee franchise and excise tax exemption 11856024

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tennessee Department of Revenue franchise and excise tax annual exemption renewal process?

The Tennessee Department of Revenue franchise and excise tax annual exemption renewal process allows eligible businesses to renew their exemption status annually. This ensures that businesses remain compliant and avoid unnecessary tax liabilities. Completing the renewal is straightforward, especially with solutions like airSlate SignNow that facilitate efficient documentation.

-

How can airSlate SignNow help with the Tennessee Department of Revenue franchise and excise tax annual exemption renewal?

AirSlate SignNow streamlines the document signing process, making it easier to complete the necessary forms for the Tennessee Department of Revenue franchise and excise tax annual exemption renewal. With its user-friendly interface, businesses can quickly gather signatures and ensure timely submissions, minimizing the risk of delays or errors.

-

What are the costs associated with the Tennessee Department of Revenue franchise and excise tax annual exemption renewal?

The actual renewal fee for the Tennessee Department of Revenue franchise and excise tax annual exemption may vary based on business classification. However, using cost-effective solutions like airSlate SignNow can signNowly reduce administrative overhead, allowing companies to allocate resources more effectively during the renewal process.

-

Are there any benefits to using airSlate SignNow for eSigning the renewal documents?

Using airSlate SignNow to eSign renewal documents for the Tennessee Department of Revenue franchise and excise tax annual exemption offers several advantages. It improves turnaround time, ensures the documents are securely signed, and provides a clear audit trail, which is essential for compliance and record-keeping.

-

What features does airSlate SignNow offer for managing the exemption renewal documentation?

AirSlate SignNow includes features such as customizable templates, automated reminders, and real-time tracking to aid in managing the Tennessee Department of Revenue franchise and excise tax annual exemption renewal documentation. These tools enhance organization and efficiency, making the process seamless for businesses.

-

Can airSlate SignNow integrate with other tools for the exemption renewal process?

Yes, airSlate SignNow offers integrations with several platforms which can enhance your experience when managing the Tennessee Department of Revenue franchise and excise tax annual exemption renewal. This allows for smoother workflows, as documents can be managed alongside other business apps for maximized productivity.

-

Is it necessary to hire a professional for the Tennessee Department of Revenue franchise and excise tax annual exemption renewal?

While professional assistance can be beneficial for complex exemptions, many businesses successfully manage the Tennessee Department of Revenue franchise and excise tax annual exemption renewal independently using tools like airSlate SignNow. The platform simplifies the process, making it accessible for users without extensive tax knowledge.

Get more for Tennessee Franchise And Excise Tax Exemption

- Concealed carry license and renewal application form

- Deq va comprehensive site compliance evaluation sample 2011 2019 form

- South carolina department of motor vehicles request for scdmv form

- Sel 114 candidate filing individual electors oregon secretary of form

- Nonfriable asbestos removal form oregongov

- Pa fish and boat commission triploid grass carp 2017 2019 form

- Air inventory form 2014 2019

- Form 2066 sc sg 2015 2019

Find out other Tennessee Franchise And Excise Tax Exemption

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document