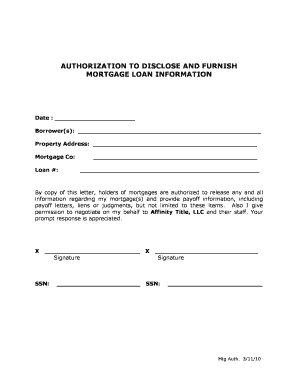

AUTHORIZATION to DISCLOSE and FURNISH MORTGAGE LOAN Form

Understanding the authorization to disclose and furnish mortgage loan

The authorization to disclose and furnish mortgage loan is a formal document that allows a lender or financial institution to share specific loan-related information with third parties. This document is crucial for processes such as refinancing, applying for a new mortgage, or when a borrower needs to provide proof of their mortgage status. It ensures that the necessary parties have access to pertinent information while maintaining the borrower's privacy and security.

Steps to complete the authorization to disclose and furnish mortgage loan

Completing the authorization to disclose and furnish mortgage loan involves several straightforward steps:

- Obtain the form: Access the official form from your lender or financial institution’s website.

- Fill in your details: Provide your personal information, including your name, address, and loan number.

- Specify the parties: Clearly identify the individuals or organizations that are authorized to receive the information.

- Sign and date: Ensure you sign and date the document to validate your consent.

- Submit the form: Send the completed form to your lender or the specified third parties as instructed.

Key elements of the authorization to disclose and furnish mortgage loan

Several key elements must be included in the authorization to disclose and furnish mortgage loan to ensure its effectiveness:

- Borrower information: Full name, address, and contact information.

- Loan details: Specific loan number and type of mortgage.

- Authorized parties: Names and contact details of individuals or institutions receiving the information.

- Scope of disclosure: Clear description of what information can be shared.

- Signatures: The borrower's signature, along with the date of signing.

Legal use of the authorization to disclose and furnish mortgage loan

The authorization to disclose and furnish mortgage loan is legally binding when completed correctly. It must comply with relevant federal and state laws regarding privacy and data protection. This ensures that the lender and any authorized third parties can share information without violating the borrower's rights. Understanding these legal frameworks is essential for both borrowers and lenders to maintain compliance and protect sensitive information.

How to use the authorization to disclose and furnish mortgage loan

Using the authorization to disclose and furnish mortgage loan involves several practical applications:

- Refinancing: When seeking better loan terms, this authorization allows lenders to verify existing mortgage details.

- Loan applications: New lenders often require this authorization to assess the borrower's creditworthiness.

- Verification of mortgage status: This document can be used to confirm a borrower's current mortgage status to other financial institutions.

Examples of using the authorization to disclose and furnish mortgage loan

There are various scenarios in which the authorization to disclose and furnish mortgage loan is utilized:

- Applying for a new mortgage: A borrower may need to provide their current mortgage details to a new lender.

- Refinancing an existing mortgage: The current lender may require this authorization to process the refinancing application.

- Transferring a mortgage: When a mortgage is being transferred to another party, this authorization facilitates the necessary disclosures.

Quick guide on how to complete authorization to disclose and furnish mortgage loan

Complete AUTHORIZATION TO DISCLOSE AND FURNISH MORTGAGE LOAN effortlessly on any device

Online document management has gained increased popularity among companies and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can acquire the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage AUTHORIZATION TO DISCLOSE AND FURNISH MORTGAGE LOAN on any platform with the airSlate SignNow applications for Android or iOS and simplify any document-related procedure today.

How to alter and eSign AUTHORIZATION TO DISCLOSE AND FURNISH MORTGAGE LOAN with ease

- Find AUTHORIZATION TO DISCLOSE AND FURNISH MORTGAGE LOAN and then click Get Form to initiate the process.

- Utilize the tools we provide to finalize your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your selected device. Edit and eSign AUTHORIZATION TO DISCLOSE AND FURNISH MORTGAGE LOAN and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the authorization to disclose and furnish mortgage loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the authorization to release loan information form?

The authorization to release loan information form is a document that allows a borrower to grant permission for their lender to share specific loan-related details with third parties. This form is crucial for ensuring that all parties involved have the necessary information to process loans effectively.

-

How do I create an authorization to release loan information form with airSlate SignNow?

Creating an authorization to release loan information form with airSlate SignNow is simple. You can use our intuitive design tools to customize the form with your specific requirements and then easily send it out for eSignature to streamline the process.

-

What are the benefits of using airSlate SignNow for the authorization to release loan information form?

Using airSlate SignNow for your authorization to release loan information form simplifies the document signing process. It offers features like real-time tracking, easy sharing, and secure storage, ensuring a hassle-free experience for both lenders and borrowers.

-

Is there a cost associated with sending an authorization to release loan information form?

Yes, there is a cost associated with sending documents through airSlate SignNow. Our pricing plans are designed to be cost-effective while providing extensive features that improve the workflow of managing your authorization to release loan information form and other documents.

-

Can the authorization to release loan information form be integrated with other software?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing you to connect your authorization to release loan information form to your existing systems. This enhances efficiency and helps manage your documents across platforms.

-

How secure is the authorization to release loan information form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform for your authorization to release loan information form, you'll benefit from advanced encryption and compliance with industry standards, ensuring that all sensitive information remains safe and secure.

-

How long does it take to process an authorization to release loan information form?

Processing the authorization to release loan information form with airSlate SignNow can be done in minutes. Once sent, you can track the document's status in real-time, ensuring that there are no delays in your loan process.

Get more for AUTHORIZATION TO DISCLOSE AND FURNISH MORTGAGE LOAN

Find out other AUTHORIZATION TO DISCLOSE AND FURNISH MORTGAGE LOAN

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free